Switzerland decided to break with its tradition of remaining neutral in geopolitical conflicts by adopting European Union sanctions against Russia. This is breaking a tradition of neutrality that goes way back to 1812. Swiss banks, long known for protecting the privacy of their clients, are now freezing assets of clients that the EU has sanctioned.

Switzerland told its banks to halt new business with people and entities on the EU sanctions blacklist, which the neutral country has adopted to ensure it is not used to circumvent measures against Russia over its invasion of Ukraine. Russians held over $11 billion in Switzerland in 2020 and likely much more during the past year.

I’ll leave the political and ethical arguments aside for the moment, only to say that a blanket ban on all Russian accounts certainly will see plenty of innocent people and entities caught up in the enforcement. It is likely that several of these account holders were against the invasion of Ukraine and had nothing to do with the decision-making.

Cryptocurrency exchanges have been taking a more balanced approach to demands from Ukraine to freeze all Russian accounts. They have refused these calls, instead only showing a willingness to freeze accounts of individuals that are on banned lists.

“Our mission Kraken is to bridge individual humans out of the legacy financial system and bring them in to the world of crypto, where arbitrary lines on maps no longer matter, where they don’t have to worry about being caught in broad, indiscriminate wealth confiscation.” – Jesse Powell

When Hillary Clinton expressed her disappointment that crypto exchanges still provide services to Russian users, Mr. Powell responded: “Just want to say that I’m happy, in good health and absolutely not feeling suicidal at all.“

Crypto exchange Binance is blocking the accounts of any Russian clients targeted by sanctions, but will not freeze the accounts of others after Ukraine called for a block on Russian users at major digital currency platforms.

“We are not going to unilaterally freeze millions of innocent users’ accounts. Crypto was meant to provide greater financial freedom for people across the globe.” – CZ

At any rate, the decision by Switzerland to join sanctions and freeze bank accounts breaks a long-standing tradition. Switzerland was a bastion of neutrality through two world wars. The new steps are fundamentally different from anything Switzerland has done previously against Russia, but it is not clear if Russia’s Central Bank holds large foreign reserves in Switzerland. Either way, the country is no longer going to be viewed as a safe haven for the wealthy, from Russia or other regions of the globe, and this has major implications for other asset classes such as cryptocurrencies.

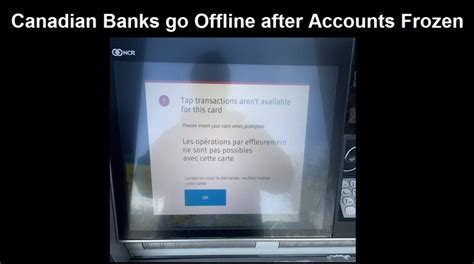

In addition, the recent actions of the Canadian government to freeze the assets of protestors highlight an elevated government willingness to go after the assets of those they view as acting unfavorably or breaking some loosely-interpreted law. Many of those bank accounts are still frozen, despite the dropping of the Emergency measures.

It could be Canadian truckers or Russian citizens this time, but it doesn’t take much stretching of the imagination to consider governments seizing funds for a wide range of behaviors they don’t condone. Pointing out government corruption? Protesting wars? Making personal health care choices they don’t like? Sharing the wrong information on social media? And down the social credit rabbit hole we could go.

But back to the flow of capital that is inevitably abandoning Swiss bank accounts as we speak. Many of the wealthiest people in the world use Swiss bank accounts due to the privacy and neutrality the country has offered. But now a good number of them will now be looking for a new place to park their capital.

“Bitcoin fixes this,” as they say. It is a digitally scarce store of value that can be easily and safely custodied by individuals or institutions via hardware wallets the size of a thumb drive. It can be sent around the world near-instantly for a few bucks, can cross borders, and even be transported in someone’s mind through the memory of a 12-word seed phrase. Bitcoin allows people to be their own bank and eliminate the custodial risk that comes with keeping assets within the legacy banking system.

Those wanting to protect their financial privacy can purchase coins such as Monero or use a mixing service to obfuscate wallet history. And yes, there are plenty of legitimate reasons to want to keep your financial history private. These are significant advantages versus other solutions such as cash or gold, which can be easily confiscated by criminals or tyrannical governments.

Now imagine tens of billions in capital rushing out of fiat money once held in bank accounts in Switzerland and other locations. Where is it going? Increasingly the answer is into Bitcoin or other cryptocurrencies. And this is happening at a time when the supply of Bitcoin available on exchanges has reached an all-time low.

Some might suggest that Bitcoin’s volatility is a deal-breaker, but the long-term trend remains firmly to the upside with the average annual returns in the triple digits. And those needing stability can opt for stablecoins, which not only hold their value relative to the dollar, but can generate a yield of 10% to 20% annually in any number of centralized or decentralized venues. This helps citizens ensure that they do lose their wealth to the hidden tax of inflation. Either way, the goal is to have financial sovereignty. You want to control all of your private keys so that no one will ever be able to lock, seize or access your funds.

There has been an incredible amount of bullish news for Bitcoin and the cryptocurrency sector in recent months, from nations adopting it as legal tender to major institutional investing to growing retail adoption. But I don’t think investors and crypto advocates are fully appreciating the significance of this move by Switzerland or the bullish implications for crypto demand.

As governments and their paymasters continue to encroach on civil liberties and seek greater control over their citizenry, the importance of having a store of wealth outside of their financial system becomes glaringly clear. These conditions set up the potential for an explosive move higher in cryptocurrency prices over the next few years as the world wakes up to these new realities and opportunities.

We believe that Bitcoin’s market cap is likely to reach parity with gold’s market cap by the end of 2024. This puts Bitcoin at a price of $500,000 or higher, implying the possibility of a 10x within a few years.

Near-term, we think there is a good chance that the current dip will prove to be an excellent buying opportunity with strong support around $35,000 and upside potential to over $70,000 in the months ahead.

Legacy banking institutions are destroying their moat by abandoning their tradition of neutrality. This might ensnare a small number of bad actors, but it will inevitably scare away billions in good capital. This makes cryptocurrency an increasingly attractive place to park money during heightened geopolitical tensions.

At Nicoya Research, we believe it is important to hold a mix of assets outside of the traditional banking system, including crypto, precious metals, and smaller amounts of cash that are in your possession or easily accessible. Your financial sovereignty is becoming more and more important each day as the race to debase fiat currencies is making scarce assets exponentially more desirable.

We favor dollar-cost averaging over time, rather than trying to time the markets and think investors will continue to be rewarded for owning cryptocurrencies in the years ahead.

We offer investment research covering precious metals, mining stocks, cryptocurrencies, and other asset classes, along with a chat room where we are active daily. Sign up today to get instant access to our top stock and cryptocurrency picks, how-to guides, plus our monthly newsletters, trade alerts, and more!