This post will highlight what some key indicators are telling us about the current state of the market.

1. Yield Curve Inversion

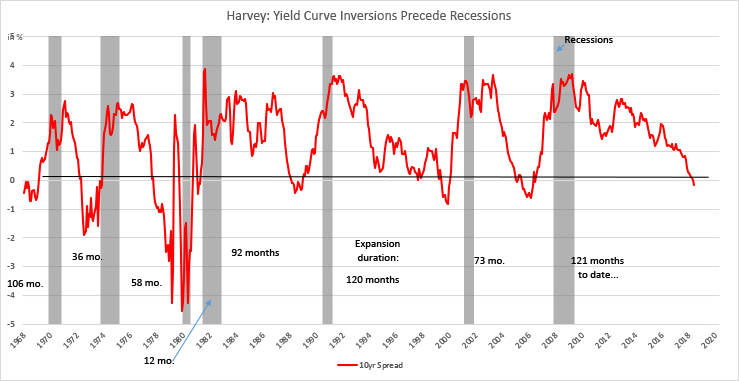

One of the best indicators for a coming recession has been an inversion of the yield curve. An inversion is when short-term interest rates (on debt instruments) exceed long-term rates. The yield curve has inverted before every U.S. recession since 1968. In general, a recession has followed within 14–34 months of the yield curve going upside down (or inverting).

There is a handy metric that The Federal Reserve Bank of New York has created which translates fluctuations in the yield curve into recession probabilities twelve months ahead. As of January 6, 2020, the model puts the chance of a recession starting in the next year at about 24%. A year ago, the chances were at about 21%, and two years ago they were at about 11%.

The Bond market also indicates a bubble. There is currently more than $10 trillion negative-yielding debt. Similar to previous bubbles, various Governments continue to try and inflate their way out of their debts instead of dealing with them head-on.

2. Gross Domestic Product (GDP)

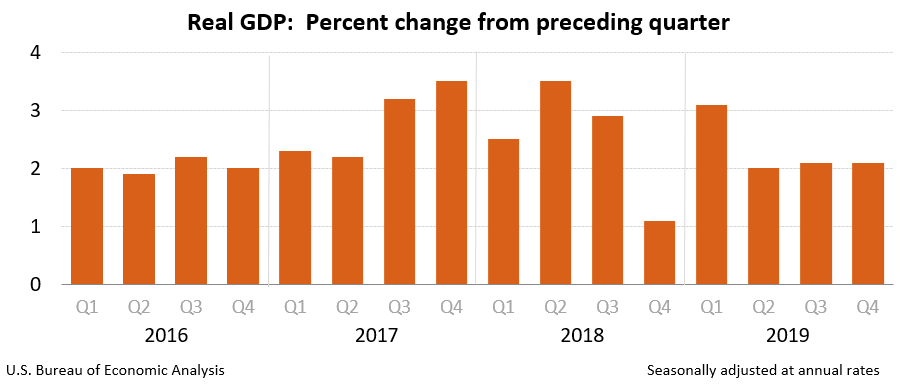

GDP is one of the best, if not the best measure of an overall economy’s health. We technically enter a recession when there are two consecutive quarters of negative GDP growth.

While the rate of growth is rather low (2% past few quarters), it isn’t indicating a coming recession. Slowing GDP numbers though may mean that we could slip into a negative growth situation rather quickly.

3. Purchasing Managers’ Index (PMI)

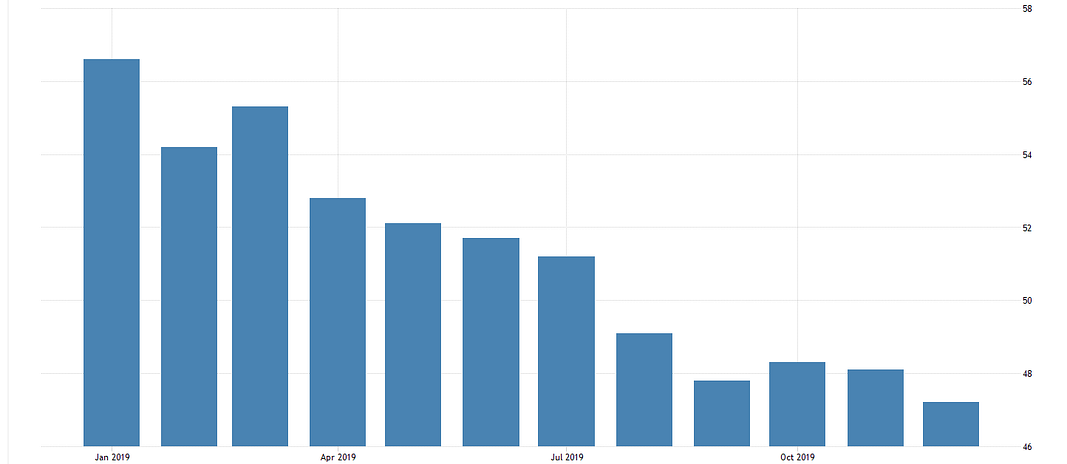

The PMI, according to Investopedia, is a “measure of the prevailing direction of economic trends in manufacturing.” More specifically, it is a measure of the overall health of the manufacturing industry.

A PMI reading of over 50 (or 50%) indicates that the manufacturing sector is growing. A reading below 50 indicates the sector is contracting. Similar to consumer confidence, if business sentiment is low, it can also foretell a potential slowdown to come.

The December 2019 PMI registered at 47.2%; its lowest level since June 2009.

According to Charlie Bilello, when the PMI falls below 50 for 4 straight months, a recession usually follows within two years. Out of the 17 times the PMI fell below 50 (since 1948) a recession has followed 11 times.

While a relatively useful indicator, it is important to keep in mind that U.S. manufacturing accounts for a smaller percentage of GDP today than previously.

4. Consumer Sentiment and Consumer Confidence Index

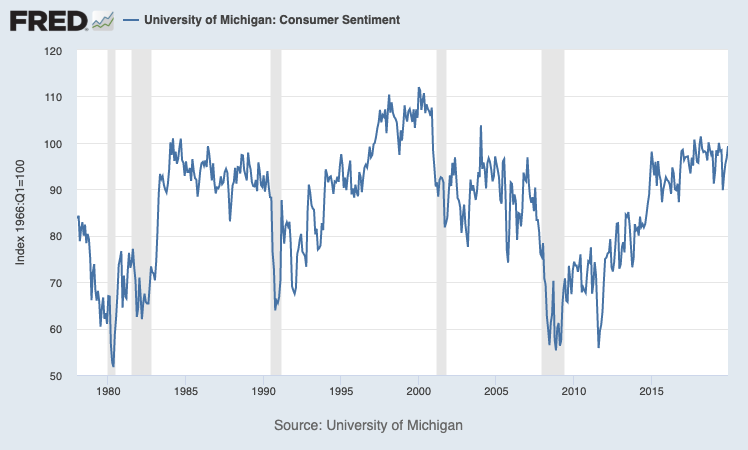

- Consumer Sentiment Index (CSI)

According to the chart below, the economy isn’t in trouble. Sentiment has been trailing higher for several years now. Consumer sentiment though is a lagging indicator, as by the time spending slows, a recession is probably already underway.

- Consumer Confidence Index (CCI)

Consumers are currently confident about the economy as well. The indicator being above 100 signals such. A signal above 100 also indicates that consumers are less likely to save, and more likely to spend money on major purchases in the next 12 months.

5. Unemployment Rate

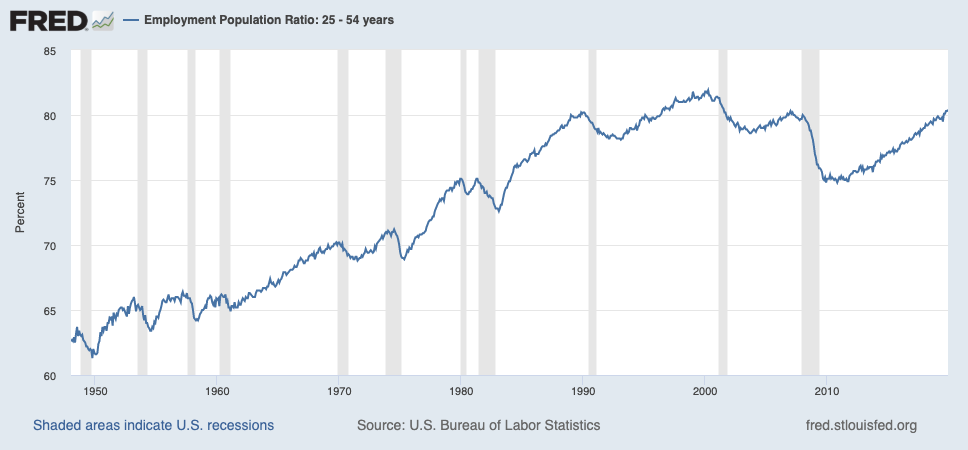

A good indicator of labor-market strength is the prime-age employment-population ratio. Despite all the issues in society, this ratio has been steadily increasing since the last downturn.

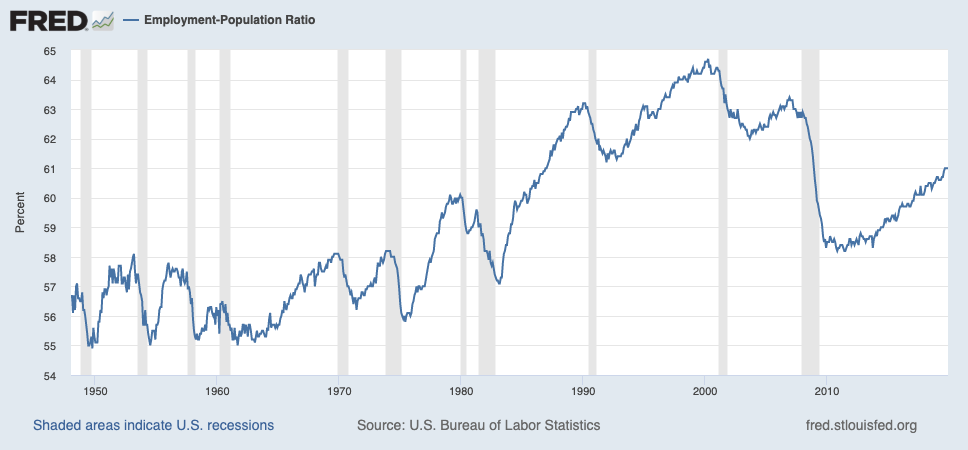

The employment-population ratio, in general, has been increasing over the past several years.

While the unemployment rate is rather low, it is key to watch for a potential drop in such. In every previous recession, there was a quick drop in the employment rate. When such occurs, a recession is almost certainly on its way or is already present. While a good indicator, this ratio is also considered a lagging indicator, as it is unlikely to be the first place to pick up on signs of trouble.

Other Relevant Indicators/Factors

Other relevant indicators include the trade war(s), stock market volatility, stock valuations being massively overpriced, the massive debt present worldwide, the 2020 elections, low-interest rates continuing to drop, and the weakening of the US dollar.

Recap

No one knows when the next recession will arrive or how severe it will be. All we know is that the market will eventually go through a downturn. With the length of the current business cycle being its longest since postwar history, a recession may be closer than ever. Investors must focus on building a portfolio that can support itself through such economic hardships.

Gold has long been the staple safe-haven asset during times of uncertainty. With many of the major nations stockpiling gold and gold hitting record highs in many currencies worldwide, the long term outlook on gold is bright. Bitcoin, while a slightly riskier investment, is another way for investors to be prepared for a potential downturn. Bitcoin has no correlation to any other market and has its own unique and apolitical monetary supply. It is best to be diversified during these times of uncertainty.

To get our premium research into precious metals, mining stocks, and cryptocurrencies, plus our top picks in each sector, click here for instant access.