As if global inflation at multi-decade highs, persistent supply-chain issues, and escalating geopolitical tensions weren’t enough, we now have two major crises that could derail the recent stock market rally. Are new lows in store for stocks, crypto, and other assets?

First off, we are seeing an increasing amount of evidence that the Chinese economy could be in serious trouble. Half a million banking customers have lost their deposits as the banks lent indiscriminately to housing developers who are now facing cascading defaults. This information is slowly leaking out as the Chinese government expends significant effort on keeping all negative news from coming to light.

It is being reported that Chinese developers have suffered a meltdown of at least $90 billion in stocks and dollar bonds this year, with a bursting housing bubble and an intensifying debt crisis threatening to inflict even more pain.

The backstory is that roughly 70% of China’s wealth is tied to real estate (twice as high as the US) with the median home price as high as 25 times the median annual income! Reports are now emerging about real estate Ponzi schemes, mortgage boycotts, and an unfolding banking crisis.

The insatiable demand leads to Ponzi schemes where developers pre-sell homes (which are not even built), use the pre-sale money to start more projects, and then collect more pre-sales from new projects. Buyers started a mortgage boycott, refusing to pay as the properties have not been completed. The government is stepping in to try to prevent contagion, but it may be too late.

The crisis has spread to banks, as they had loaned out depositors’ money to developers who are now defaulting on payments. Banks runs have led to frozen deposits and protests erupting all over China, suggesting there could be critical systemic issues.

Given the above, we think China is unlikely to meet its targeted 5.5% GDP growth rate for 2022. Youth unemployment is at nearly 20% in China and is likely to get worse.

But these issues are not limited to just China and with the global nature of the economy today, bad news for the Chinese economy will impact everyone. China has the world’s second-largest economy when measured by nominal GDP, totaling around US$17.7 trillion in 2021, and the world’s largest economy since 2017 when measured by Purchasing Power Parity (PPP). In addition, Chinese companies have substantial investments in US equities and might sell these positions during a crisis. Selloffs can snowball, tilt investor sentiment to fear, and trigger a major selloff.

Outside of China, Germany is facing a recession as the energy situation escalates. German next-year power prices now trade over €500/MWh for the first time ever. And these prices could climb much higher as they have shut down nuclear power plants and are seeing restricted energy supply from Russia.

Update: In the few days since I published this article, the German 1-year ahead power price has spiked to 700!

Most people don’t yet understand the repercussions of the energy crisis unfolding in Germany. It has the potential to force businesses to shut down, create massive job losses, and cascading debt defaults. Some analysts believe that it could incite a contagion event throughout global credit markets.

This situation was largely avoidable and should be a cautionary tale for other nations. Germany created its own energy crisis by shutting down nuclear plants and making its energy mix more volatile, intermittent, and expensive. Germans may be learning the hard way that it is not worth plunging your country into an economic crisis and freezing to death for Nato / US brownie points.

An energy crisis in Germany doesn’t simply mean that people have to suffer through a few cold nights in their homes. It means that manufacturing begins to grind to a halt because it becomes uneconomical. If this happens, a credit crisis could be on the horizon.

A new report published by the Employment Research (IAB) on Tuesday outlines how Germany’s economy will lose a whopping 260 billion euros ($265 billion) in added value by the end of the decade due to high energy prices sparked by the conflict in Ukraine and ensuring sanctions. These actions could have severe ramifications on the labor market. IAB said Germany’s price-adjusted GDP could be 1.7% lower in 2023, with approximately 240,000 job losses, adding labor market turmoil could last through 2026.

Germany’s main transport route the River Rhine is on the verge of collapse with ships only carrying 25% loads. The industry is being seriously impacted. It’s shaping up to be a perfect storm.

In the U.S., the housing market has been a bright spot, holding up rather well so far. But there are now clear signs that the housing bubble is deflating and prices are likely to follow. A July survey from the Census Bureau, reported by Bloomberg News, found that a staggering 5.4 million households, or 40% of households that are not current on their rent or mortgage payments, said they were likely to be evicted or foreclosed on in the next two months.

Sales plunged by 5.9% in July from June, the sixth month in a row of month-to-month declines, and by 20% from a year ago, the 12th month in a row of year-over-year declines. The sales volume of houses and condos in the entire San Francisco Bay Area has collapsed by 37% from a year ago.

We’re witnessing a housing recession in terms of declining home sales and home building. It is not a recession in home prices yet, but declining prices are expected to follow and we have already seen some early signs in select markets. In July, the number of sellers that reduced prices of their properties on the market spiked by 31% from June, and more than doubled (+109%) from July last year. The median price dipped to $403,800 in July, which whittled down the year-over-year increase to 10.8%. As big as it sounds, it was the smallest year-over-year increase since July 2020, after having spiked by 25% last year. In San Francisco, the median price was down 8.2% year-over-year.

U.S. mortgage lenders are starting to go broke. After a sharp spike in lending rates and a meltdown in purchasing and refinancing activity, the U.S. mortgage industry is seeing its first lenders go out of business. Independent lenders handle more of the mortgage business than in previous decades, and they’re struggling to stay afloat given the sharp drop in business volume. These ‘shadow banks’ are not as well capitalized as the money-center or regional banks and remain the most vulnerable to the recent housing downturn.

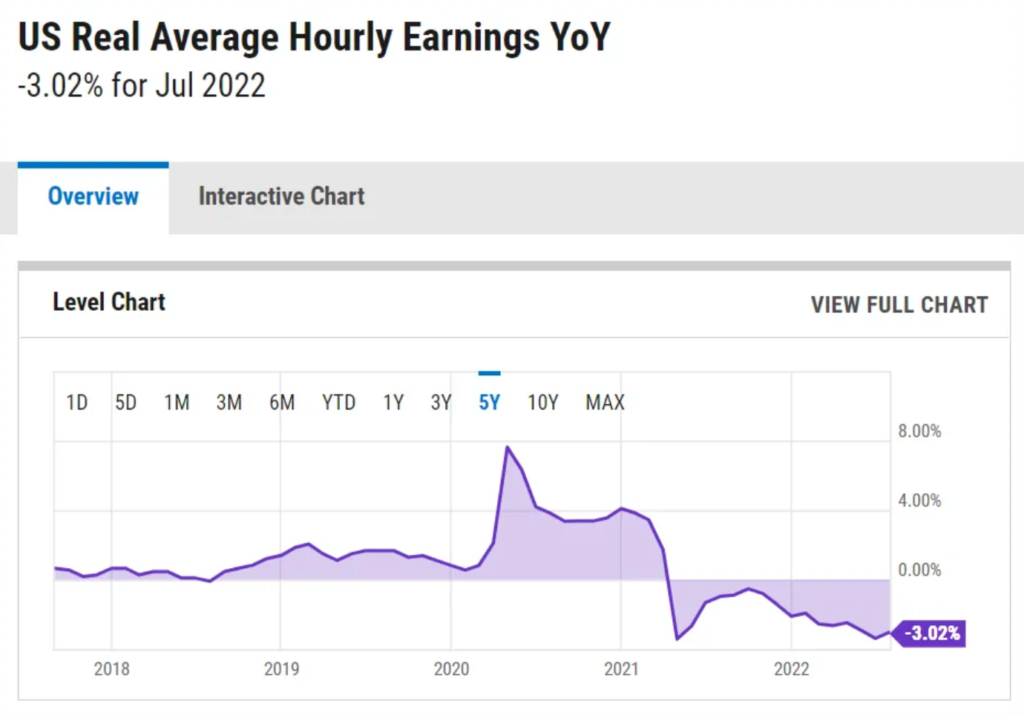

And while nominal wages are increasing, real wages (adjusted for inflation) continue to decline.

Such a precipitous and sustained loss of real income crushes the actual buying power of all Americans, especially working-class citizens who see their lifestyles decline measurably every single month. The weight of this destruction of prosperity compelled millions of workers to turn to the dangerous practice of loading up on high-interest credit cards to cope with the inflation explosion. Total credit card debt in the Second Quarter of this year jumped $46 billion, the highest clip in 20 years.

Germany’s producer prices rose 37.2% YoY and 5.3% MoM…the highest on record. Eurozone inflation was 8.9% and U.S. inflation was 8.5% in the latest month. Spain hit 10.8% and Estonia’s inflation is a crushing 22%! These are the highest levels in decades and it translates to diminished purchasing power and overall consumer spending, the key driver of economies.

Adding to the precarious economic situation, the war in Ukraine rages on and President Zelensky has warned that the world is on the ‘verge of nuclear disaster’ as fighting continues near the Zaporizhzhia nuclear power plant. It is Europe’s largest nuclear power plant and both sides have warned that the other side may attack the plant. Both sides said the other could seek to deflect blame through false flag operation.

The latest escalation is the assassination of the daughter of Putin ally in a car bombing outside Moscow today. The daughter of Alexander Dugin – a close ally and adviser to Russian President Vladimir Putin – has reportedly been killed in what many are assuming was an assassination attempt meant for her father. Dugin is the former chief editor of the pro-Putin Tsargrad TV network, and has been often portrayed in Western media as being a ‘mastermind’ of the Ukraine invasion, as well as an intellectual / philosopher who’s had a large influence in Russia’s post-Soviet nationalism. Some are calling this a Franz Ferdinand moment, but let’s hope that is an exaggeration of the situation.

The United States is also antagonizing China over Taiwan, so we are actively provoking the other two major superpowers in the world. It seems foolish and we can hope that cooler heads prevail, but it is a cloud that hangs over economic growth and could get out of control rather quickly. The odds of escalation to a military conflict between superpowers is probably the highest it has been since the Cuban missile crisis. And even if those odds remain relatively low, it is worth considering both the odds and the severity of such a crisis.

The United States is also dealing with a generational drought in the west that would force American to import a greater percentage of food at a time when food prices are skyrocketing. Many scientists are ringing alarm bells that it could mark a tipping point in the water crisis that threatens life in the West as we know it, particularly agriculture.

Agriculture uses about 80% of the water from the Colorado River which feeds Arizona, California, Nevada, and parts of Mexico. In Arizona, some farmers have already seen their water allotments reduced significantly and many of these farmers will be forced out of business.

The good news is that the labor market in the U.S. seems to be holding up, Covid lockdowns are over and people are spending on vacation and leisure after hunkering down for so long. But inflation is already eating into vacation spending, as households are left with less discretionary income due to rapidly rising housing, fuel, and food costs. And the low unemployment rate is a double-edged sword because there is a labor shortage that is causing businesses to close down or offer limited hours.

The FED released meeting notes showing that they don’t expect inflation to slow anytime soon and that they expect unemployment to increase in the months ahead.

We won’t hold our breath expecting the Inflation Reduction Act to help the situation. Reckless spending and money printing is the main cause of inflation, so more deficit spending doesn’t seem like a solution. Not to mention that government is historically inefficient at capital allocation, so billions are likely to be wasted, go missing, or be directed to kickbacks via no-bid contracts. The political and economic systems are intertwined and both broken beyond repair in our view.

So, what is an investor to do in this environment? There aren’t many great options. Gold and bitcoin should be flourishing in times like this, but neither has offered much safe haven in the past year. Gold is down 3%, Bitcoin is down over 50% and the major stock indices are also down over the past year. We still hold constructive views on gold, silver, mining stocks, and bitcoin over the medium term, but the macro headwinds have thus far been too overbearing and the crypto correlation to stocks continues.

Energy has been one of the few winning sectors in the past year and may continue offering strong returns to investors going forward. Oil is up 46% and natural gas is up 142%, largely driven by supply constraints from Russia and re-surging demand following Covid lockdowns. Prices have cooled a bit in the past two months, but we think the upward price trajectory is likely to continue in the months ahead. If this thesis is correct, buying the current dip could prove to be a profitable play.

The United States Natural Gas ETF LP (UNG) is one way to profit from this trend. Natural gas producers like Chesapeake Energy Corporation (CHK) and Southwestern Energy Company (SWN) are other methods of getting exposure.

While profitable plays have been hard to come by in 2022, we have also generated double-digit gains from one of our farmland plays. Revenue for Farmland Partners (FPI) was up 25% in the latest quarter and they swung to a profit versus the same quarter in the prior year. Global food demand is rising and arable land supply per capita is declining, making farmland more valuable.

While it is difficult to predict short-term moves, we think the bulk of the economic data and geopolitical cues suggest there is more near-term pain ahead in the markets. Eventually, the Federal Reserve will end rate hikes and may need to pivot and once again reduce rates and prevent a market collapse. It is unclear how successful they will be at propping up markets, but we believe that scarce assets will benefit greatly from the pivot.

Until that point, investors might want to consider hedging long portfolios, moving to cash, and focusing on the few sectors that have been able to weather the recent storm. We will then look to buy the coming dip, expecting a major bounce in 2023 across the asset classes that we cover.

We have taken a hit in 2022, but have outpaced the market by a wide margin over the past decade. If you would like to receive our research, you can sign up here: https://nicoyaresearch.com/premium-services/.