Bitcoin had a pop in price of almost 5% following the assassination of Qassem Soleimani, a major Iranian Official. Gold, long considered a safe haven asset, also had an uptick of about 1.5% on the news. While gold is still the most favored hedge against geopolitical uncertainty, the question of whether Bitcoin can be a potential safe haven for future political/economic turmoil still looms.

This post explores whether Bitcoin can be considered a safe haven asset.

Correlations between Bitcoin and the S&P 500?

Bitcoin, for the most part, remains largely uncorrelated with the S&P 500. While there is nothing conclusive regarding a potential correlation between the two in the long term, there is one interesting trend, which began in mid-2019, to watch for.

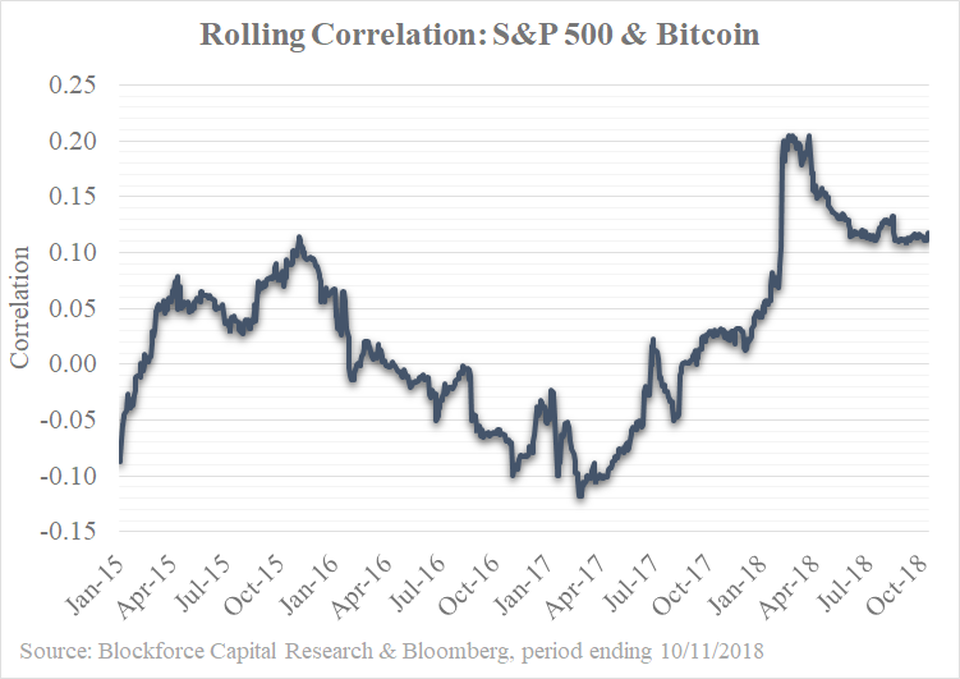

According to Blockforce Capital, from January 2015 through October 2018, the correlation between the S&P 500 and Bitcoin was rather insignificant.

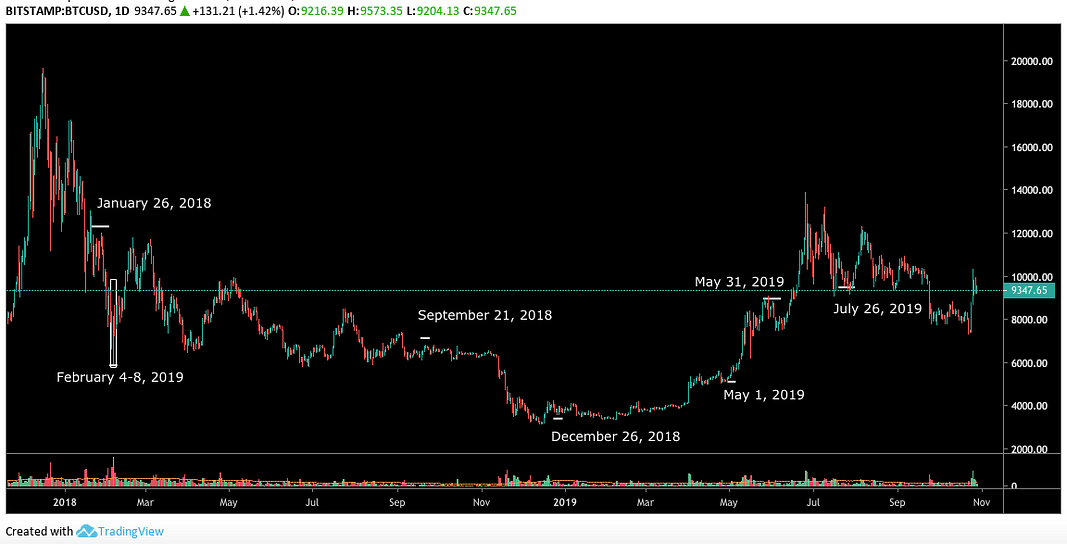

We can get a better picture of any potential correlations by comparing the chart of Bitcoin with that of the S&P 500 index (SPX):

Nothing from these two charts points to Bitcoin being a safe haven asset at the moment. For example, during the beginning of 2018, when the SPX fell by about 10%, Bitcoin dropped by about 25% as well. A safe haven asset, such as gold, rose during this time period. In addition, when the SPX fell massively from September to December 2018, Bitcoin also had a steep decline. Gold, on the other hand, gained about 5% during this time period. In general, there was no clear relationship between Bitcoin and stocks in 2018/2019.

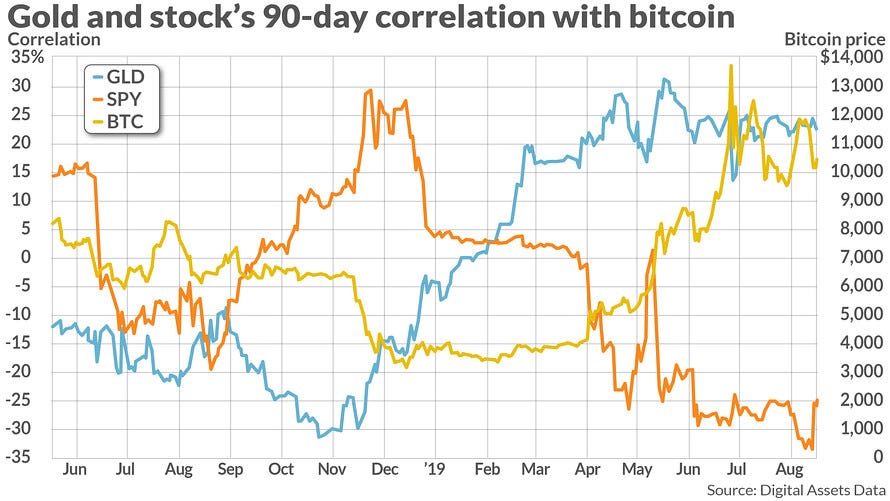

One interesting thing to note is the correlation forming between Bitcoin and the S&P 500 starting from May 2019. According to Digital Asset Data, starting from May through the Summer of 2019, Bitcoin moved in tandem with gold and inversely with the stock market.

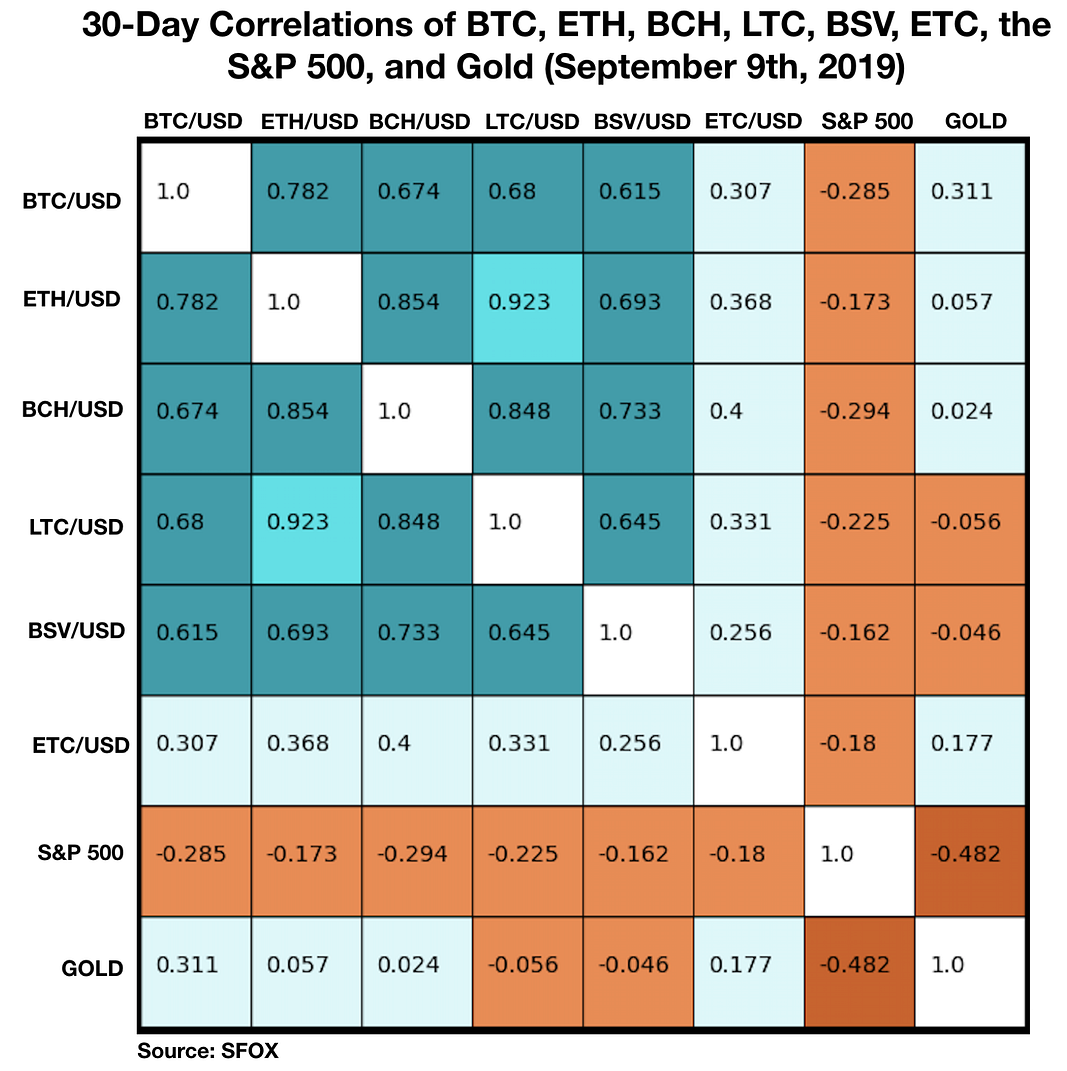

This trend, according to San Francisco Open Exchange (SFOX), has continued for the next few months. Bitcoin and the S&P 500 have moved inversely with each other in September and October of 2019, with negative correlations of -0.285 and -.0224 respectively. While this trend came to a slight halt in November, where the correlation turned positive (0.15) and continued in December, where the correlation grew more positive to 0.267, it is still interesting to watch whether these past two months were exceptions in the upcoming months.

Correlations Between Bitcoin and Gold?

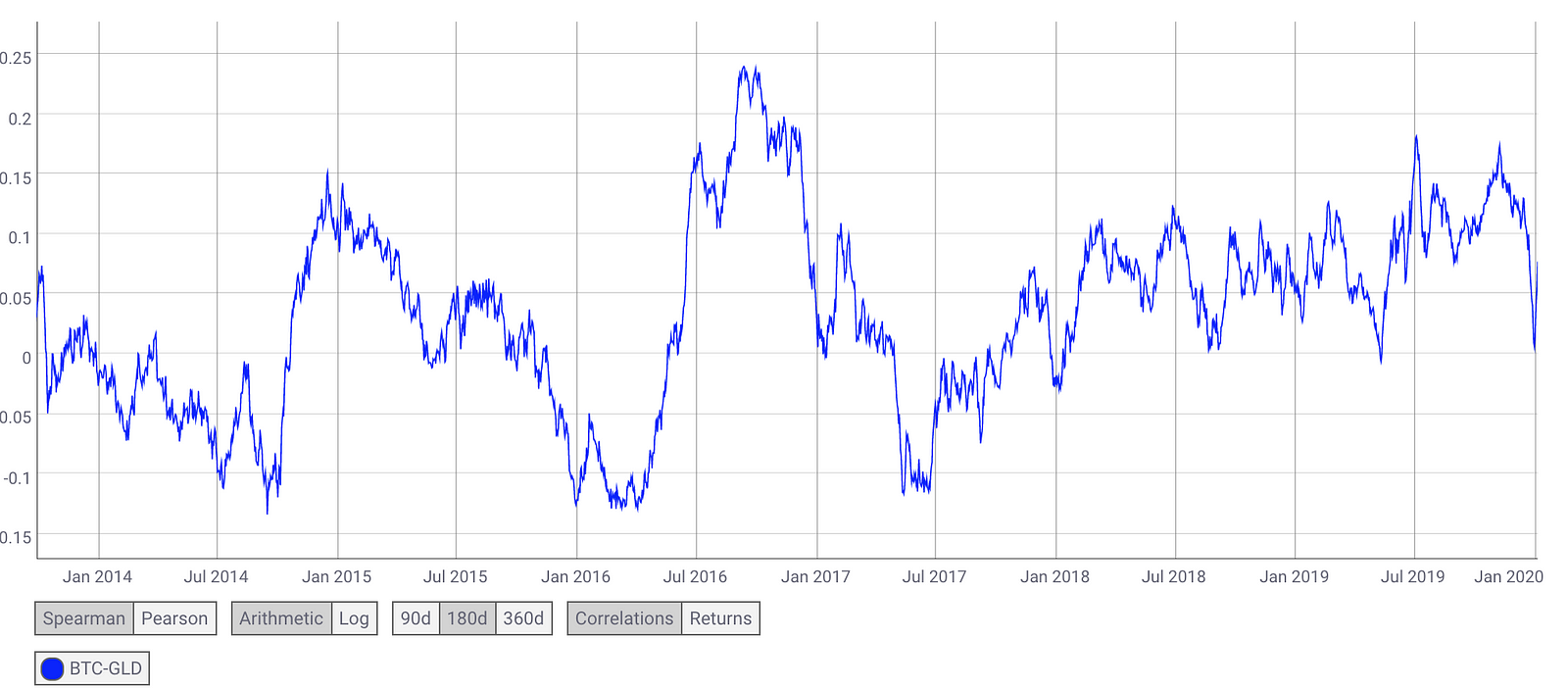

According to Coin Metrics, there has been effectively no correlation between gold and Bitcoin over the past five years. In addition, the price of gold and Bitcoin do not tend to move in tandem as well.

A New Trend With Bitcoin Appearing as of Late?

While no discernible trend between Bitcoin and other markets is currently present, there is one new interesting trend that is forming. Bitcoin, as of late, is acting similar to that of a safe haven asset during times of armed conflict.

Following the assassination of a top Iranian official, Bitcoin increased by about 5%. Bitcoin also increased by about 4% following Iran’s retaliation on the U.S. the other day. What makes this trend more interesting is the fact that Bitcoin, similar to gold, dropped following the de-escalations of tensions with Iran. While just a few examples, Bitcoin is mimicking gold and acting like a safe haven asset as of late.

Many pin Bitcoin as “digital gold,” or as a store of value. As of late, it has been acting as such. During times of war, inflation tends to increase as nations print and borrow money to fund the war. This makes fiat money less attractive and forms of money with limited supply, such as gold and bitcoin, more attractive. The U.S-Iran conflict, and the rise in the price of Bitcoin following the conflict, may be a sign that Bitcoin is maturing into a safe haven/store of value asset.

Take-Aways

Bitcoin cannot be considered a safe haven asset yet, as it is still for the most part non-correlated to traditional investments and gold. This non-correlation may also be attributed to Bitcoin’s short existence, as it was created following the 2008 financial crisis and has not yet existed during any major recession/financial collapse.

While non-correlated to any other market, Bitcoin, as of recently, has been acting as a safe haven asset. The assassination of a top Iranian official and Iran’s retaliation against the U.S. for such, both saw a rise in the price of the cryptocurrency. While a relatively small sample, it will be interesting to see whether future economic turmoil will continue this trend.

While gold and Bitcoin are not correlated in any way, they both are complementary assets and investors should consider holding both. Bitcoin often referred to as “digital gold,” is a good hedging asset, with the unique and apolitical nature of its monetary supply. Gold, on the other hand, has always existed as a safe haven asset and hedge against the poor ways various governments continue to handle the money supply. It is best to be diversified during these times of uncertainty.

To get our premium research into precious metals, mining stocks, and cryptocurrencies, plus our top picks in each sector, click here for instant access.