By now you have probably seen this crazy phenomenon happening where a growing group of retail investors on Reddit called Wall Street Bets has been largely responsible for pushing up the share price of Gamestop (GME) from $20 to $350. They specifically targeted GME due to the high percentage of shorts against the stock. The later did the same with the AMC Entertainment Holdings (AMC), which rocketed over 300% higher in a single day last week.

Reddit investor “Roaring Kitty” briefly turned $53,000 into $48 million, managing to use social media and community investing to squeeze leveraged shorts. By pooling together resources and buying up shares, they effectively forced a short squeeze and in the process caused billions in losses for hedge funds, putting Melvin Capital out of business and inflicting heavy losses on their backers, including Citadel, which is known to buy order-flow data from Robinhood to front-run retail investors.

Robinhood then went so far as to not allow buying, only selling, of shares in GME, AMC and others. They did this under the guise of protecting investors, but it seems clear they were really protecting their true customer, Citadel, which has ownership in Melvin Capital.

In this case Robinhood investors are not the customers, but the product, as they sell customer order-flow data to large funds like Citadel that can use the info to literally steal from unsuspecting retail investors. For this reason, we support the movement to #cancelrobinhood and think it is wise to move funds off that platform and use an alternative like Fidelity, TDAmeritrade, Webull or CashApp.

There have been widespread calls by lawmakers on both sides of the aisle to investigate Robinhood restricting trades. The SEC has signaled an investigation over the firm blocking stock buys. While I appreciate the firm forcing the industry to adopt free trades, it was never ethical to sell user data to hedge funds that scalped profits at the expense of individual investors trying to generate returns for their families.

And the irony of a company with the name Robinhood helping the rich steal from the poor/middle class is not lost in this chaos.

Wall Street Bets investors then took to Twitter, mentioning the crypto meme coin DOGE, sending it more than 800% higher in a day. And while I have a soft spot for Dogecoin, this really wasn’t a trade that I could get behind as it is a meme coin and there are dozens of better cryptocurrencies with real-world use cases, high utility and larger/more active communities behind them.

I’m also not particularly bullish on GME or AMC, as I think they have antiquated business models and have failed to innovate fast enough. But I think this is a significant event with retail investors organizing to beat Wall Street hedge funds at their own game. I’m not shedding a tear given the history of these funds taking advantage of retail investors and requesting bailouts from taxpayers when their bets soured.

What caught my eye was the first post in this Reddit group to suggest targeting silver and silver stocks for a potential short squeeze. Reddit first took down the entire subreddit and then the moderator of the group decided to delete the post. But it was too late and the idea has spread like wildfire. Here is a quick snippet of the original post to give you an idea:

THE BIGGEST SHORT SQUEEZE IN THE WORLD $SLV Silver $25 to $1000

They are looking for ways to squeeze those that are massively short silver and have been manipulating prices for years. Besides buying physical silver, silver ETFs and standing for delivery on silver futures, their first silver stock target is First Majestic Silver (AG). The reason for targeting this stock is the concentrated short position at 23% of outstanding shares. This compares to 1% to 3% of float shorted for many of First Majestic’s peers, thus making it a good target to force a short squeeze.

This is a new phenomenon in investing and I am not sure if they will have repeat success. But just in case they do, Nicoya Research added shares of AG last week at lower prices and have already seen double-digit returns. But we think that the bulk of the gains are still ahead.

Outside of the potential for a short squeeze, I expect a leveraged move to the silver price in 2021 for silver miners and am targeting for silver to rise above $50 and to as high as $100 by year end. In an environment where silver goes up 2x to 4x, I expect to see quality miners going up 4x to 10x. I realize these are aggressive targets, but this rally is long overdue and I think we could see a serious pick-up in momentum with the shear number of investors backing the silver short squeeze movement.

In addition to these reasons for our bullish case, First Majestic Silver also received good news this week as they won a reprieve on criminal tax fraud charges in initial Mexican court hearings. You can read more here.

The company also reported Q4 silver output jumped 9% from the prior quarter to 3.5M oz., for the company’s second-highest quarterly silver production. I also like the First Majestic management has led a movement for silver producers to hold back production until prices rise and hold silver as reserves instead of cash.

So there are multiple reasons to be bullish on First Majestic. But the WSB community movement to force the short squeeze is probably our main driver in the decision to add. Outside of this news, I would still prefer the silver stocks that have been in the GSB portfolio.

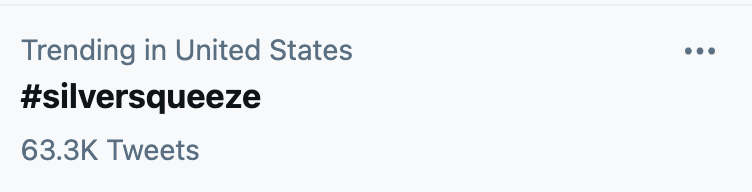

The movement to force a short-squeeze on silver and heavily shorted miners have gained significant backing in the past few days. Updated posts include the following comments:

“The Silver Bullion Market is one of the most manipulated on earth. Any short squeeze in silver paper shorts would be EPIC. We know billion banks are manipulating gold and silver to cover real inflation. Both the industrial case and monetary case, debt printing has never been more favorable for the No. 1 inflation hedge Silver.”

A more recent post laid out the case for higher silver prices:

Silver: the Epitome of Wall Street manipulation & Its Achilles’ heel – Why the AG short squeeze is very possible:

- Naturally occurring, the available quantity of gold/silver has a ratio of 1:8, yet the price ratio is 1:70! This ratio could drop massively, increasing the silver price. That’s not all (credits to u/Mintmoondog): Remember, silver is significantly lighter than Au, so most of the historic Ag mines were nearer the surface of the earth – most of those have been depleted and today over 2/3 of Ag is mined as a by-product of other mines. The actual above ground number of ounces of silver is LESS than Gold! That is because over 40% of annual mining production of Ag is consumed (non-recoverable). The above ground inventory is so tight that a small group of autists and retards could theoretically wipe out most dealers’ inventory in 30 minutes, using pocket change. This pushes the dealer to pressure the spot price. ?? ???

- Green & other future technologies will require a lot of silver for efficiency purposes, since it’s the absolute best element to conduct electricity and has other unique properties that no other element can substitute. Many central banks (ECB & FED) have talked about “green QE” = buying corporate stocks that produce green energy technology = Central bank indirectly funds the future silver short squize! ⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️⚡️???

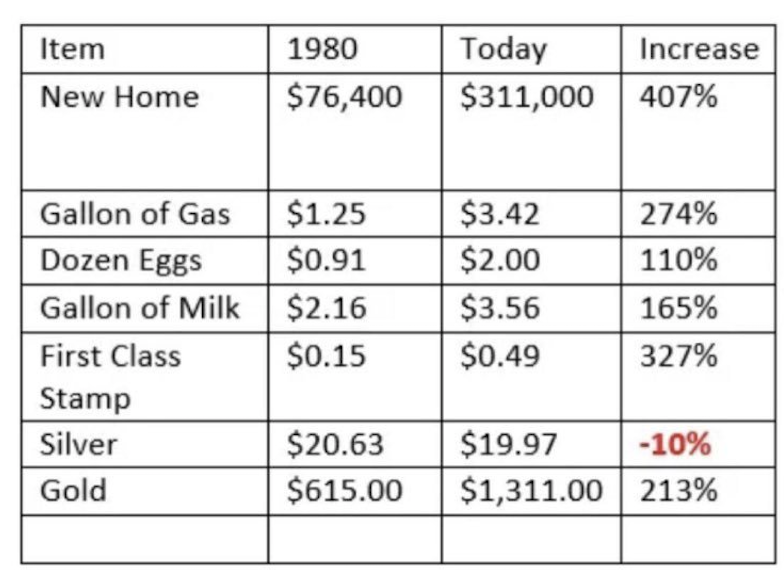

- Silver is still 50% down from its all time high 10 years ago! The quantity of silver mined has been far lower (end even decreasing) than the increase in inflation, and silver is a good hedge against BOTH inflation AND deflation, historically speaking. If accounted for monetary inflation, the natural equilibrium price should be around 1000$, but this can be pushed higher due to the massive short interest of the bullion banks. They already made a loss from their silver shorts in 2020, but that was a fraction of the short interest they still have.☄️☄️??

- Historic justice. The silver price has been artificially kept down for nearly 100 years. First by the US government from 1935-1970, because it was too effective as a hedge against inflation. Afterwards, and this was confirmed by wikileaks, the US & London bankers took over this role by pushing the creation of the precious metals section at the COMEX, so that banks could artificially keep the price down. You see, they let the COMEX or LBMA sell futures contracts and options, and each time many contracts are near expiry and ITM (profitable), they pull a massive naked short. This has been going on for 50 years. But unlike the G** stock, it IS FUNDAMENTALLY UNDERVALUED. ???

- The precedent. The silver squize has happened before – when it went from 6$ -> 50$ from 1979-1980 – due to the Hunt brothers hoarding the physical and buying more via futures that were supposed to be delivered. But before this delivery, the COMEX changed the rules and demanded futures had to be backed by margin, which is why the brothers got an engineered margin call. This caused the markets to panic-sell their silver, which ended the squize. If 2 brothers can realize the silver squize, many retarded brothers can do the same. Important to note here: the Hunts probably achieved their play because they uno-carded the big bullyon banks. More in this, and the legal details, here (p60-70).

- The retarded game of musical chairs. They have so much short interest, and vastly overstated stored silver reserves (due to double counting & other deceptive accountancy practices), that ther’s an ENORMOUS divergence between silver traded on paper and actual, physical silver: around 200-400x more paper silver than physical. GME is nothing compared to this. If every autistic retard here demands physical delivery or, even if staying stored in a vault, demands that their silver may not be lent out, the short squize of short squizes could easily be realized. ??????☄️

- What if there’s not enough Silver? If they can’t hand over the physical silver, they will legally still be obligated to pay the price of that silver at the moment you exercised your ITM option/contract! But it gets better! If they indeed fail to deliver physical, they have to pay you the gains you made + a premium (extra money), to sort of buy you out of demanding the actual silver. If enough people would use their collective retardedness to decline this premium, the premium would only go up, as would the silver price! And since the counterparty of these options and contracts mostly are big investment banks, they absolutely have the $ to pay for this. Seems like a way more effective wealth transfer than stimmy. ????

- Backwardation (retardation) & Shadow contracts. Backwardation is the divergence between the spot price (= buy directly at this moment) and the futures price, more specifically, it means that the current price of spot is higher than the futures price. This is unnatural, and certainly in the present macro-economic environment since it implies that financial actors expect that the price will drop. So why did we experience a lot of backwardation last year, during a bull run? Simple: there was such a strong demand that is was easier for providers to deliver later, since they didn’t have enough physical in inventory. More backwardation = more signs that there is a lack of physical inventory. In fact, there were many signs that the backwardation and actual demand that was physically delivered, was suppressed with the use of “shadow contracts”. These contracts are deliveries of physical that they try to hide with big boy accountancy tactics. Increase in backwardation and shadow contract = squize squizing squizier till it will be squozed. It’s complicated but here’s a great source that explains this. ?????

- Can’t issue more silver – unlike the fact you can issue more stocks/fiat! Furthermore, it’s an extremely safe store of value – as electronic means of payment are dependant on electricity. When silver starts to moon, states – especially ?? authoritarian states – will scramble to get a strategic supply and thus feed us many a tendies. Also, it is an amazing hedge against the unavoidable future inflation, which is necessary to monetize our global debt. Physical ownership also deters paper hands. Lastly, it takes YEARS to properly set u a mine. Today, there’s also a growing risk ??states will nationalize their mines, further constricting supply. More on this from Silver billionaire Kaplan, who is now bullish silver again.

- Alpha ?? JPM has our backs! JPM, due to its actions, is probably on a tight rope above a valley of aggressive criminal lawsuits (according to the source below) – for at least the coming few years. It has therefore ended most silver shorts and now mostly holds physical silver. They know they can’t short much anymore because the schmuckery needed to manipulate such fundamentals would be gravely persecuted. This is great. The shorts have been taken over by smaller, Melvin-like institutions. These already showed they are way worse at manipulating. Eventually, JPM will ride the wave with the plebs, since the worth of their own physical would then grow multiples! Retards will ride the alpha ?? to fuck the beta ????. More on this, here.

- Technical case. If the above wasn’t enough, there’s also a very strong technical case to be made, my fellow technicals-loving-autists. The bull run is written in the stars, as technical patterns and indicators predicted it long before WSB & larger retail knew about it.

Buy? 100% physical-backed futures/options or just pure physical silver = a) PSLV, b) AG & c) Miners (= less efficient, but can multiply if spot rises) d) Delivery from warehouses for you rich autists that can take them without margin.

!! DON’T BUY CDF’s or FOREX Silver or unbacked futures/option – they’re NOT backed and could prove worthless + they facilitate naked short manipulation !!

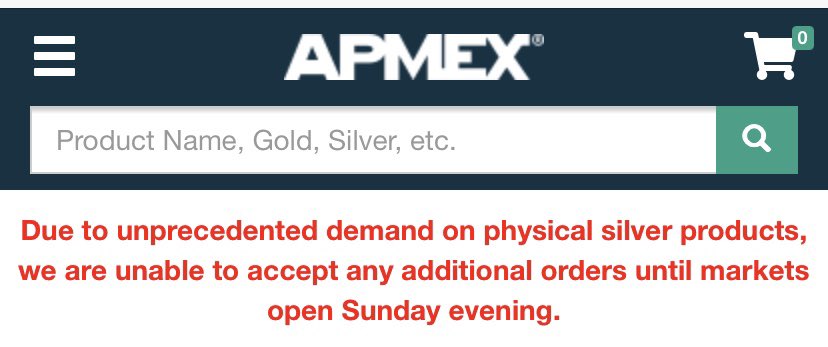

And there are indeed signs that investors are putting their money behind this movement as many gold/silver dealers are running out of stock and/or posting notices or long delays due to unprecedented demand. Could the paper silver Ponzi scheme be imploding?

This “Could Destabilize All (Gold & Silver) Contracts”

January 29 (King World News) – Alasdair Macleod out of London: “The bullion bank silver short on Comex is about 100 million ounces and there is no liquidity in London. It won’t take much to put a rocket under the price, as we are now seeing. Could destabilise all PM contracts.”

Silver On The Way To $100

Lawrence Lepard: “Not only that, but silver is also the cheapest financial asset on the planet. By far. Still 50% below its double top all time high at $50. It makes $100 easily.”

Some have suggested that manipulating gold and silver prices is done to mask inflation. Either way, it doesn’t make sense for so many assets and good to have gone up so much while the silver price is still significantly below the 2011 high and even 10% below the 1980 price!

Adding to the evidence that the silver short squeeze is on, the iShares Silver Trust (SLV) took in almost a BILLION dollars Friday, nearly double the old record for this 15-yr old ETF, after being targeted by WSB as a way to go after the banks.

Some are pointing out that SLV can just sit on the money or buy paper silver, not actually contributing to a squeeze or creating real-world physical demand. They instead suggest buying the Sprott Physical Silver Trust (PSLV) or actual physical bullion. If you are new to investing in silver bullion, you can *usually* find supply and good prices at:

jmbullion.com, providentmetals.com, apmex.com, goldsilver.com, sdbullion.com, moneymetals.com, ebay.com, craigslist.com or even your local coin shop if premiums are not too high.

As I write this, premiums on American Silver Eagles on Ebay have roughly doubled from $5 to $10. They were selling for around $33/ounce just yesterday, but are now in the $38 to $40 per ounce range. With the spot price at $27, this is a premium of more than $10 or roughly 40%!

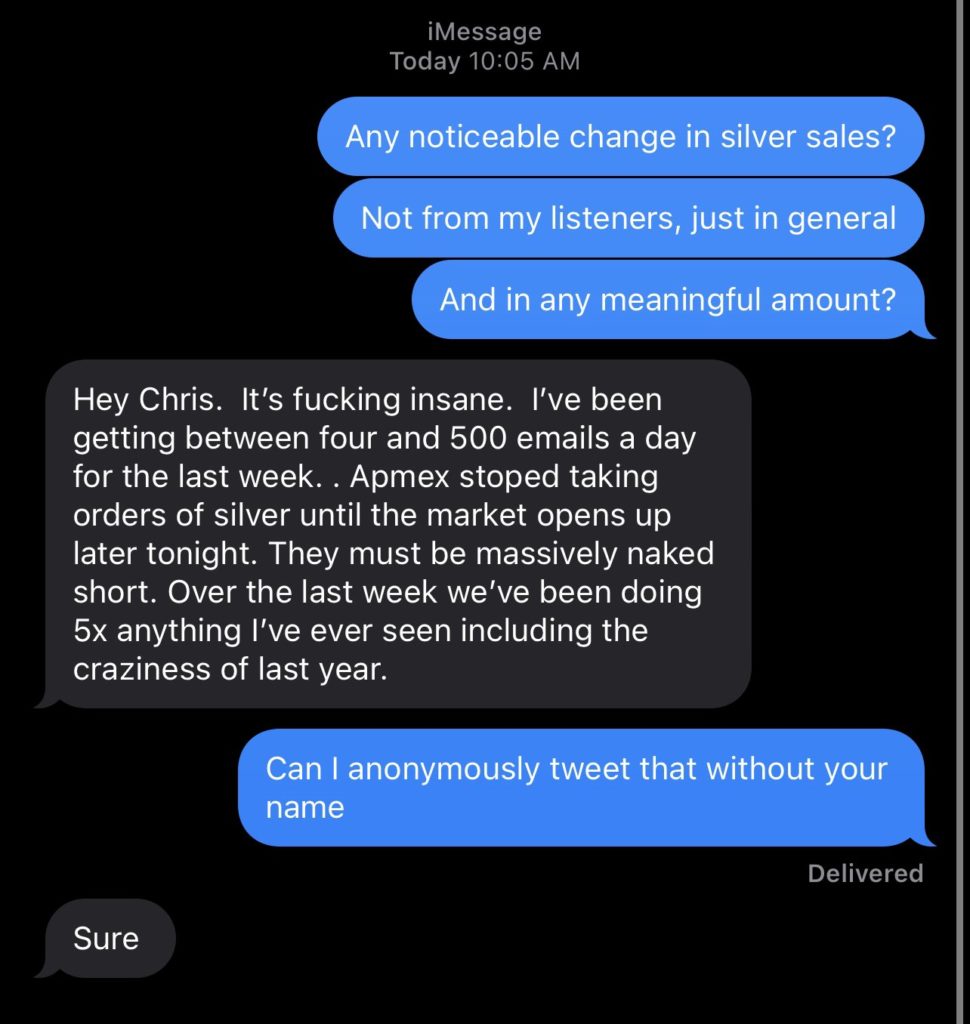

“My friend runs a major, major gold and silver dealer that’s been around for three decades. I just text him this. And his response…”

And another good point from Cameron Winklevoss:

And Max Keiser, who has been supportive of the #silversqueeze initiative, thinks it may be hard to execute and believes Bitcoin is the better target:

“As I’ve been reminding #SilverSqueeze The short-sellers have a trillion in ‘naked-shorts’ available to manipulate the price at will. A global short squeeze (and physical delivery) will be met with a wall of naked-shorts. All roads lead to #BTC.”

Max Keiser

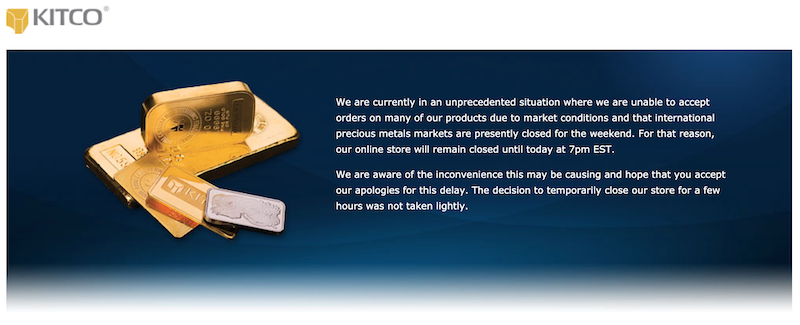

We can now confirm Kitco.com had to halt sales due to unprecedented demand for silver:

The ramifications of a #silversqueeze cannot be underestimated. If it’s exposed that there are more paper claims on silver than actual silver, not only would the payoff be enormous, but gold would be next.

Helping to squeeze the manipulators is not only a feel-good investment opportunity, but could also be a very profitable one. We see near-term upside of 200% to 300% and downside risk of no more than 20%. These asymmetric investment opportunities do not come around too often.

At Nicoya Research, we have been bullish on silver and silver miners for quite some time. We have long advocated for holding physical silver in your possession and have sent trade alerts to subscribers to increase allocations to silver mining stocks over the past few months.

In our view, 2021 will be be a huge year for silver due to the levels of central bank money-printing in response to the pandemic and increasing industrial demand, particularly from the clean-energy sector. The Wall Street Bets subreddit and blossoming #silversqueeze movement are only pouring gas on the fire.

We think the silver price will easily make a new record high above $50 this year and likely challenge $100 per ounce. If the silver short squeeze movement has any success, these price targets will look conservative.

UPDATE: In early Asian trade, silver has spiked 6% to $28.65. I have a feeling this is just getting started.

Click below to get our top silver stock picks and more!

Start here to get our top silver stock picks, investment research, top rated newsletter and mining stock portfolio!