Gold, considered a safe haven investment for many years now, is gearing up to have a historical run-up in the coming years. From U.S. sanctions pushing countries to use gold as a payment option, to the massive currency debasement going on during each quarterly printing of money, factors driving the price of gold are plenty.

This post highlights the many reasons as to why gold and the precious metals sector is set to have a great year.

Technical Analysis

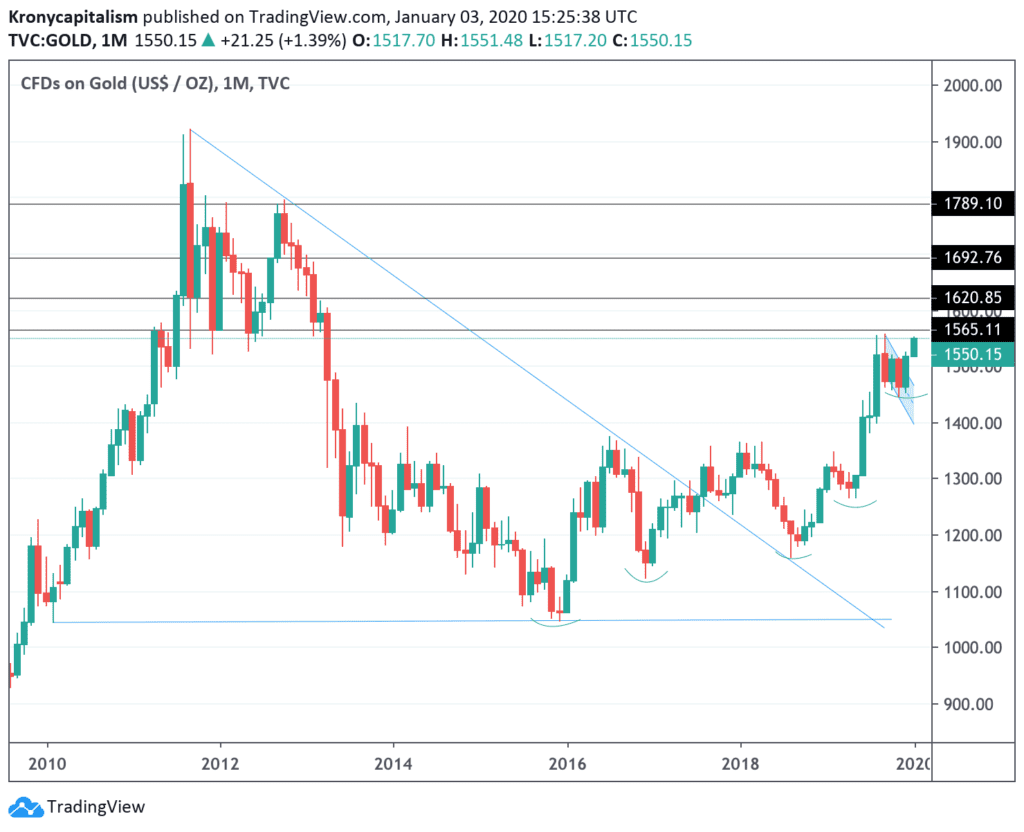

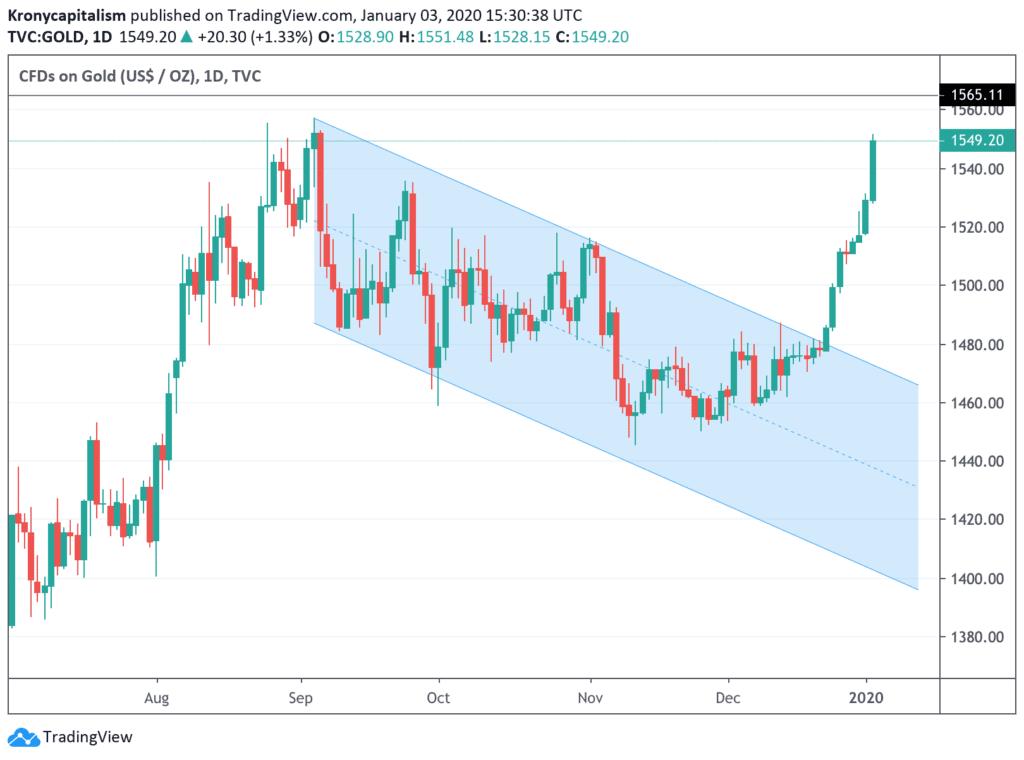

Gold broke out of its multi-year downtrend mid-2017. It has also been printing higher lows since its break out as well, a good indication that a reversal of the downtrend/bear market has occurred. There is also limited resistance on the way up to gold’s all-time high of about $1,900.

On another positive note, gold broke out of its recent descending channel to the upside. Gold has also rallied substantially since the break out as well.

Gold Market Cycle

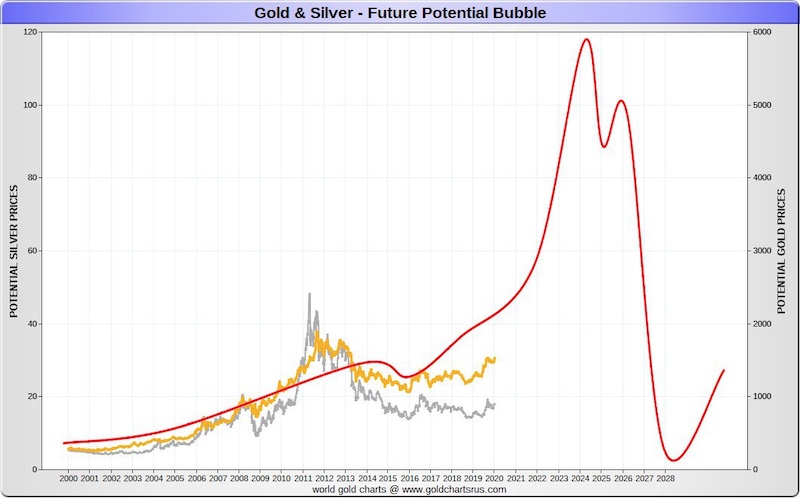

The gold market, on average, functions on an 8-year cycle. The market has a 3-year cycle where it goes up and a 5-year cycle where it goes down. There is that rare moment in 2004, where after a 3-year uptrend, gold continued its uptrend for another 8 years, with all corrections being relatively short-lived.

It is very likely that we are in a similar cycle. Gold has continued its uptrend after an initial 3-year cycle. With the economy in the current condition, it is very likely that the market will follow the same cycle as before.

Potential Price Targets For Upcoming Bull Run

1. Comparing This Bull Market to Previous Ones

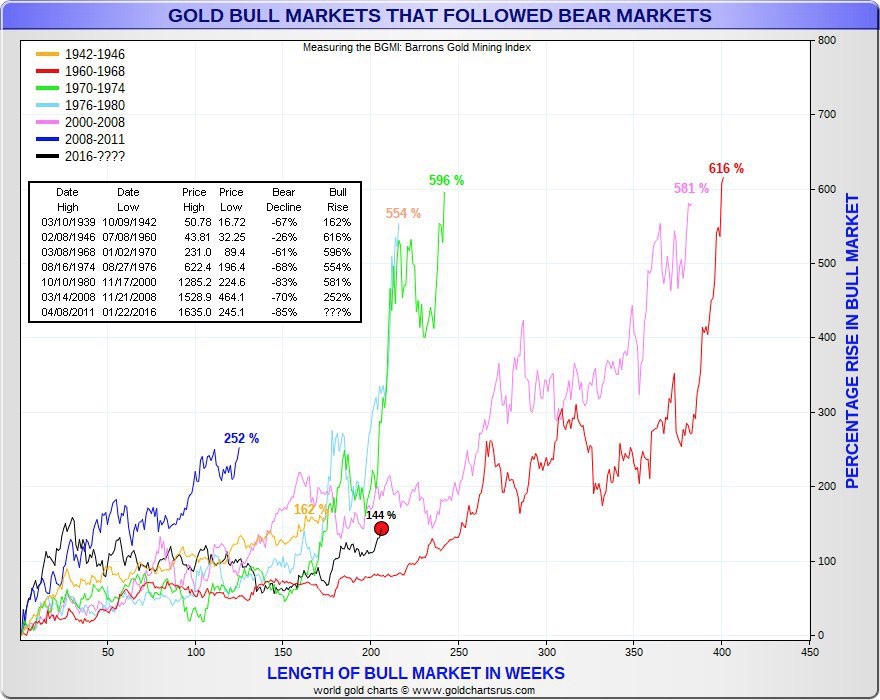

Gold is up around 48% ($500) since its bottom of $1,050 in late 2015. During gold’s last multi-year bull market, it gained around 600% in 10 years. If gold rallies in a similar fashion, a price of around $6,300 is feasible. Seeing yearly gains of 25–30% would also not be out of the ordinary.

Silver, with an average ratio of 47/1, would also see dramatic gains. With a gold-to-silver ratio currently above 80, silver can dramatically outperform gold in the long run.

One may also potentially glean the potential future price of gold from the chart below. On average, gold has rallied 460% during a bull market. Thus far, gold has only rallied 144%. There is still a lot of room for growth for gold.

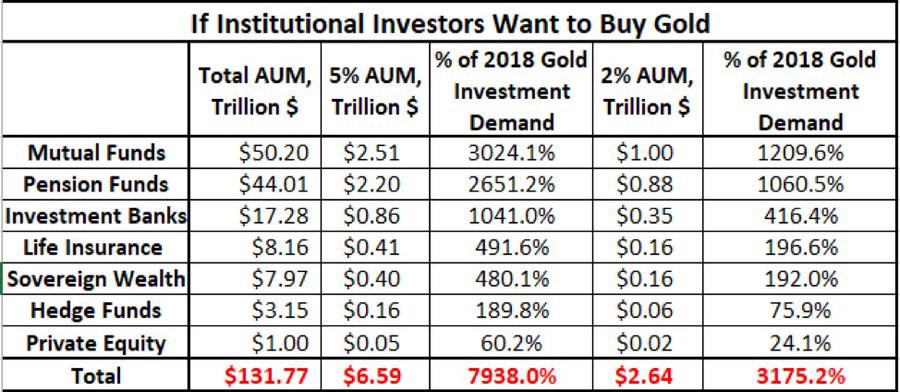

2. If Institutional Investors Were to Buy Gold

The gold market is also very small when compared to global assets. In 2018 the demand for gold investments was about $83.6 billion. Below is what 2% and 5% of institutional investors funds allocated into gold would look like.

The pension fund industry alone would buy more than 10 times all of 2018’s demand. If these investors as a group wanted a mere 2% exposure to gold, it would be 31 times more than all the demand in 2018!

Key Factors Driving the Price of Gold

- Gold Becoming More Easily Accessible to the Masses

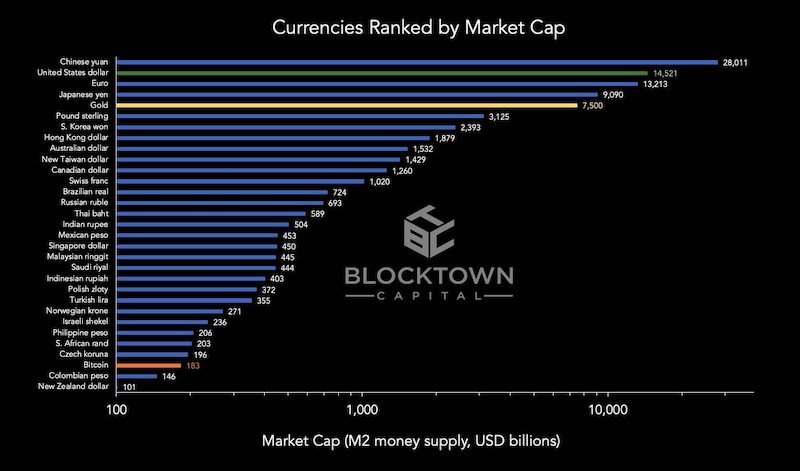

The amount of gold-backed cryptocurrencies coming to the market has been growing exponentially. Several countries are also building their own blockchain platforms for digital gold transfers. Combining gold with blockchain technology allows for an efficient way to store and use the precious metal. Such a combination also allows anyone to use gold as money with just their cellphone. As a currency, gold is already among the top 5 by Market Cap.

Countries building their own gold-backed cryptocurrencies include Turkey, China, Russia, Iran, and many more. Roy Sebag said it best: Applying blockchain technology to enable the frictionless exchange of title to gold is the single most significant innovation in monetary technology since the advent of standardized coinage in the first millennium BC.

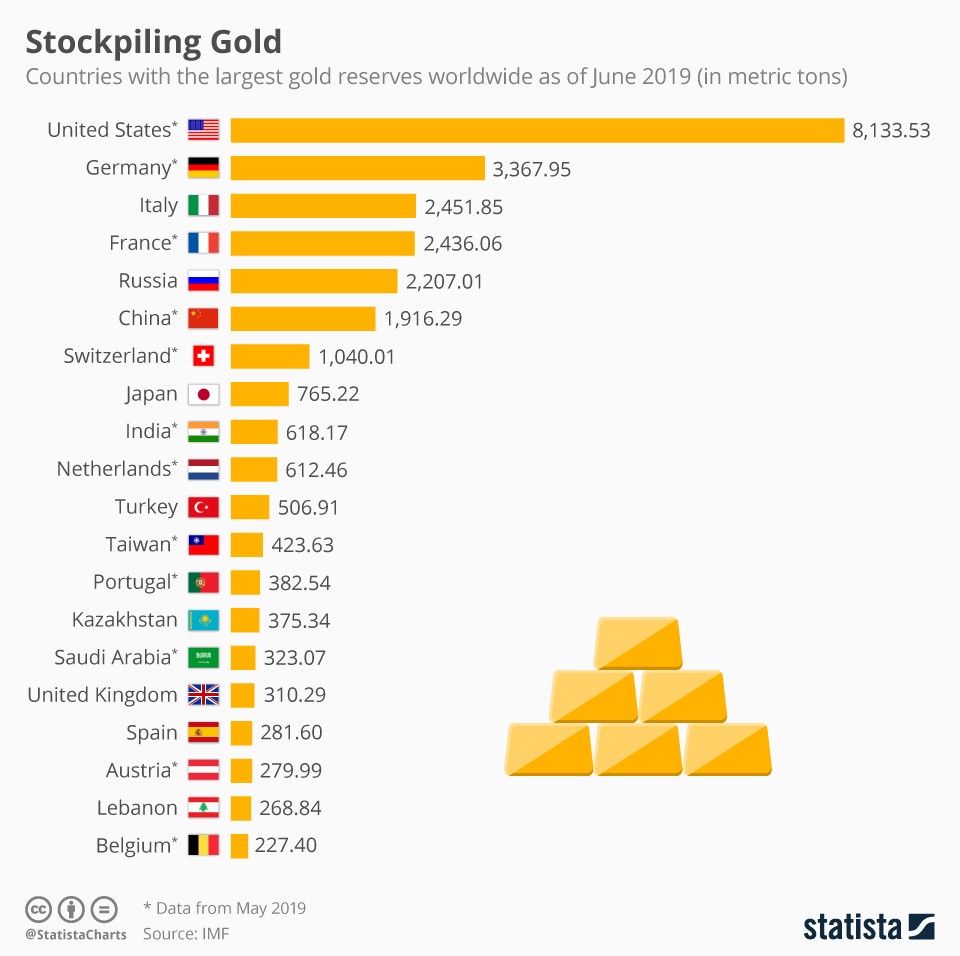

2. Major Nations and Central Banks are Stockpiling Gold

Many major nations are stockpiling gold. Over the past 10 years, Russia has increased its total volume of gold reserves by 400%. Russia has also notably dumped almost $100 billion worth of U.S. Treasuries, and according to the World Gold Council, replaced much of it with gold. China has been on a consistent buying spree since 2015 as well, adding over 100 tons to its reserves in 2019.

It is highly likely that the global financial markets are headed to a recession. The Debt Crisis in the U.S. and many other nations has reached unmanageable levels. Many nations are trying to pull away from their dependence on the U.S. dollar and embrace more sound money practices than ever before. Buying gold is a strategy by these countries of hedging against a sagging dollar, and is also a reflection of these governments’ growing worries about their abilities to stabilize their currencies in this uncertain climate. A return of gold to the world market will be a strong blow to the U.S. dollar as well.

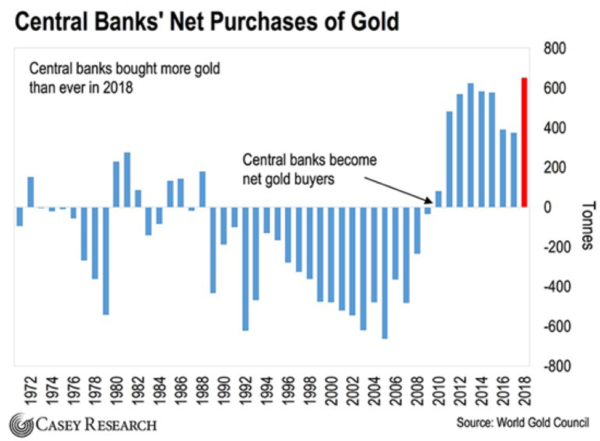

Central banks are buying more gold than they ever have in the past several years as well.

3. Sanctioned Countries Are Turning to Other Payment Avenues/Options

Cuba, Iran, Iraq, North Korea, Sudan, Syria, and Zimbabwe are some of the countries that are currently sanctioned by the U.S. Some of these countries are turning to the barter system (i.e.: the direct exchange of goods and services without money) as a way to avoid sanctions. Settling trades with gold shipments, cryptocurrencies/blockchain technology, and oil, are some of the ways the above-mentioned countries are avoiding U.S. sanctions. This, in turn, weakens the dollar as well, as many are finding that they don’t need to use the universal currency to transact with others.

4. Inversion of the Yield Curve

An inversion of the yield curve is one of the best indicators for a coming recession. An inversion is when short-term interest rates (on debt instruments) exceed long-term rates. The yield curve has inverted before every U.S. recession since 1968. The chart below shows examples of when the yield curve inverted and when the recession that followed happened as well. In general, a recession has followed within 14–34 months of the yield curve going upside down (or inverting). This is obviously very bullish for gold as investors flock to safe-haven assets during times of turmoil.

5. The Dollar Losing Value

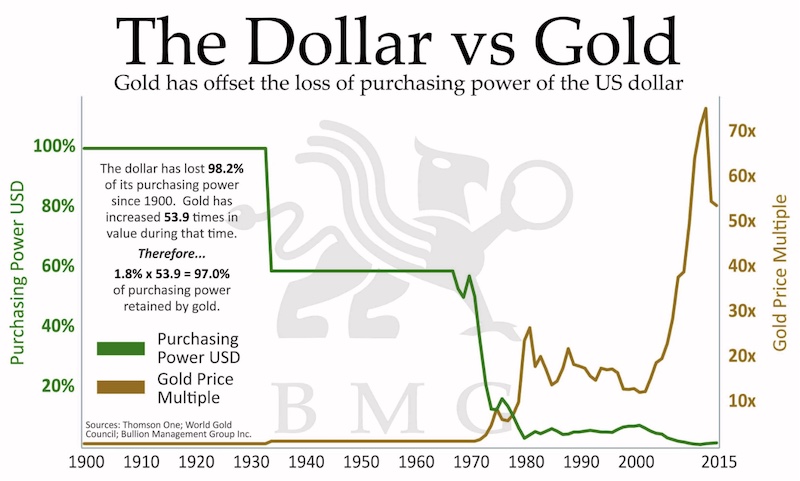

Since international gold is dollar-denominated, any weakness in the dollar pushes the price of gold up and vice versa. The dollar, as of late, has been losing its value. The dollar broke out of its multi-year ascending channel to the downside recently, a very bearish situation and a likely hint as whats to further come. This is another situation that helps gold as investors may want to look for better places to store value.

The dollar has also lost its purchasing power dramatically since 1913. $100 in 1913 would only be worth about $4 today. Gold, on the other hand, has long held its value/purchasing power.

6. Various Other Reasons

Other key factors driving the price of gold include (1) Interest rates being at or near zero, (2) 17 trillion in Negative-Yielding Debt, (3) Intensifying trade war issues between the U.S. and various other nations, and (4) massive growing debt worldwide, to name a few.

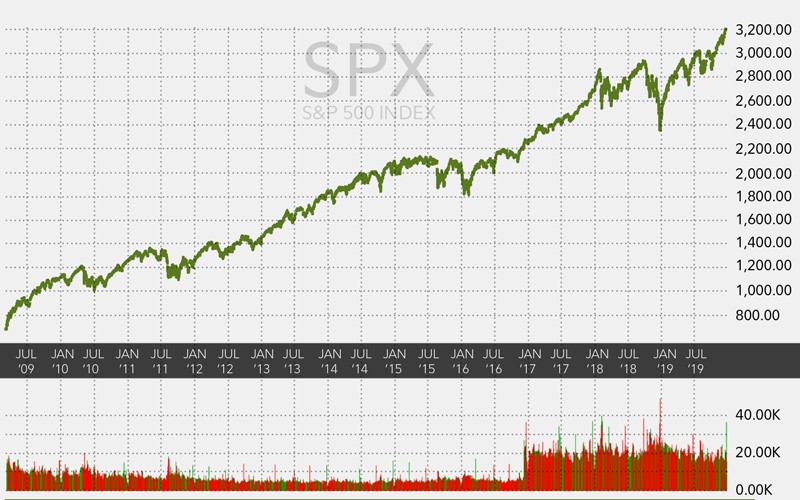

We are also currently in the longest bull market in American history as well. All the above factors can be reasons for the derailment of this bull run. It is only a matter of time before the market crashes and the U.S. enters a recession. Recessions have also been key factors for a rise in the price of gold.

Recap

The Bank of Finland called gold the “eternal payment instrument.” It has been used as a medium of exchange for several thousands of years. With the global debt-to-GDP now over 300%, interest rates getting pushed lower, and the dollar losing its value, it seems gold’s time to shine is right around the corner.

At Nicoya Research, we publish one of the top-rated gold investment newsletters. We advocate for owning physical precious metals in your possession first. But we focus our research on junior and mid-tier mining stocks that are under-appreciated by the market to capture leverages returns. Click here to get instant access to the GSB portfolio, newsletter and trade alerts.