Get our gold price prediction and silver price prediction for 2020, 2021 and beyond by clicking here.

There’s no question we are living in uncertain times.

The COVID-19 pandemic has led many national governments to take draconian measures to protect their populations, forcing businesses to shut down and people to stay at home. Most of the economy in most parts of the world has been shut down. Economic activity has come to a complete standstill, rather than declining or stalling as it has in every major crisis to-date.

And even if we do get back to business as usual (which isn’t guaranteed, according to some sources), there’s no way to flip a switch and turn the economy back on. Many small businesses that have no way of staying afloat will never be coming back. There will be a long list of run-on effects of this shutdown that will lead to dramatic and lasting effects on life as we know it, many of which don’t apply to our discussion of gold mining stocks in 2020.

As far as the financial world is concerned, we’re in uncharted territory. The word “unprecedented” is getting thrown around a lot because there aren’t many other ways to describe what’s happening. There are no real historical comparisons from which to draw conclusions other than maybe the Spanish Flu of 1918.

Despite this, it is possible to navigate uncharted waters to a degree.

The State of Precious Metals and Gold Mining Stocks in 2020

In light of everything just mentioned, it’s wise to refrain from making concrete predictions about specific investments. As with everything else, we don’t have an infallible crystal ball to rely on for forecasting (although the current crisis, in general, has been foretold for a long time by multiple forecasters).

Instead, I’m offering several variables for consideration. They include things affecting the gold mining industry such as miners not mining, refineries not refining, bullion selling out fast, some mining stocks already being on the move, and the state of markets in general.

Here are five variables to consider with regard to gold mining stocks in 2020.

Miners Halt Operations

This first variable has a big impact on the overall gold mining industry outlook for 2020. Some miners are reporting that they will have to shut down part of their operations for a time.

Mining companies that are yet mining are being forced to scale back their exploration or development activities. This means that their timelines for moving toward production are getting pushed back and the news flow from drill results will be limited. The COVID-19 pandemic impacts miners in all stages from early exploration and full commercial production.

The USA is the fourth-largest global producer of gold, responsible for the production of about 250 tons per year. China is number one at 400 tons per year. And we know that nonessential businesses in these areas have been forced to shut down. So, a significant portion of global gold production could go offline. And given that the US and China have been hit hard by the current pandemic, it could take a while for production to come back online.

The clear upside is that lower supplies are price supportive and miner profit margins are likely to increase in this environment. Shutting or slowing operations for a few months could lead to the companies mining the gold at higher prices, so this factor helps to offset the limited operations to some extent.

Mining stock valuations took a hit with the initial market decline from mid-February to mid-March. But they have been trending higher since then, leading some to believe that mining stocks might have already bottomed with that initial plunge. After all, markets are pricing in the future and perhaps forecasting a near-term peak in COVID-19 cases and potential restart of mining operations in the near term.

On the other hand, past crises led to several months of downside, not just the few weeks that miners have experienced this time around. While there are sound arguments that things will move faster this time around, the odds that we have another leg down in panicked liquidation selling remain relatively high.

Will mining stocks escape the sell-off in this case or will they be dragged down again? This remains to be seen and the answer is likely nuanced, with a variety of factors in play. We track this situation closely for subscribers and provide regular updates via email or our chat room as the situation unfolds.

Companies in many industries have begun withdrawing forward-looking guidance, as there are too many variables at play for them to have any chance at producing reliable earnings estimates. For that matter, estimating any financial metric is almost impossible when most of the world more or less stops moving. The mining industry is no exception.

Refineries Shut Down

The following was reported by Reuters on March 23rd:

LONDON, March 23 (Reuters) – Three of the world’s largest gold refineries said on Monday they had suspended production in Switzerland for at least a week after local authorities ordered the closure of non-essential industry to curtail the spread of the coronavirus.

The refineries – Valcambi, Argor-Heraeus and PAMP – are in the Swiss canton of Ticino bordering Italy, where the virus has killed more than 5,000 people in Europe’s worst outbreak.

Together, these refineries are responsible for refining about 30% of the world’s gold supply, plus various amounts of other precious metals.

Refineries are the cornerstone of the precious metals supply chain. Without a way to refine raw material into usable metal and bullion, we’re stuck in the stone age. All the miners in the world working overtime won’t make much of a difference if there are no refineries.

Now, it’s not as if all refineries the world over have disappeared forever. Only a few of the biggest have shut down for now. It’s not as though there will never be more gold or silver bullion minted or that we can never use metals for industrial purposes again. But it does mean that for now, an already complicated supply chain situation has just had a major monkey wrench thrown into it a week ago.

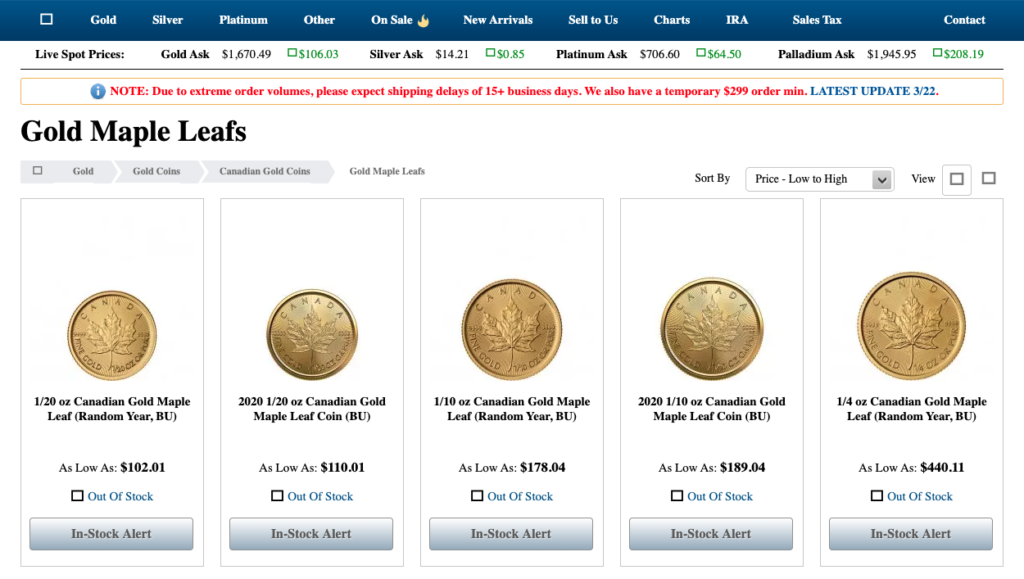

Bullion Dealers Low on Supply

This has been a trending topic online, although most mainstream financial news sources have barely touched on the matter.

Physical silver and gold have become almost impossible to find. Just try finding bullion at any online dealer. Even before the recent lockdowns began, reports were coming in that local coin shops had little to no supply.

In addition, the U.S. Mint sold 120,500 Gold Eagles year-to-date as of March 23rd. In contrast, 152,000 Gold Eagles were sold during the entire year of 2019!

Looking at the numbers for U.S. Mint Silver Eagles on a month-to-month basis, the numbers are even more astonishing. In February, the mint sold 650,000 silver coins. By March 23rd, they had already sold 4.83 million.

The demand has spiked so high that the premiums on silver coins have in some cases exceeded 100% of the spot price. In other words, people are willing to pay twice the phony paper market price of an ounce of silver for an actual ounce of silver.

Combine this incredible demand with the shrinking supply brought on by refineries and miners shutting down operations, and it’s hard to see a scenario in which silver and gold prices do not soar. But it still remains to be seen if gold and silver mining stocks will keep pace or offer leveraged returns in 2020 as they have in the past.

The shortages in physical gold may extend beyond retail dealers. Zerohedge reported that on Tuesday 23 March, the London market had seen gold bid-ask spot spreads blowing out to US$ 100 and LBMA market makers breaching their responsibility to actively provide two-way price quotations, the LBMA forged ahead with pinning the blame on COMEX, and bizarrely offered to support COMEX to ‘facilitate physical delivery in New York’.

What this meant, said LBMA-embedded news wire Reuters, was that:

“the LBMA and executives at major gold-trading banks asked CME to allow 400-ounce bars to be used to settle Comex contracts”

Next day, Wednesday, March 25, the CME played out its part of the script, announcing the launch of a “new gold futures contract with expanded delivery options that include 100-troy ounce, 400-troy ounce and 1-kilo gold bars” but a contract which still has a unit size of 100 ounces, identical to the COMEX flagship GC 100 contract.

Fast forward to March 30, and with the new ‘Gold Enhanced Delivery futures’ contract ready to start trading, the COMEX daily gold vault inventory report (which lists nine approved vaults in New York City and surrounding areas) has just been published showing a new set of lines items for 400 oz bars, but, and here is the punchline, there are absolutely no 400 oz gold bars listed on the entire report. Not one.

So what does all of this mean? Is there not even one vaulted 400 oz gold bar in the whole of New York? Why is COMEX rushing in a new contract deliverable in 400 oz gold bars when it is reporting that there are zero 400 oz gold bars in its approved vaults. Is this all just a smoke and mirrors exercise with the bullion bankers in London and New York laughing over champagne as mainstream new reports claim the very same bankers are scrambling to charter private jets laden with gold bars from London to New York?

And finally, are JP Morgan vault staff currently scrambling to rush 400 oz gold bars across the tunnel between the NY Fed gold vault and Chase Manhattan gold vault under Liberty Street in southern Manhattan? Inquiring minds would like to know.

After this article was published early morning March 31, New York Time (NYT), the CME has now completely removed the 400 oz gold bar category from its COMEX daily gold inventory report dated March 30, and reissued it without the new category.

Some Stocks Already Soaring

Even now, some mining stocks have seen sharp upward bursts in their share prices over the past week or two. Does this mean a new bull market has begun?

Not so fast.

I think it’s likely that the bottom for most mining stocks is not far off (disclaimer – I’m not a financial advisor and this isn’t investment advice). Over the course of the next week or two, it will be much easier to determine, and there’s a chance the bottom will be found during that time. This lies in stark contrast to the broader market indexes, which will take months (perhaps over a year) to find any kind of meaningful bottom.

It’s likely that investors will pour into mining stocks despite the fundamental problems that miners have to cope with at present. The rising gold price and soaring demand mean that even if miners only maintain a fraction of production capacity, they will still thrive long-term.

Markets on the Move

For this last point, I find it important to mention the markets at large in comparison to the gold miners.

There’s no question that at the time of writing, we’re in a massive bull trap. How do we know this?

There are several indicators, but to me, the most simple and profound include the following:

- Every long-term technical support level has been breached

- The major US indexes still haven’t reverted to the mean

- Google searches for “how to buy stocks” have eclipsed their previous all-time high

- COVID-19 cases in the US/West are still climbing the exponential curve

Each one of these points could be expanded upon in detail but they go beyond the scope of this article. Interested readers seeking to understand the bull trap situation better would do well to research the factors mentioned above further.

Most notably, the long-term trend line going back to the 2009 low for the S&P 500 Index was broken for the first time in 11 years on March 18th:

Needless to say, this is a very bearish indicator for US equities, and short-term rallies don’t invalidate this trend.

Bullish on Gold Mining Stocks in 2020

Overall, there remain many reasons to stay long gold mining stocks in 2020, even though things look uncertain right now. Most miners have only enacted partial operational shutdowns rather than just going out of business altogether. It’s only a matter of selecting high-quality miners and choosing a good entry point.

I don’t want to say “we told you so.” But this crisis has been a long time coming, and all the same advice given by Gold Stock Bull and Nicoya Research for years now holds truer than ever.

For example, see this article published on GSB almost exactly one year ago entitled: Global Economic Slowdown 2019 Continues – Protect Yourself and Profit by Taking These Simple Steps

To summarize the main points in terms of protecting yourself:

- Hold physical gold and silver

- Own bitcoin in your own hardware wallet

- Hold gold mining stocks for leverage

- Have some cash reserves

I hope you’ve been preparing throughout the more calm and prosperous times. It’s my belief that we’re entering into an economic depression that could match or exceed the one that the US experienced in the 1930s. But it doesn’t have to result in a negative outcome for everyone.

For access to the exclusive newsletters, real-time portfolios, market updates, trade alerts, chat room and more, subscribe to Nicoya Research today.