Any current metric will show that Ethereum is the leading smart contract platform. It is by far the most widely used blockchain by developers everywhere.

This post will explore the growth of the Ethereum ecosystem over the past few years, and highlight some important updates coming up as well.

Ethereum Leading the Pack

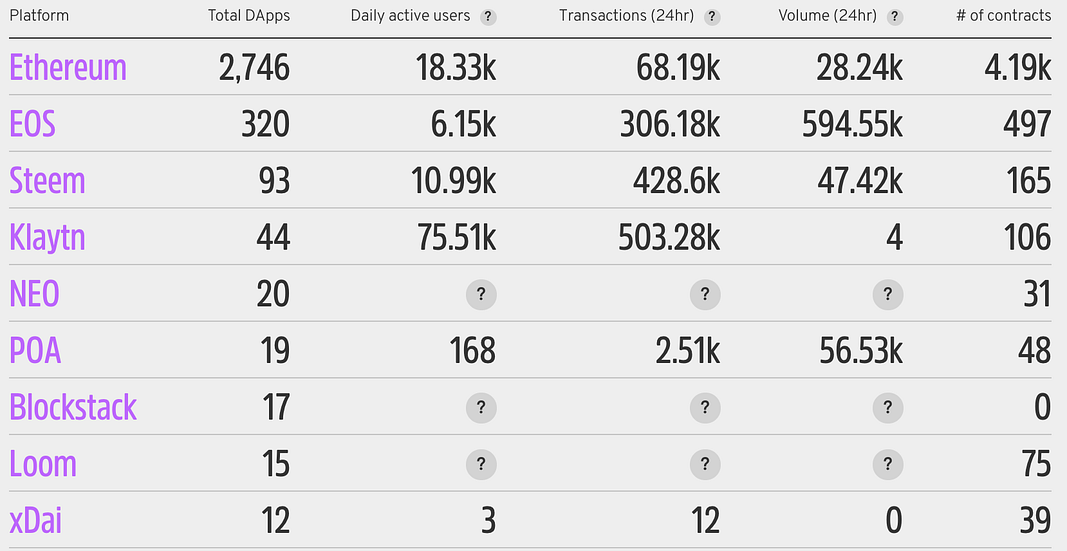

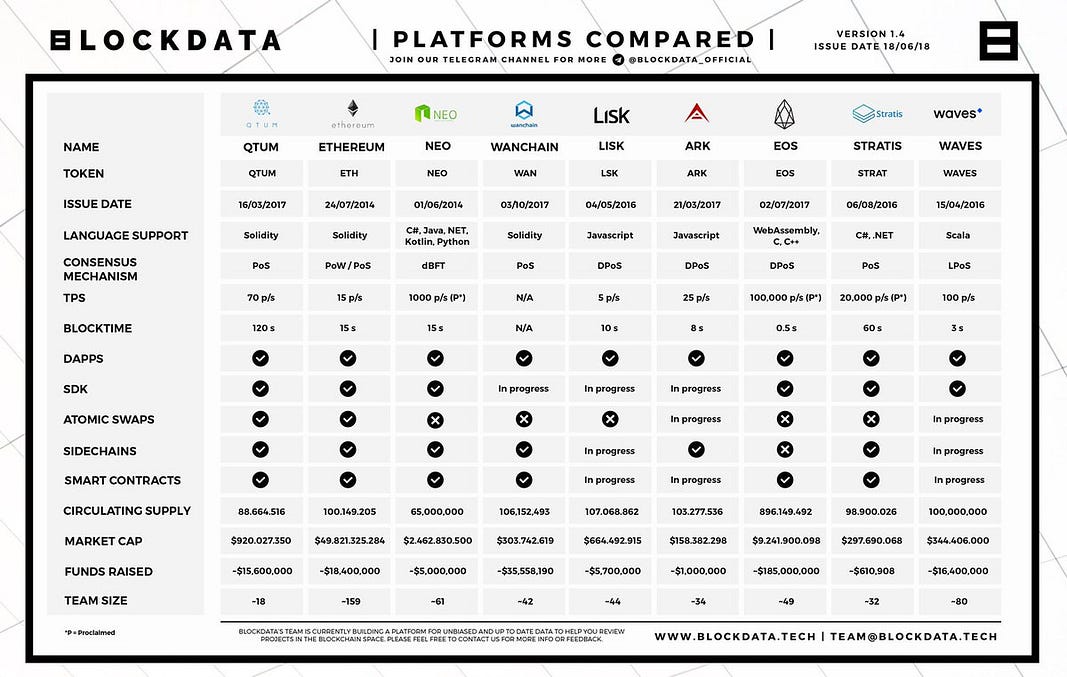

A quick scan of the top 200 tokens on CoinMarketCap will show that over 90% of projects are built on the Ethereum network. Comparing this to other smart contract platforms will show just how far ahead of the competition Ethereum is in terms of adoption.

Out of the top 200 tokens, there are only 2 projects built on EOS, Tron, and Stellar. There are 4 built on Binance and 3 built on NEO. Despite the vast and ever-growing competition in the space, Ethereum is still leading the pack, and by far. The total number of DApps built on Ethereum is also leaps and bounds ahead of any other platform.

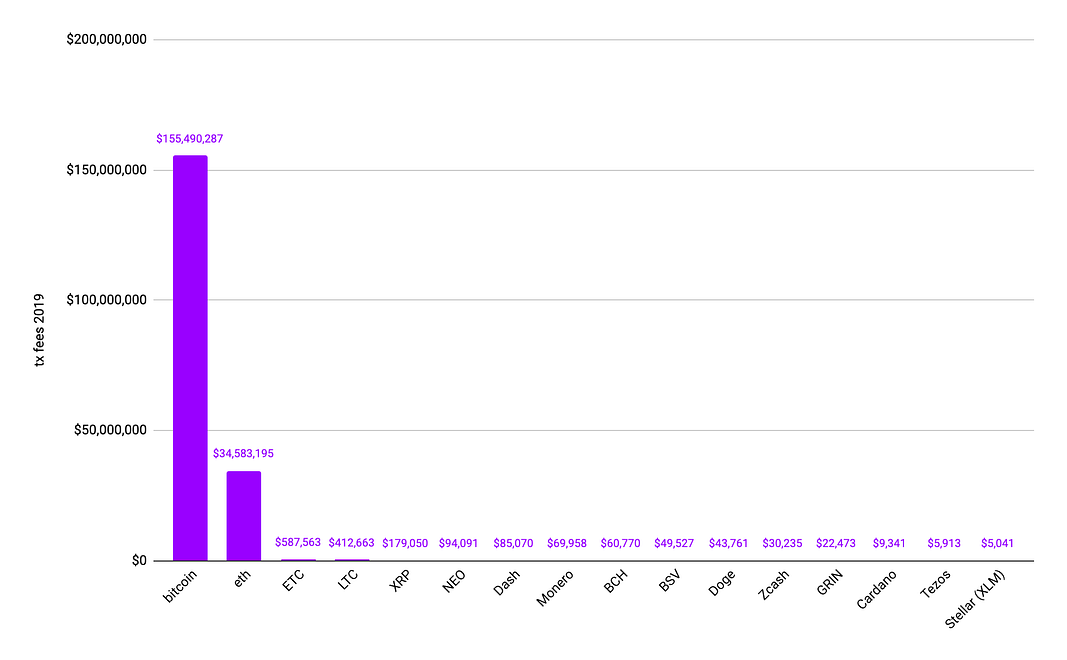

The chart below further shows how the adoption of Ethereum is ahead of almost every other blockchain project. Bitcoin and Ethereum are the only two blockchains with any real use on them.

Growth of Decentralized Finance (DeFi)

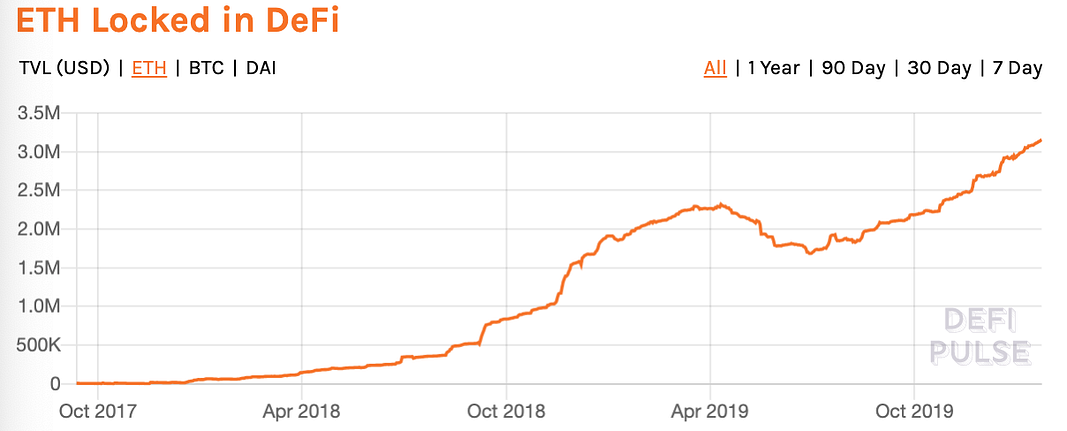

DeFi, while only a relatively recent phenomenon, has been gaining traction very quickly. Almost all of the dominant DeFi applications are being built on Ethereum.

In a little over two years, the amount of Ether locked in DeFi has grown from about 5,000 to over 3 million. That is over $500,000,000 USD worth of Ether that is currently locked up across DeFi applications. The total value of Ether locked in every DeFi category has been only going up as well.

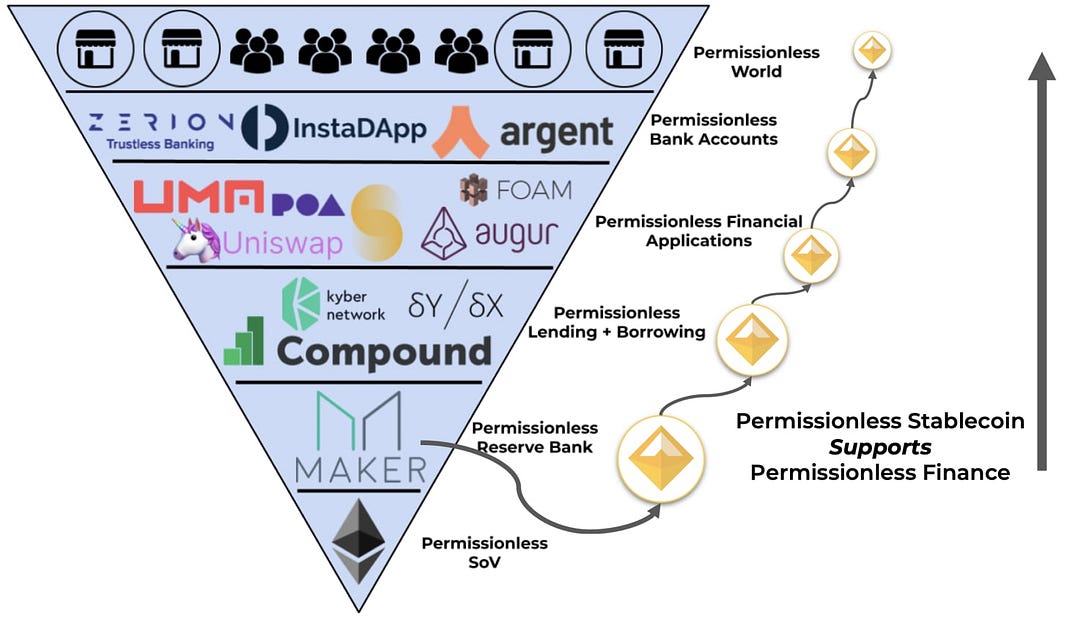

The picture below is an example of how this permissionless new world functions. Ethereum’s native token Ether acts as a permissionless Store of Value and as the base layer for this new world.

This is all bullish for the price of Ethereum as well. With the DeFi space only continuing to grow, there will be more Ether locked up in the future. More locked Ether means less overall supply available on the market.

Ethereum 2.0

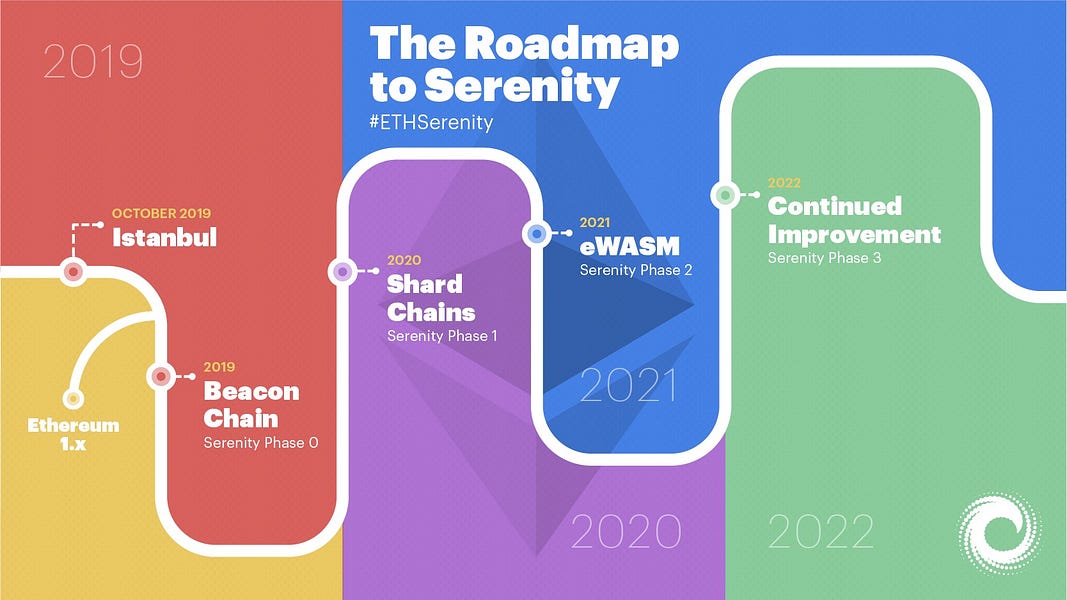

The Ethereum blockchain is currently limited in its capacity. To address this concern, the team has announced the launch of Serenity (or Ethereum 2.0), the last stage of Ethereum development. This last stage has been laid out as a three-phase process:

- Phase 0: Beacon Chain: This is a proof-of-stake (PoS) blockchain that will run in parallel to the main proof-of-work (PoW) blockchain until the two merge into one system. The Beacon Chain is expected to launch in Q1/2 of this year.

- Phase 1: Shard Chains: Sharding is a second-layer scalability solution. It helps transactions scale by dividing the network across multiple shards, allowing the network to process many transactions concurrently.

- Phase 2: Ethereum Web Assembly (eWASM): This is a rebuilt Ethereum Virtual Machine (EVM) that supports PoS and sharding. It also supports more languages, allowing developers to write code in C, C++, and Rust.

Serenity is an upgrade that combines the above ideas into a new chain. These new implementations will help Ethereum scale massively and will allow for better decentralization, security, and resilience. These phases are set to be implemented during the next few years.

If Ethereum 2.0 can solve the hard problems around proof of stake and sharding, then it may be well-poised to maintain its lead as the biggest smart contract platform.

Speed/Throughput Comparison

As stated above, one of the biggest issues with the Ethereum platform is its limited throughput. The latest Istanbul update partially addresses this issue.

According to Vitalik Buterin, Ethereum can handle 3000+ Transactions Per Second (TPS) post-Istanbul update. An analysis done by iden3 found that Ethereum, using ZKRollup (a Layer 2 scaling solution), can handle a theoretical maximum of 2048 TPS. One limitation to this is that this kind of speed can only be achieved when the blockchain is running on powerful servers.

Ethereum’s current TPS, without using ZKRollup, is about 30. This is the only limiting factor present. Though even with this current limitation, Ethereum is still the most widely adopted platform. One thing to keep an eye on is the upcoming few updates. If the Serenity update goes through successfully, then scaling will no longer be an issue on the platform.

Other Relevant Info

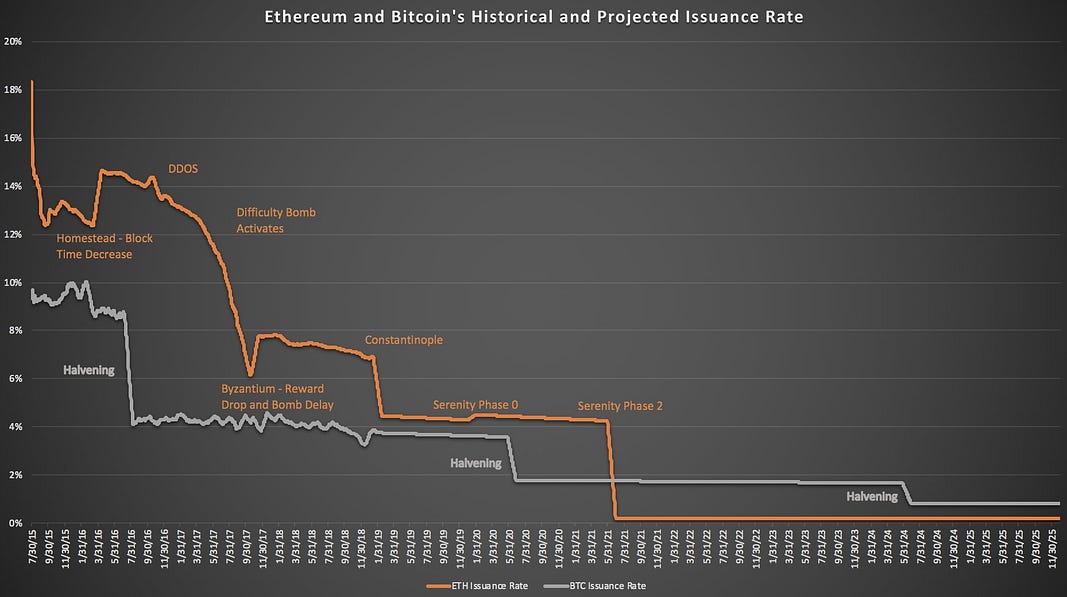

- Comparison of Issuance (inflation) Rates

Ethereum is set to have one of the lowest issuance rates following the Serenity update. Its issuance rate will be lower than Bitcoin in the next few years.

2. The Many Big Players Building Products on Ethereum

According to Adam Cochran there are about 359 companies building a product on Ethereum. Some Megacorp’s building products on Ethereum include Nike, Ernst and Young, The Bank of New York, and Barclays. Even with Ethereum’s limited scalability, companies are still building products on it.

3. $ETH Is Money

According to Lucas for a decentralized smart contract platform to “successfully provide the world with a permissionless, trustless economy, it will require its native asset to supply trillions in economic bandwidth.” You can read more about Lucas’ “Trillion-dollar case for ETH” here.

4. Various Other Useful Sources

- David Hoffman wrote one of the most in-depth articles as to why “Ether is the Best Model for Money the World has Ever Seen.” His article defines Ether as an asset, explains its application layer, and explains the many crucial DApps being built on Ethereum. You can find his full article here.

- Josh Stark’s article “The Year in Ethereum 2019”, provides a comprehensive review of everything important that happened in the Ethereum ecosystem in 2019.

- You can also follow Ethglobal.co to stay up with all the latest events and highlights going on in the Ethereum ecosystem.

There are multiple bullish catalysts on the horizon for Ethereum, from increasing DeFi usage to scaling solutions and more powerful feature sets rolling out as part of ETH 2.0. We believe that the price will trend significantly higher over the next 12 to 24 months.

We were early into cryptocurrency, first recommending Ethereum under $10 (currently $165)! We just added a new up-and-coming DeFi token to our portfolio and expect big things ahead in 2020. You can subscribe to our cryptocurrency newsletter and get our top picks by clicking here. Use the coupon code ETH2020 to take 20% off the regular subscription price! This offer will expire at the end of the month.

We also just published our updated Guide to Investing in Cryptocurrency, which includes detailed tips and tricks we have gleaned over the years.

What to buy? Where to buy it? How to store it safely? What to avoid? How to earn interest on your crypto? And plenty more within this guide that is available to Crypto Corner or Mastermind subscribers.