News about the coronavirus has been making its rounds as of late, but many are downplaying its overall potential impact.

Supply Chain Disruptions

The impacts of this new virus are being felt everywhere. A new Dun & Bradstreet study estimates that 94% of Fortune 1000 companies are seeing supply chain disruptions because of the virus. Several companies have issued earnings warnings related to this virus as well.

The situation is likely to get worse as well. In a survey of over 150 American companies in China in mid-February, only about 18% of them said they expect business operations to return to normal by the end of February. 28% of companies are expecting a return to normal by the end of March.

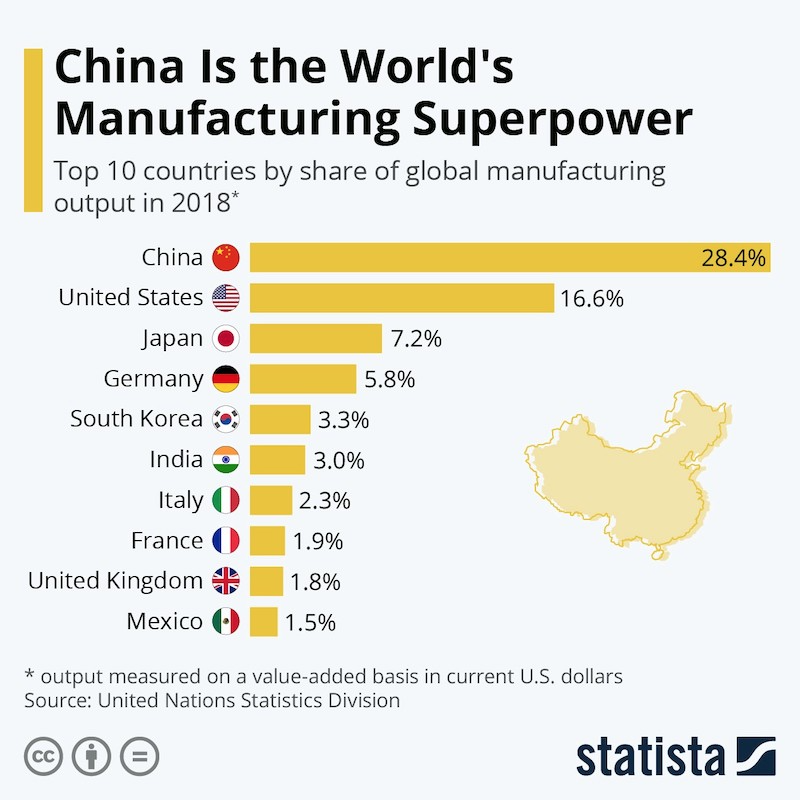

China is the world’s second-largest economy and the world’s largest manufacturing hub. The country represents 20% of global GDP and 18% of global wealth. A slowdown in China’s economy hurts everyone.

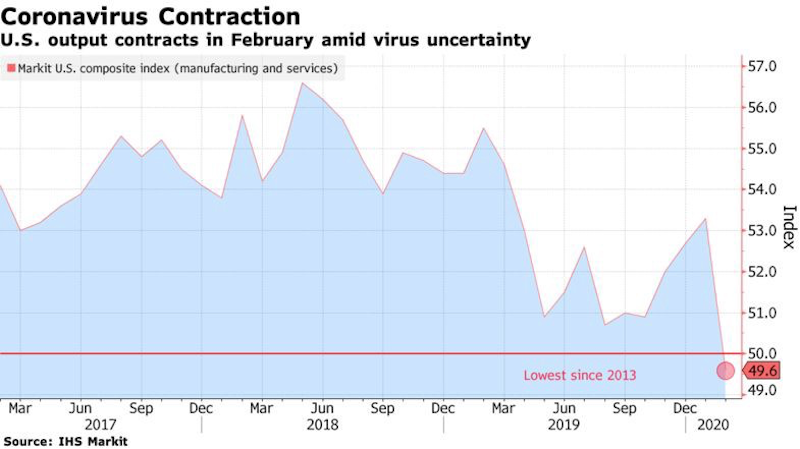

The effects of the virus are being felt in the U.S. as well. Business activity shrank in February for the first time since 2013. The IHS Markit purchasing managers’ index measuring composite output at factories and service providers fell by almost 4 points to 49.6. Readings below 50 indicate contraction. Similar indexes in Japan and Australia have also weakened. Manufacturing in Japan shrank the most in seven years in February.

China’s economy is suffering as well. Car sales sank 92% in the first half of February. China’s economic growth is also expected to slow to 4.5% in the first quarter of 2020 as well — the slowest pace since the financial crisis. China is also facing a lose-lose decision: maintain its widespread quarantine or send people back to work. Maintaining the quarantine will continue hurting their economy while sending people back to work can further spread the virus.

Effects on Overall Economy

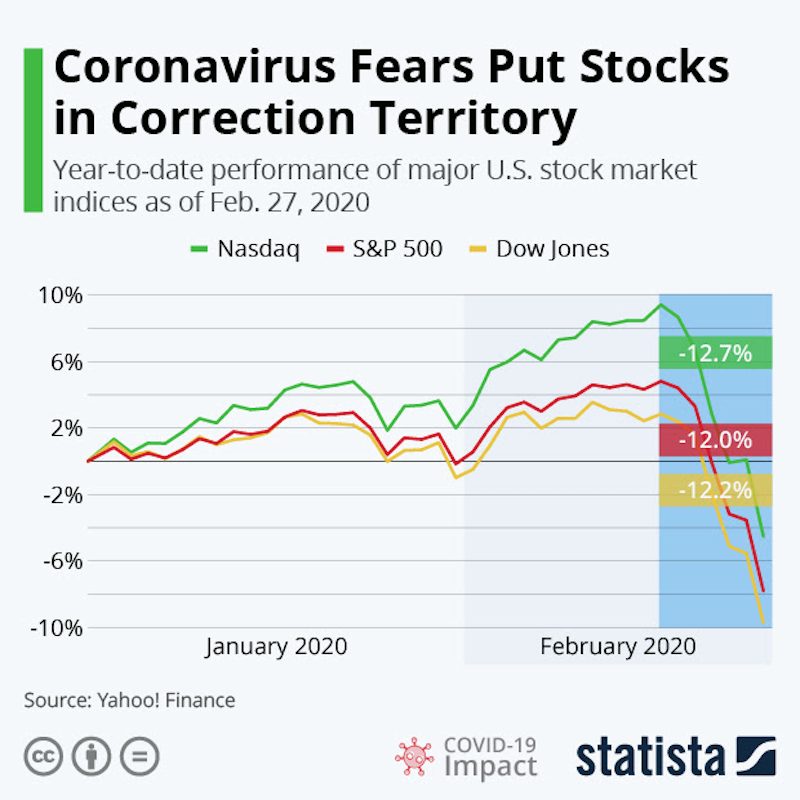

It is estimated that global trade will take a hit of nearly $600 billion because of the current shutdown of China’s economy. The effects are being felt in the U.S. as well as the 30-year Treasury yield touched a record low. The stock market has also been suffering.

World stocks lost about $5 trillion in market cap during the last week, the biggest loss ever. Banks and Airline stocks suffered their biggest weekly drop in over a decade. Even precious metals and the major cryptocurrencies (Bitcoin and Ethereum) are down substantially over the past week.

The situation can get a lot worse if the outbreak is not contained. Oxford predicts more than $1 trillion, or $1.3%, would be knocked off of global economic growth in 2020 if the outbreak morphs into a global pandemic. This is on top of the fact that world growth was the weakest in a decade in 2019.

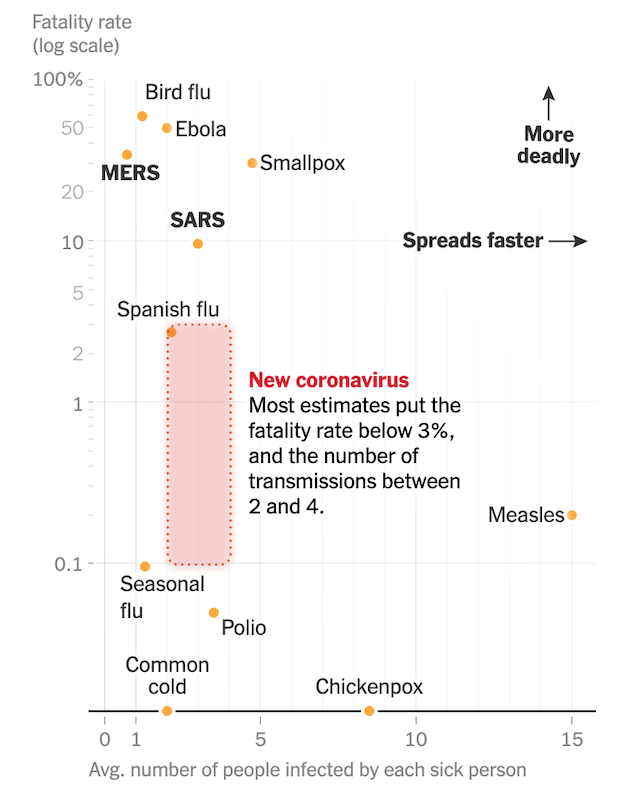

The spread rate of the virus is very high as well. The spread rate is over 2 and possibly as high as 6. This means that for every person infected at least 2 to possibly 6 more get the disease. Health officials are recommending that Americans prepare for “significant disruption” in the coming weeks.

Spread of Virus

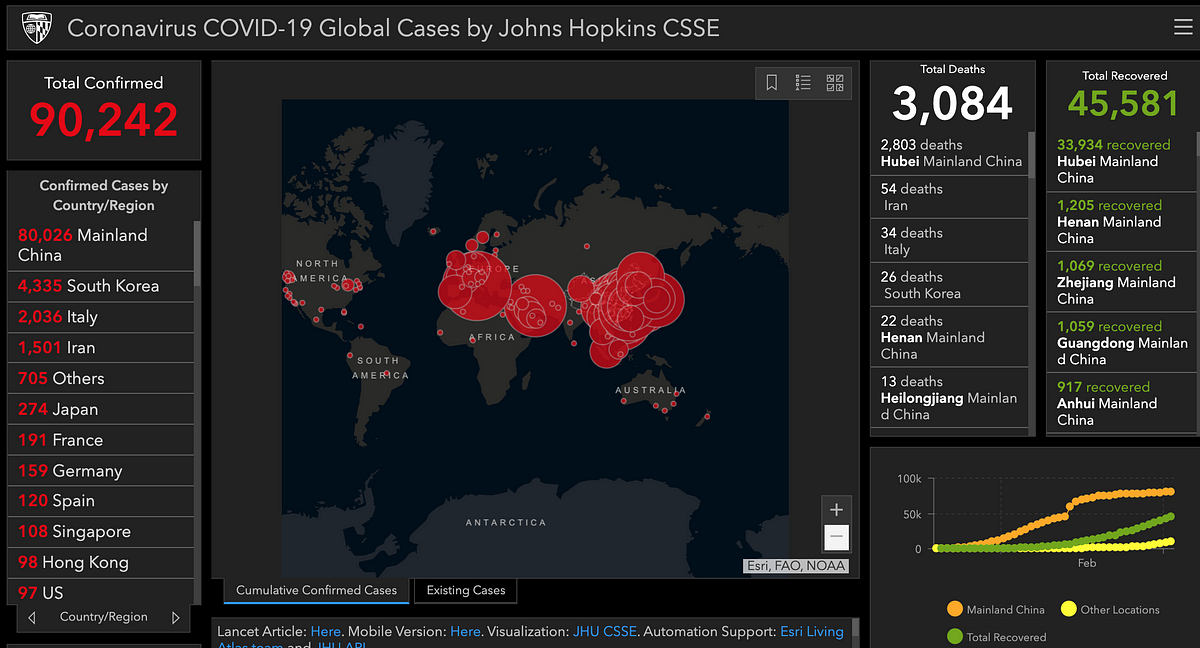

The virus continues to spread very quickly throughout the world. In South Korea, the number of people infected grew from 31 on February 18, to over 400 as of March 2. In Italy, the first confirmed outbreak was on January 31st. There are over 1,100 confirmed cases in the country now. The military has begun quarantining certain cities in an effort to contain the virus.

The first few deaths in the U.S. have also been recently reported. There are up to 6 deaths now in the U.S. and the number of infected people is almost 100. It was only 30 the other week. These high spikes in confirmed cases are happening elsewhere as well as countries such as Iran, Japan, Singapore, and France are all showing an influx of infected people.

Countries are also closing borders with each other due to the virus. Afghanistan, Turkey, and Pakistan have all closed their borders with Iran as Iran appears to be the hub from which the virus is spreading in the Middle East. Iran has also started to close schools and universities in an effort to contain the virus. Saudi Arabia is also temporarily closing its borders, and not allowing any tourists to visit if they come from any country with a confirmed outbreak.

Many nations are trying to contain the virus as well. The UAE is banning citizens from traveling to Iran and Thailand. Kuwait is also banning citizens from traveling to Thailand (more on this below). In the U.S only five states have the ability to test for the virus. Getting a vaccine ready just for testing is going to take more than just a few months as well. With a fatality rate between 1–2%, the situation can get a lot worse and quickly.

Many countries are likely underreporting the number of people that are infected. In China, for instance, there are reports that infections are potentially 52 times higher than reported. Thailand is likely underreporting as well. According to a citizen, the Country never ceased any daily flights to and from Wuhan when the breakout first occurred (in January). This means that those infected were free to go wherever they wanted after having landed in Thailand.

Comparison of Past Breakouts

SARS– SARS, which also emerged in China, sickened 8,098 people and killed 774 before it was contained. Coronavirus has already killed almost 3,000 people, with over 80,000 confirmed cases, and rising quickly.

In addition, China only accounted for 2% of Global GDP in 2003 (when SARS came about). Today it accounts for 20%.

Ebola- While Ebola has a 40% fatality rate, the infection only spreads through direct contact with bodily fluids. Coronavirus spreads via droplets and aerosols, making it a lot more contagious.

The Flu- The coronavirus is much more deadly than the flu. It is about 20–50 times more deadly. There is also a very high complication rate as there is a 15% chance of getting pneumonia and up to 5% requiring intensive care.

The image below shows how this new virus compares with other infectious diseases as well:

Gold and Bitcoin’s Reaction

Both Gold and Bitcoin were doing very well to start the year. Gold went up as high as $1680 an ounce, its highest in 7 years. Bitcoin was up over 50% since the new year.

Gold suffered its worst day since June 2013 during the past week as it is down about 6%. Bitcoin is down about 13% over the past week as well. While Bitcoin was likely due for a correction after posting such gains to start the year, the massive sell-off in gold is what confuses many. One thing to note is that these sell-offs in gold have happened before and that gold usually is first to bounce back while the markets are in decline.

Market’s Reaction Following the Crash

The stock market has been rallying after the biggest point drop in history the past week. Many are anticipating the FED stepping in to the rescue the markets as Jay Powell announced that they (the FED) will “act as appropriate” to support the U.S. economy. Any near-term bounce is unlikely to hold though. For starters injecting more money into the markets does not start production chains or cause airlines to fly. Rate cuts are also not going to cure this new virus. The economy is still overwhelmed by debt and is expecting very low growth this year as well. There is only so much that the FED (and only so few rate cuts left) can do before it all collapses on them.

Many other assets have been recovering well after last week’s rush to cash. Gold is up .25% and is hovering around the $1600 mark. Silver is up half a percent. Mining stocks are also bouncing back. VanEck Vectors Gold Miners ETF (GDX) is up 4% and VanEck Vectors Junior Gold Miners ETF (GDXJ) is up almost 6% on the day. It seems that investors are getting back into assets that typically provide a hedge.

The crypto markets are rallying as well. Bitcoin is up over 4% and Ethereum is up almost 7%. The top 10 cryptocurrencies are all in the green today.

Recap

The virus continues to spread around the world. Infections continue to grow at a non-linear (i.e., exponential) rate as new cases and deaths are doubling worldwide every 4–5 days. We are also seeing new cases being reported in new countries almost daily now. There are about 60 countries reporting the presence of the virus. This new virus also spreads asymptomatically (i.e.: spreads with no symptoms present) and has an incubation period of about 20 days, making it very hard to contain and detect.

The economy is greatly slowing as well. Supply chains are being disrupted, travel restrictions are now being imposed, and schools and business closures are also present. It is also going to take several months for a vaccine to be ready just for testing as well. The global economy and financial markets are likely to be quite volatile in the next few months.

To get our premium research into precious metals, mining stocks, and cryptocurrencies, plus our top picks in each sector, click here for instant access.