Moscow has proposed its own international standard of precious metals exchange , dubbed the “Moscow World Standard” (MWS). The MWS would compete with the London Bullion Market Association (LBMA) which is one of the world’s current leading gold and silver exchanges, but would not use leveraged paper schemes to keep a lid on the gold price. Some believe creating this fair market for gold could quickly send the price toward true free-market levels, well above $2,500 per ounce.

Gold analysts for the past few decades have claimed that the LBMA manipulates the precious metals market and artificially keeps prices low. Many view this as a way to hide dollar weakness and keep capital from flowing out of overvalued equities markets and into a sector that is harder to profit from. Moscow has a similar view and believes part of the motivation is to negatively affects precious metal exporters.

Russia would like to see a new monetary unit for international trade, such as the newly proposed BRICS currency. Russian President Vladimir Putin believes that a new currency based on commodities will positively benefit member nations and prove to have greater stability than strictly fiat currencies.

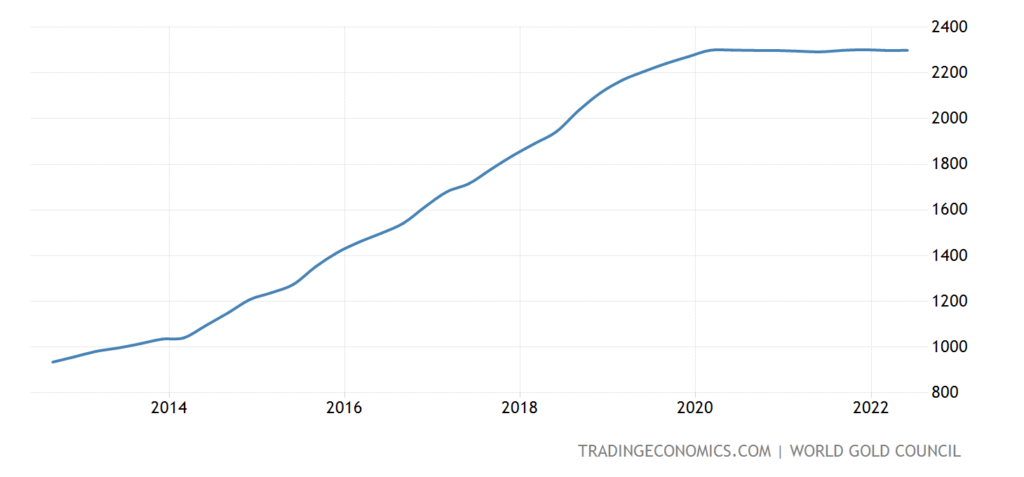

Russia’s gold reserves more than doubled over the past decade and are likely much higher than being reported.

Russia and its partners account for 62% of the worlds controlling stake in gold when including Venezuela and Peru. Because of this, Russia believes it can break up the ‘monopoly’ of LBMA and allow gold prices to revalue to fair levels. They also believe this will normalize functions within the precious metals sector.

The failed sanctions the West has applied on Russia were a watershed moment in international markets. Russia and China see an opportunity to partner with nations that have been bullied by the US and negatively impacted by the dollar’s hegemony. Repricing and normalizing the gold market would help in their efforts to end the price manipulation and set up a more fair system that does not utilize leverage to suppress prices.

Using the current Moscow World Standard where they price gold in Rubles, it would price gold at around $2,500 in US dollars. This level is somewhere closer to where natural supply and demand would dictate. China, India and others may join Russia in their efforts to destroy the monopoly that the LBMA has on the gold price. Countries that have been bullied by Western economic policies will be more than eager to wrestle some power from the LBMA and help to create a more equitable system and fairer monetary standard.

Rising interest rates could lead to a contraction of the gold derivatives market, helping to increase the odds of a revaluation of gold. It is an uphill battle versus entrenched interests, but if enough of the world sees the opportunity for fair pricing and a break from US hegemony, the odds could be higher than many are currently anticipating.

As geopolitical conflicts between the West and East escalate, currency wars will become increasingly important. This shift in commodity control will threaten the position of the US dollar as the world’s reserve currency. World governments, particularly BRICS nations, are reverting towards precious metals and commodities to back their new currencies.

Some believe that the West and IMF may back their upcoming central bank digital currencies (CBDCs) with some level of gold to give it greater legitimacy. This would create a massive upward revaluation on gold, above and beyond the repricing that we already expect from the LBMA losing its dominance.

We advocate for holding physical gold and silver in your possession, but we also hold a basket of junior and mid-tier mining stocks in the Gold Stock Bull portfolio. And while we traditionally enjoyed greater returns from these smaller-cap, up and coming miners, the majors are currently offering exceptional value and high dividend yields. This makes stocks like Newmont Mining (NEM), with a 5.2% yield, worth considering at current levels.