What an incredible year it has been for cryptocurrency investors! Just last week, Bitcoin broke through $18,000, hit a new market cap record above $329 billion and briefly flirted with $19,000. This is the highest price for Bitcoin since late 2017 and it is less than $1,000 from an all-time price high.

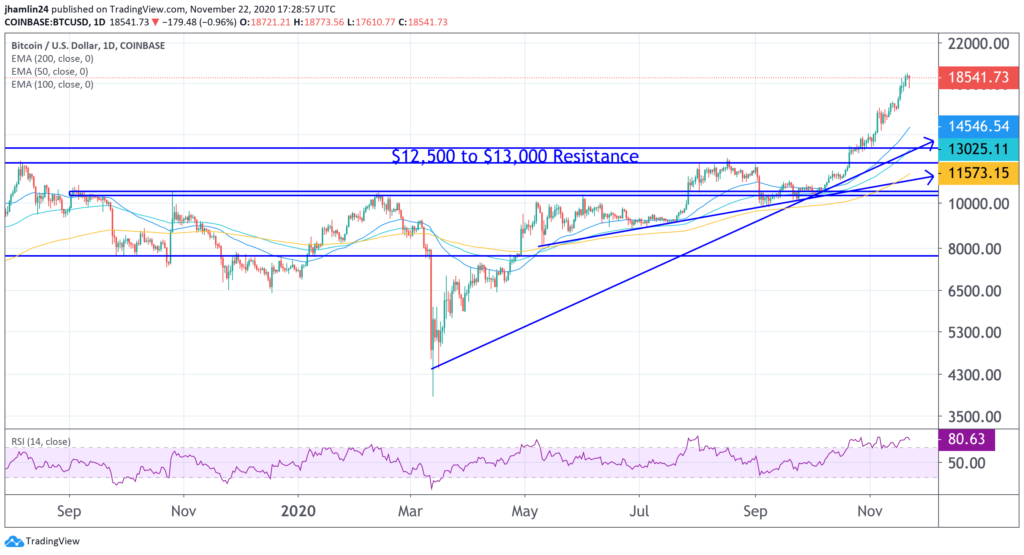

Bitcoin is up 155% year-to-date in 2020! This easily crushes the 10% gain for the S&P 500, 31% gain for the Nasdaq and 21% advance in the gold price. But the BTC chart is overextended with the relative strength indicator (RSI) overbought at a reading of 80.

So, is it too late to buy?

In a word, no.

Bitcoin is the first time in history that digital scarcity was achieved and this was no simple feat. There is a strict cap of 21 million to the supply and over 18 million are already in existence. The supply is highly unlikely to ever be changed as it would be against the financial interests of the miners and the community that supports Bitcoin.

Bitcoin is increasingly seen as a store of value or digital gold. Multiple economists and financial analysis have recently pointed out how investors are seeing it as a better option than gold and that Bitcoin is likely capturing more of these investment dollars.

It is more scarce than gold in the sense that massive new gold discoveries could happen at any time, either here on Earth or elsewhere. And while there is a strict cap to BTC, there is none for gold. Bitcoin is also easier and less expensive to store, transfer and use for transactions.

So, if Bitcoin is viewed as having similar or even superior characteristics to gold as a store of value, we can easily envision a day soon when Bitcoin’s total market capitalization will match or surpass that of gold. With gold’s current market cap of around $9 to $10 trillion and Bitcoin at $340 billion, this implies upside of roughly 30x for Bitcoin or a price above $500,000.

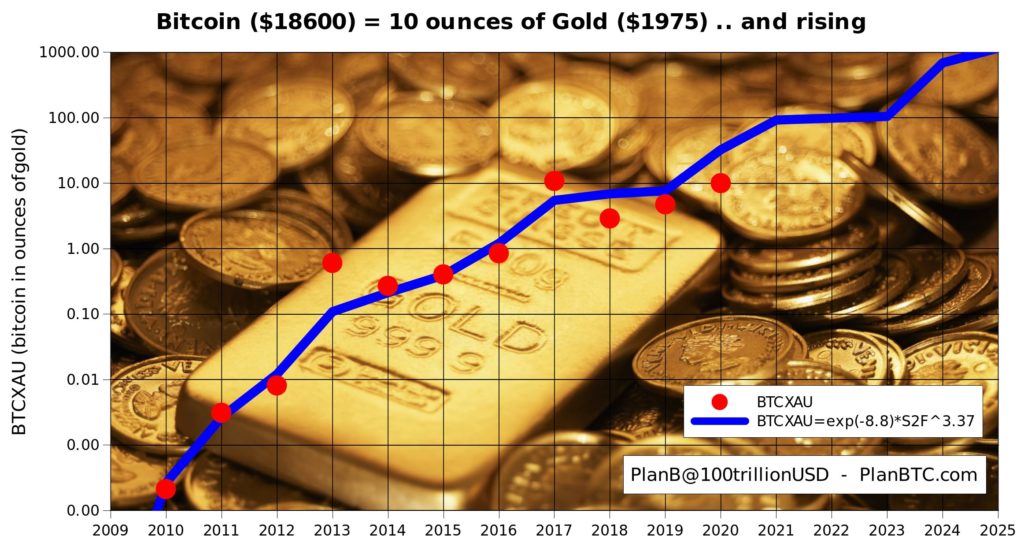

I remember when it was a big deal for the Bitcoin price to reach parity with the price of one ounce of gold. It is now worth 10 ounces of gold and rising!

A leaked report from Wall Street giant Citibank has revealed a senior analyst thinks bitcoin could potentially hit a high of $318,000 by December 2021, calling it “21st century gold.” Stock-to-flow scarcity models suggest Bitcoin will easily surpass $100,000 by the end of next year and a focal point of $288,000 before the next bitcoin halving in 2024. The top for BTC over the next few years, as PlanB previously explained, could be more than double that amount or roughly in line with the market cap of gold.

Of course, these are just price models and not guarantees of what the price will do in the coming years. But the fundamentals have also been incredibly bullish this year. Institutional money is finally flowing into Bitcoin, PayPal has integrated cryptocurrency, Square has seen record numbers of revenue from Bitcoin transactions in their Cash app, the Grayscale Bitcoin Fund is buying more BTC each quarter than are being mined, while Paul Tudor Jones, Stanley Drukenmiller and other notable investors have announced their holdings in Bitcoin and bullish outlook.

The third richest man in Mexico, 106th in the world, Ricardo Salinas, just disclosed he holds 10% of his portfolio in Bitcoin.

“There seems to be an increasing demand to use bitcoin where gold used to be used to hedge dollar risk, inflation, and other things.”

— Deutsche Bank Head of Global Fundamental Credit Strategy

New Daily #Bitcoin Issuance: 900 BTC

Current Estimated Avg. Daily Demand of

1. CashApp: 360

2. PayPal: 630

3. GBTC: 1,280

4. QBTC: 320= ~2.6K BTC

If you want to own Bitcoin, you're going to have to convince a holder to sell it to you.

— Anil (@anilsaidso) November 20, 2020

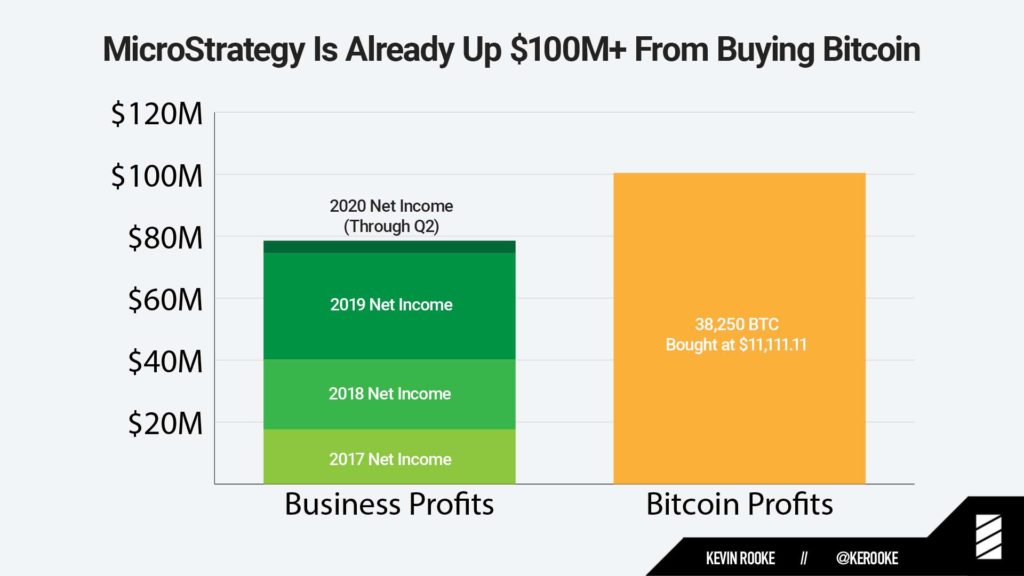

We have also seen several companies announce that they have bought Bitcoin to hold as a treasury asset on their balance sheet in replace of fiat dollars that are losing value. Michael Saylor of Microstrategy started the trend and has been rewarded with more profits from his Bitcoin investment than his core business has generated in the past three or more years!

Square followed with a $50 million investment in Bitcoin and no doubt Microstrategy’s results will have other corporations rushing to get a piece of the limited supply of Bitcoin in circulation. Imagine Apple or Amazon allocating just a single-digit percentage of their massive cash reserves to Bitcoin.

Why is this happening?

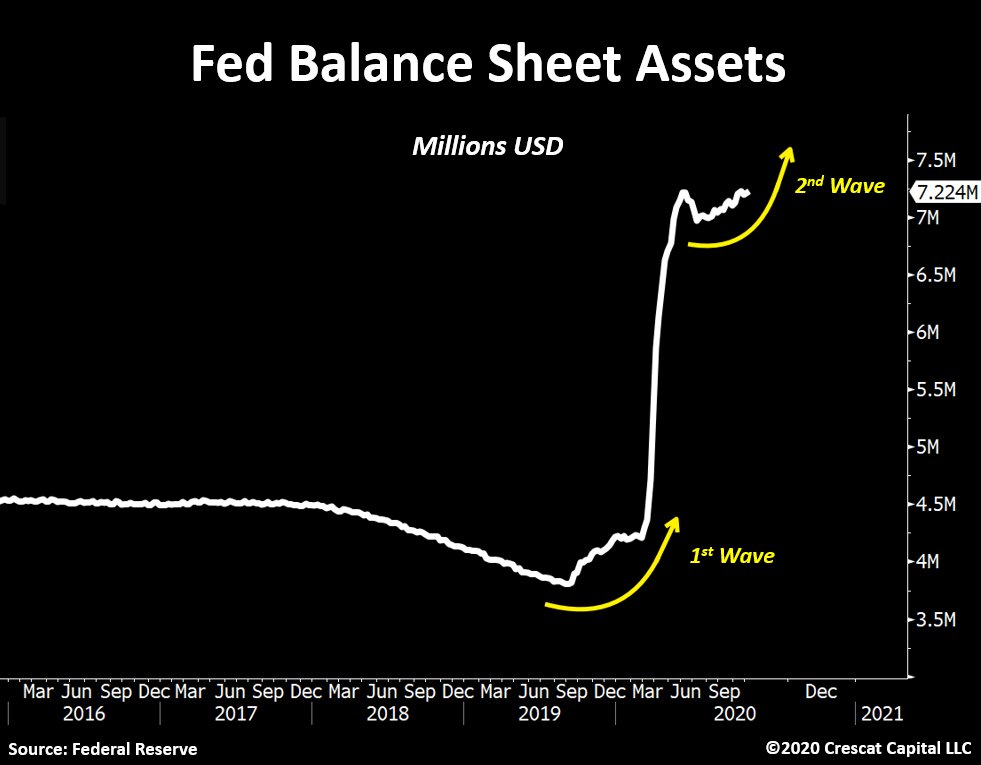

There is no doubt that the unprecedented levels of new money creation and stimulus in response to the pandemic is driving gains in scarce assets like Bitcoin. Central banks and governments around the globe are inflating their respective fiat money supplies at rates never seen before, with over $10 trillion dollars worth of new money creation in the past 6 months! And this is not just isolated to the United States/Federal Reserve, as central banks in the EU, Japan, China and elsewhere inflate away their money supply, giving birth to the popular “money printer to brrrrrrr meme.”

And we are about to embark on a major second wave of stimulus, which will need to be much larger than has so far been discussed as rising Covid-19 cases and lockdowns continue to accelerate.

This stands in stark contrast to the disinflationary monetary characteristics of Bitcoin, which underwent a halving in May of this year. Bitcoin’s inflation rate dropped from 3.65% to just 1.79% and will continue to be cut in half every four years until there is no more supply output and the maximum 21 million cap is hit.

Achieving digital scarcity was a technological innovation that has been under-appreciated thus far but is being reflected in the price advance. And in our opinion things are just getting started with exponential moves expected over the next 12 months.

The true available supply will end up being much less than 21 million, as many Bitcoin have been lost or are otherwise irretrievable. At the current time, over 18.5 million of those 21 million total, have already been mined. So, there is very little Bitcoin available in the market, which offers clear advantages versus fiat money that can be created in infinite amounts.

While the performance of Bitcoin is impressive, the #2 cryptocurrency Ethereum (ETH) is up 327% YTD. Two of our top picks in the Crypto Corner Portfolio are up over 600% so far in 2020!

I personally have over 50% of my net worth in cryptocurrency, primarily in Bitcoin and I continue to buy more every month at regular intervals. I realize everyone will have different levels of risk tolerance and different financial objectives so this number won’t make sense for many people. But I think it is important to have some exposure to this asymmetric and non-correlated asset class.

I also have a good portion of my cryptocurrency generating compound returns in various centralized and decentralized platforms. The yields range from 5% APY on the low end to well over 20% on the high-end. So my crypto is not only a store of value but is working for me at the same time. These are yield levels that you will not find at your local bank, from gold or even from most dividends stocks.

So is it too late to invest in Bitcoin and other top-tier cryptocurrencies?

From my point of you the answer is clearly no. Cryptocurrency is a volatile asset and there will certainly be wild swings. But I believe that all major dips are best viewed as buying opportunities. Bitcoin has been the best performing asset class over the past decade and will continue to be over the next decade in my view. We are still in early innings.

At Nicoya Research, we were one of the first investment newsletters to recommend cryptocurrency to our readers back in 2016 with Bitcoin under $1,000 and Ethereum under $10. We have also generated eye-popping gains from various altcoins in recent years. Whether you are just getting started or would like to take your crypto investing to the next level, consider subscribing to our Crypto Corner newsletter.

This will get you real-time access to our crypto portfolio, our monthly newsletter, buy/sell trade alerts, and our chat room if you opt for the Mastermind Membership.

Please be sure to perform your own due diligence. We are not investment advisors and nothing in this article should be construed as investment advice.