“It is better to have and not need than to need and not have.”

– Franz Kafka

Underlying Conditions That Could Cause a Crisis

I first wrote this guide in 2008, as the financial markets started to fall apart. I had concerns that the fiat fractional reserve monetary system could collapse, with bank runs, a dollar crash, supply chain disruptions, and rioting.

The FED came to the rescue and pledged taxpayer funds to cover banking sector losses. It was an unprecedented amount of stimulus, but ended up preventing total collapse and led to a relatively quick recovery in the financial markets. There were casualties, of course, as several businesses went under and many families suffered devastating financial losses.

But the market bounced back and regained all losses over the next 3 to 4 years. From the bottom in 2009 to 2020, the major stock indices went up nearly 5x!

Fast forward to March of 2020 and I feel compelled to update the guide given the current COVID-19 outbreak and extreme stock market volatility that it has caused. It is inevitable that there will come a time when central bankers face something they can’t fix. COVID-19 could provide that moment.

The World Health Organization (WHO) declared COVID-19 a global pandemic and the United States declared a national emergency. Beyond the health implications, it is also likely to create a financial pandemic. So far, we have seen the largest single-day point drop in the stock market EVER and the first emergency rate cut (50 basis points) since the 2008 financial crisis. $1.5 trillion in stimulus was announced and I’m sure that more central bank and government stimulus will be enacted by the time you are reading this. Update: An extra $700 billion in QE and rates dropped to ZERO!

The economic disruption is very real, as major events and conferences are being canceled around the globe. Governments are ordering school-closures, companies are encouraging employees to stay home or telecommute, multiple major corporations have revised down guidance and Goldman Sachs is now projecting zero economic growth in 2020. That may be too optimistic.

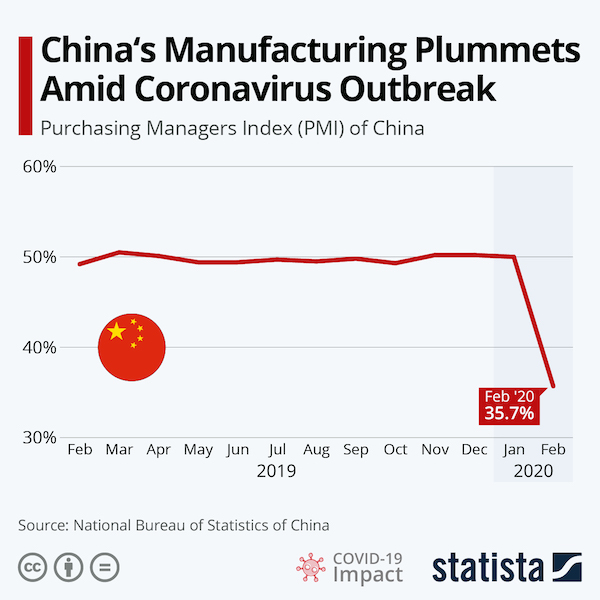

Key Economic Data Tumble, Events Canceled

The 10-year Treasury yield fell to record lows below 0.5% and the global manufacturing PMI for February fell to 47.2, the lowest level since 2009. Chinese manufacturing data for February was the worst on record, with the government’s official PMI reading tumbling to 35.7.

Major festivals like SXSW and Coachella have been canceled, the NBA, March Madness college basketball and multiple major sporting events are suspended. Surreal.

Schools have been closed across the country and now all non-food serving bars, restaurants, and gyms are closing. I am hopeful that as warmer weather arrives, this current coronavirus epidemic will go away, as with SARS and H1N1. But some experts say that even if it dies down in the summer, it is likely to come back in fall. It is important to flatten the curve via social distancing so that health care systems aren’t overwhelmed and the frail in society are protected.

I’m not one to panic, but it is always good to be prepared. It is better to have and not need than to need and not have. We are once again faced with increasing odds of major supply chain disruptions, quarantines and exclusion zones that will make it difficult to find items that you may need if you are forced to stay home for an extended time. Grocery store shelves are already empty in many places, an occurrence that I hope will be temporary.

If business growth slows to a halt, quarantines are increased and employees cannot go to work, people are going to have a hard time paying bills. A recent survey showed that 58% of Americans have less than $1,000 in savings.

This comes at a time when equities and real estate were already looking highly overvalued and overdue for a major correction. It also comes at a time when there are growing challenges to the petrodollar as the world reserve currency.

The banking system remains highly concentrated, leveraged and prone to another crisis, almost as if they didn’t learn their lesson last time. They hold only around 10% of the actual cash people have deposited. If the panic that has happened at the grocery stores extends to banks and people look to withdrawal their cash all at once, bank runs are certainly possible.

The fact that many banks have leveraged bets on oil and equity markets that are crashing increases the odds that they could become insolvent.

The fractional reserve fiat monetary system is a giant Ponzi scheme that is unsustainable. The 2008 crisis was just the tip of the iceberg and rather than addressing and correcting the problems, our leaders simply created a short term fix by inflating new bubbles. This is only delaying the inevitable crash. Could COVID-19 be the pin that pricks the global ‘everything bubble?’

Much of the stock market growth in the past decade can be attributed to share buybacks, a corresponding increase to corporate debt and easy money. The debt situation in Western nations has become unsustainable. You may already be familiar with these statistics, but they are worth repeating:

- ✔The US debt is now greater than 100% of GDP, with the true number estimated at over $100 trillion, when including unfunded liabilities and off-balance-sheet debt.

- ✔Consumer debt in the US has increased roughly 10X since 1980 to $14 trillion, with auto loan debt up to $1.2 trillion.

- ✔The FED’s balance sheet is once again expanding, having added around $400 billion in the past six months to a balance of $3.8 trillion.

The US government is essentially broke and is forced to borrow roughly $1 trillion every year to close its budget gap. No matter which political party wins power, the United States is no closer to balancing the budget. The debt burden continues to increase until the day it will finally implode.

What to Expect – How the Crisis Might Unfold

So, what might this scenario look like and what should you do to prepare?

If the COVID-19 coronavirus continues to spread and worsen, we are likely to see a major economic slowdown, Recession or even Depression. A significant percentage of the population will be out of work. This will trigger rising delinquencies and bankruptcies, foreclosures, and eventually inflation following unprecedented levels of new money printing/stimulus.

Quarantines in the US and elsewhere could restrict travel and increase fear and anxiety. Add in public panic and stockpiling and it could soon be difficult to find food and supplies at local stores or online. This has already started in many regions as canned foods, bottled water, and many popular ‘prepper’ items are out of stock.

Food shortages might seem like something that can’t happen in America, but it is happening already. This could create civil unrest, martial law and plenty of other ugly scenarios in the weeks ahead. I think the rational approach is to hope for the best but prepare for the worst.

10 Steps You Should Take to Prepare / Essential Items to Secure Now

I see these common-sense steps as asymmetric. They have little to no downside and significant upside. They can help to protect hard-earned wealth and in the worst-case scenario, ensure survival. At a minimum, you can attain a little comfort and peace of mind as we ride out the storm.

Even if the COVID-19 pandemic is transient and a major economic crash does not materialize, it will be invaluable for you to learn critical skills and stockpile essential goods, which can be used during an earthquake or weather event, even absent a major crisis. The value of these items is likely to go up regardless, so there is really little downside to preparing.

#1 Diversify Out of Fiat Money and Into Gold and Bitcoin

Fiat money has been losing value slowly over time, but the pace of that decline could accelerate dramatically as the FED cranks up the printing press to stimulate the economy and avoid collapse. If you want to preserve your wealth, you should reduce exposure to fiat money and increase exposure to finite assets such as gold and bitcoin. It is advisable to store the gold in your possession and maintain control of the private keys to your bitcoin.

This doesn’t mean to get rid of all cash. It is recommended to keep at least 3 months worth of living expenses in cash. You may also wish to store some in a safe deposit box, where you are more likely to be able to access it if withdrawals from accounts are limited. Having a good mixture of cash, gold, silver and bitcoin will give you more payment options in a crisis situation.

#2 Store and Be Able to Filter Water

Water is absolutely the most important thing to have in the event of a crisis. You can survive without food for a few days or even weeks, but won’t last more than a few days without water. While in most cases the water in your home is likely to continue flowing, you don’t want to rely on your local municipality 100%. So, it is wise to have bottled water just in case. While losing your water supply might be low in probability, it is high in severity. So, it is worth having a back-up in the form of enough bottled water to last a few months.

If you have a well, consider installing a manual or solar pump.

Also, having a good water purification system can be life-saving. You need one that can remove dangerous living organisms and harmful bacteria, while filtering without the need for power. I ended up settling on the AquaRain system, which uses gravity to filter the water and can turn rainwater, creek water or even swimming pool water into safe drinking water. Another highly rated option is the Berkey water filtration system.

#3 Purchase Food Storage

Having at least a 3-months supply of food for each member of your family is also critical, as history shows how quickly store shelves are emptied at the first sign of a crisis. Bulk freeze-dried and dehydrated foods have shelf lives of 20 years or more and can provide months of nutritious meals in the event of an emergency. Furthermore, the containers allow you to store a large number of calories in a small space. Costco or Amazon.com sell emergency supply of food storage, but may already be out of stock.

In absence of specific ‘emergency food storage,’ you can simply stock up on the food items that you normally eat in your household. Canned soups, pasta, cereals, rice and oatmeal tend to have long lives.

Also, remember to order extra pet food if you have a pet.

#4 Start Gardening and Purchase Non-Hybrid Seeds

Gardening seeds are critical in the event that the crisis lasts longer than a few months. It is incredibly valuable and rewarding to learn to garden, generate your own food supply and not have to rely on others for basic nutrition. Gardening can also be a relaxing/meditative process, allowing you and your family to get your hands dirty, reach into the soil and connect to the earth. Make sure that you buy non-GMO, non-hybrid, organic seeds, that will regenerate new seeds for future seasons.

I opted for this kit from Amazon for $49 which offers 50 varieties of fruits, vegetables and herbs. There are several options if that particular one is out of stock. You can also check your local nursery for seeds or started plants. You may also wish to start planting fruit and nut trees on your property, although it could take a few seasons to start yielding significant amounts.

If you have yet to start a garden, get on it! The sooner that you get the plants growing, learn from mistakes and develop your green thumb, the better. Not to mention the joy of nursing a plant from seed to food and then getting to eat the freshest and best-tasting produce you will ever taste. If you set up an automatic irrigation system, you can limit your gardening time to just a few hours per week. The book “Square Foot Gardening” was a huge help in reducing our learning curve with gardening.

#5 Camping Stove and/or Solar Stove

A camping stove will allow you to cook food and heat water in the event that your electricity or gas goes out. It also allows you to cook meals on the go. I chose the Coleman dual liquid, but this less expensive Coleman PerfectFlow 2-Burner Stove that uses propane is a popular pick as well.

#6 Back-Up Power Generators

This will allow you to power critical items in the event that the power goes out. This includes lighting, heating, battery charges, computers, stereos, cell phones, small refrigerators and other appliances. If you have a good amount of sunlight in your area, I would recommend a solar generator system, rather than a gas generator which can be noisy, difficult to transport, produce nauseous fumes and is obviously non-renewable. There are a variety of solar kits available starting around $500 and up, dependent on how much power you want. You basically want to purchase both a portable power station (example) and solar panels. If you have some DIY skills, you can buy the individual components and build the kit yourself at a discount.

#7 Back-Up Heat and Air Conditioning

If you live in a cold climate, a back-up heat source is recommended should the power/gas company stop supplying your home. An added bonus of having a generator is that you can plug an electric heater into it to keep a room warm.

However, for larger areas, you should consider purchasing a pellet stove and/or propane heater. This site is a great resource for some of the best pellet stoves available and has advantages and disadvantages of each. Pellet inserts do a much better job of heating the home than a fireplace because there is not as many fumes and the exhaust does not have to be as large. Instead of all the heat simply going up the chimney, it will be used to heat the room it sits in. Another reason for the higher performance is the fact that the pellets burn hotter and longer than traditional wood.

You may also want to consider a portable propane heater such as the Mr. Heater Big Buddy. It sells for about $140, produces 18,000 BTUs and can be powered by small one-pound propane tanks or the larger 20lb tanks with a hose adapter. It is safe for indoor use, has a built-in fan and gets high reviews on Amazon and elsewhere.

Likewise, a small low power air conditioning unit that can run on solar in hot climates is a good back-up plan.

Losing power/gas may have a low probability, but high severity, if it happens, are you are in a very cold or very hot climate.

#8 Protection

Protection will become important if civil unrest develops and mobs of people become desperate and start roaming from home to home looking to loot and steal. It would obviously be ideal if you were outside of a major city, in the wilderness and not visible from the street. Either way, you might want to consider investing in a gun for self-defense. For close range, you want a shotgun such as the Mossberg 500. However, you don’t necessarily need a 12-gauge to get the job done. Particularly for the elderly or smaller-framed individuals, a 20-gauge might be better.

For handguns, there is nothing wrong with the popular and trustworthy Glock series. I personally prefer the Springfield XD series. Make sure to also stock up on plenty of ammunition and if you are new to firearms, get out to a local range and practice shooting. Shot placement and accuracy under pressure are critical components to firearm self-defense.

I hope to never have to use my weapon, but I like the peace of mind it provides. If you want a handgun or semi-automatic rifle such as an AK47 or AR15, you will need to go to a gun show or shop. Other excellent methods of protection include a good guard dog, security system and bullet-proof vest. Having family and friends around will also be important, as there is safety in numbers.

Two additional considerations that fall under the protection category include night vision and perimeter defense. Stay away from Generation 1 night vision and opt for Gen 2 or Gen 3 if you can afford it. Digital night vision is making leaps and bounds lately, offering Gen 2 or 3 type quality at much lower prices. Check out the Nightowl iGEN 20/20 for a highly rated digital monocular under $500. Ebay also has deals on new and used night vision devices. Note that certain states like California prohibit sales of the higher-level units.

#9 Medicine, First Aid and Personal Care Products

What types of medicine do you personally need on a regular basis? Do you have asthma, high blood pressure or other life-threatening ailments that need a particular medicine? Something to reduce fever or for chronic pain? Stock up on all of these items as the local pharmacies are likely to run out of supplies or shut down for a period of time. Also consider things like soap, shampoo, toilet paper, razors, wet wipes, etc. which you would not want to do without for several months. Lastly, a first aid kit is critical for treating any wounds or injuries that you or your family might sustain.

#10 Batteries, Lighters, Headlamps, Radio, Tools

If the power remains out for an extended period of time or you are camping in nature, you will want to have headlamps, multi-purpose lighters and plenty of spare batteries. Pick up the value packs or if you have a power source such as the solar generator mentioned above, pick up recyclable batteries and a charger. Multi-tools are also nice to have and allow you to be able to repair a variety of things at home or on the go. The Leathermans are nice, but I opted for this Gerber Multi-tool for under $50.

If you live in a major city or densely-populated urban area, you may want to consider leaving. Your odds of contracting the virus or getting stuck in the midst of any civil unrest decline significantly. If you located near a lake or river, you will have access to water for drinking (after filtering) or growing food. Whether you have a vacation home, rent one or use an RV, being out in nature and away from cities has advantages. If the drive is long, consider buying and filling a few gas cans should the gas stations run out of fuel.

COVID-19 Items

For this particular crisis, there are items worth securing including respirator face masks (N95 or better), disposable nitrile gloves, hand sanitizer, hand soap, vitamin C in high doses, Tylenol/Advil, electrolytes (I prefer coconut water over Gatorade), paper products, bleach, Lysol or other cleaning supplies, humidifier, plastic sheeting and duct tape, etc.

It is worth repeating, social distancing is needed to flatten the curve. Stay away from others for a while, even walking by on the sidewalk. And if you must go to the store for food or supplies, consider wearing a respirator mask and disposable gloves, even if it makes you feel silly or others aren’t doing the same. Wash your hands frequently, wash your clothes after returning home, don’t wear shoes inside the house or use disposable booties. Even if you are young and healthy, you still want to do this in case you come in contact with others that are not.

Parting Shot

I believe we will get through this, but we could be in for a rough few months. These common-sense steps can help you and your family get prepared, increase your odds of making it through ok and provide a level of comfort and peace of mind. Preparing ahead of time can also put you in the position to help friends and family members that failed to do so. Reach out to them now, share this information and make sure they are making at least some basic preparations.

This period can best be viewed as an extended vacation, spending time with family and friends, connecting to nature, learning to be more self-sufficient and spending time pursuing creative interests and hobbies.

It is also an opportunity for intellectual incubation, as Shakespeare wrote “King Lear” while in quarantine from the plague and Isaac Newton invented calculus and refined his theory of gravity while in quarantine from the plague. What new ideas or creations might come from this time for you?

If you feel stressed or anxious, try meditation, yoga, hiking in nature (away from others), listening to audiobooks, etc. I hope that these worst-case scenarios don’t come to pass and that we find a way to avoid any major crisis. I believe we will fight this and win. I hope this information benefits you in some way and I wish you the best.

We anticipated the current moves in the stock market and profited significantly in the past few weeks from stocks that can do well under the current conditions such as biotech picks, testing companies, protective equipment manufacturers and companies that help people telecommute and work from home. We also bought short ETFs and select mining stocks that soared 15%+ today alone. In full transparency, we’ve also had some losses, but the above positions have hedged our portfolio and limited the financial pain. We have a long track record of outpacing the stock market.

If you would like to receive our investment research, please click here.

Cheers,

Jason Hamlin

President – Nicoya Research