Gold became an enemy of the United States due to the constraints it put on the U.S. dollar and ability of politicians to run deficits. The Bretton Woods System fixed gold to the dollar at $35 per ounce and other currencies were then fixed to the dollar. The world got used to the US dollar being the dominant force that everything was traded against.

The dollar’s supremacy was threatened in the 1960s. As a surplus of U.S. dollars caused by foreign aid, military spending, and foreign investment threatened this system, as the United States did not have enough gold to cover the volume of dollars in worldwide circulation at the rate of $35 per ounce. As a result, the dollar was overvalued.

There was actually more than 4 times as many dollars in circulation as there was gold in reserves to back the dollars. So, in August of 1971, Nixon “temporarily” suspended the convertibility of the dollar into gold. Of course, this temporary move became permanent. The war against gold had begun.

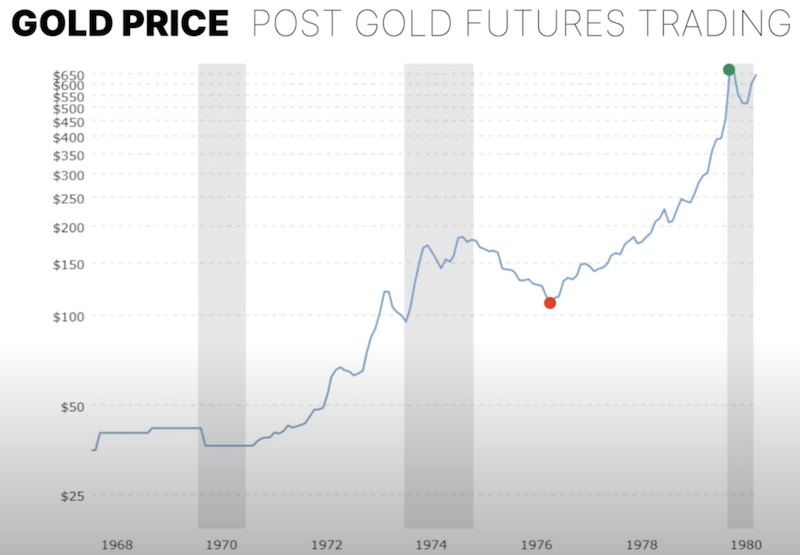

The price of gold shot from $35 to $183 per ounce in the four years that followed Nixon de-linking the dollar from gold. People were seeing stronger value in gold than paper currency like the dollar.

So what did the United States do to this threat of gold against the dollar dominance? They launched futures trading in an effort to stifle gold’s growth against the USD. In 1974, the first futures gold contract was traded and the price subsequently dropped back toward $100 per ounce by 1976. This was a drop of more than 40% from the highs and it happened in under two years.

But this was not enough to keep the gold price down, as the initial futures contracts had to physically hold the gold it was trading for redemption. This limited how much gold could be shorted and how easily it was to manipulate the price. After the initial drop, the gold price shot up 6x to around $650!

The U.S. had to do something to control the price of gold and keep the dollar looking strong, so they (with the LBMA) introduced unallocated accounts. Traders and firms no longer had to store the physical gold for redemption. This allowed fractional reserves, the paper trading of gold, and permitted the supply to expand past what physical gold was actually available. When supply outweighs demand, you get falling prices and a new mechanism to manipulate gold prices lower.

The unregulated expansion of unallocated gold derivatives led to artificially suppressed prices and gold went into a 20-year bear market, falling to around $250 by the year 2000. And even with the price moving to $1,700 today, the gold price is not fully accounting for the unprecedented levels of paper money printing that has occurred, record inflation, the 2008 global Recession, coronavirus panic, and current risk-off views from investors. Gold should have flourished in this environment, but it barely budged. And with interest rates now rising and the dollar strengthening against other fiat currencies, gold has declined further priced in the U.S. dollar.

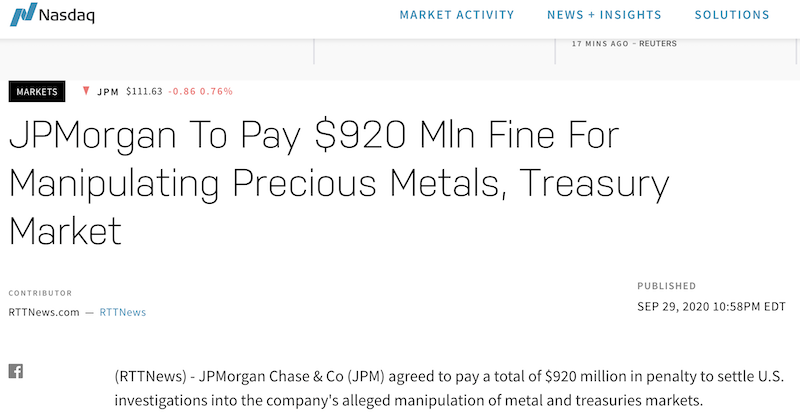

The gold price would be much higher if it were not for this paper trading and manipulation. This gold price manipulation is not a conspiracy theory. In fact, JPMorgan traders were recently convicted of fraud, attempted price manipulation, and spoofing in a multi-year market manipulation scheme.

Evidence at trial showed that the JPMorgan precious metals desk engaged in thousands of deceptive trading sequences for gold and silver futures contracts. These deceptive orders were intended to inject false and misleading information about true supply and demand into the markets. Spoofing entails putting in fake orders in the markets to buy or sell and then withdrawing those orders before they are executed with the intention of moving the price.

JPMorgan settled with a record $920 million fine on charges of precious metals price manipulation.

Frank Giustra, a Canadian businessman, mining financier and global philanthropist, who also founded Lionsgate Entertainment, believes that the gold price has been manipulated by central bank authorities. In particular, the Federal Reserve has manipulated gold for decades in a broader scheme to maintain U.S. dollar supremacy in the global monetary system.

“It’s been no secret that since the U.S. abandoned gold in 1971, they’ve tried to suppress it to allow the U.S. dollar to maintain its supremacy. That supremacy is important in terms of your home interest rates keeping them low, it’s important to anchor inflation expectations, it’s important for a whole bunch of reasons.

The financial war between countries had already started. It was already simmering before this hot war in Ukraine and now it’s full on,” he said. “We’re in a global financial war. This is war. The sanctions were an act of war if you look at it from the perspective of being sanctioned. So, there’s a war taking place and the U.S. is fighting that war in any way that they can. The last thing that the U.S. need is a $3,000 gold price, because that’s just going to alert everybody that there’s a problem. China and Russia are likely to partner together to de-dollarize in this new global reset”

– Frank Giustra

The U.S. government may now be turning its attention to another threat to the fractional reserve fiat monetary system, Bitcoin. And in doing this, the unallocated paper manipulation of gold could be ending.

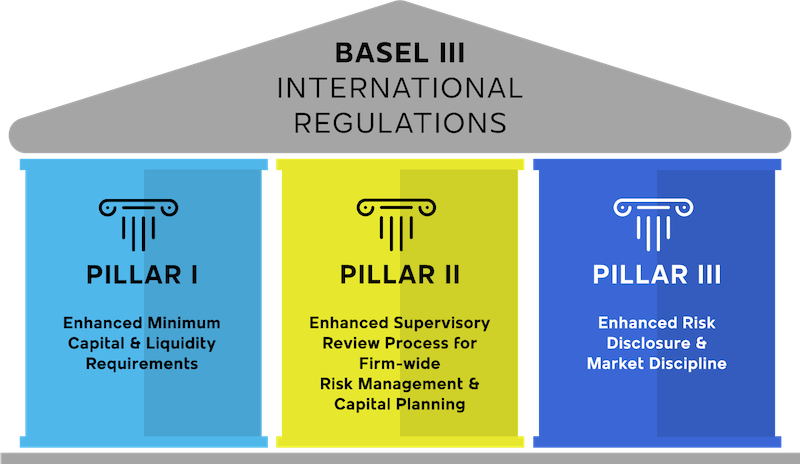

Basel III, an international regulatory accord, is coming and requires banks to manage certainly leverage ratios. This has huge implications for paper/unallocated gold. New funding requirements will make it difficult for banks to hold unallocated gold and some think this will end the paper manipulation schemes. If true, gold could rapidly rise to true free-market levels much higher than the current price.

Bitcoin may be the new target now. CME Bitcoin futures are cash-settled using via paper/unallocated accounts with no actual Bitcoin backing them.

Will Woo stated:

Arthur Hayes created the first BTC casino that real people used, trading billions per day. Arthur gloriously opened the way for us to sell 10 BTC even when we only had 1 BTC. We just need people to take the other side of our bet.

It was kind of an honest system I have to admit. I had to at least own BTC before I could sell 10x more of it. Thus there was a limit to how much I could sell. I mean if had 1 million BTC like Satoshi, I could only sell 10 million BTC and no more.

Selling 105m BTC was theoretically possible if half of the supply was engaged in selling BTC and the other half taking that offer on the BitMEX casino. Kind of gives you an idea of the power of futures markets, right? The door is open for futures markets to control BTC price.

Now along comes the CME, they launched a BTC casino where you could front USD to play. Wall Street hedge funds loved that. What is the limits on selling BTC now? Unlimited. Fiat is unlimited.

BTC doesn’t have to be killed, it just needs enough shorts in the system to suppress price. Without a large market cap, BTC doesn’t get to make global impact. Presently the arc of SEC policy has been to increase futures liquidity and dominance by approving multiple futures ETF, while rejecting all spot ETFs.

This is now a political game.

The regulators will now allow naked shorters to suppress the Bitcoin price with paper futures as they did with gold. But they will not allow a spot Bitcoin ETF, as the supply could not be manipulated and increased to suppress the price. Thus, it seems that Bitcoin may be taking gold’s place as the main target of price manipulation to defend the U.S. dollar.

We were one of the first investment newsletters to recommend Bitcoin at around $100 and we still hold a large allocation in our portfolio. We have also been buying the dip, making small purchases in recent months. But we are now looking to increase exposure to gold, silver, and mining stocks on this dip to multi-year lows. Our view is that prices are at or near the bottom for precious metals and that the upside potential dwarfs the downside risk at this juncture. You can click here to get instant access to our top picks.