“Our battery should be called Nickel-Graphite.” – Elon Musk

Graphite is becoming a hot item due to its uses in the lithium-ion batteries that power electric cars and solar power storage. Additionally, it has a number of other potentially profitable uses. When added to steel, graphite is used as a powerful protective agent. And as conducting material, graphite has an electrical conductivity 100 times higher than most nonmetal minerals. This isn’t even mentioning its tremendous use in the automobile industry including but not limited to, its use in brake linings, gaskets, and clutch materials. It makes for good pencils too.

What Is It?

Graphite is a greyish-black mineral that forms when carbon is exposed to heat and pressure in Earth’s crust and upper mantle.

This native mineral is found in metamorphic and igneous rocks (how’s that for middle school science nostalgia). According to Geology.com, graphite is a mineral of extremes.

It’s extremely soft. It has very low specific gravity. And is extremely resistant to heat and nearly unmovable when in contact with almost any other material.

Graphite for batteries currently accounts for only 5% of the global demand, according to batteryuniversity.com. Graphite comes in two forms: natural graphite from mines and synthetic graphite from petroleum coke. Both types are used for lithium batteries.

Who’s leading the charge on mining?

Graphite is mined extensively in China, India, Brazil, North Korea, Canada, and Mozambique.

There are two ways to mine graphite: the open-pit method and underground mining. The open-pit method involves extracting graphite from an open area, like a quarry. Graphite is obtained by breaking rocks, explosives, or drilling. Underground mining, on the other hand, is exactly what it sounds like. When graphite ore is deep underground, miners access it through processes like shaft mining, hard rock mining, or slope mining.

Right now, one country has major control of the graphite market. That’s China. China now produces about 62% of the world’s graphite, according to a US Geological Survey. And it keeps about 60% of its output for its own use.

Investors, however, shouldn’t worry about China’s stranglehold over the market. The country was recently under global criticism due to mass pollution in graphite-mining areas.

“All the trees were fine until the graphite plant started,” said Chinese farmer Yu Yuan in a viral article published by the Washington Post. “It killed my trees.”

China has since attempted to streamline the graphite-mining process by taking its pollutant producers offline. This has allowed countries like Brazil and Mozambique to make huge gains in global graphite production.

Sitting at the number two graphite producer in the world, Mozambique is home to two main graphite miners: Syrah Resources (ASX:SYR) and Triton Minerals (ASX:TON). Syrah is an Australian company and is currently the largest graphite mining company in the world.

It’s currently trading at $1.31 on the ASX.

Graphite Production in North America

A key factor that could restrain the growth of the graphite market is China’s stranglehold on mining the mineral. Especially, if the country isn’t able to crackdown on environmental concerns leading to global media attention. However, there are potential graphite mines and graphite deposits in Canada and around the world.

Tesla’s (TSLA) announced in 2015 that it planned to locally source its needs for lithium, graphite and cobalt for its Nevada-based gigafactory. Later that year, Tesla signed two lithium supply deals with companies whose projects are based in North America.

Syrah Resources (ASX: SYR): climbed 134.6% in 2020. The Aussie graphite miner boasts a market capitalization of $582.1 million.

Graphite mining in the US, however, has been nonexistent since 1990. Currently, only two North American countries produced any graphite at all. Canada put out 30,000 MT of the metal, while Mexico produced 4,000 MT. That’s less than 1% of China’s total graphite output.

Graphite is a precious mineral in America, and it’s led some experts to believe the countries supply is very low. But that’s not stopping some US-based companies from trying.

Graphite One Resources (TSXV:GPH), located in Alaska, claims to “controls all prospective lands with known graphite mineralization in the region.” The U.S. Government recently designated a Graphite One Project as a “High-Priority Infrastructure Project.”

Alabama Graphite (TSXV:CSPG) and American Graphite Technologies (OTC: AGIN) are two more companies set on bringing back graphite mining to the US.

How Much Can The Graphite Market Grow?

The global graphite market was valued at $14.3 billion in 2019, and is expected to reach $21.6 billion by 2027.

Graphite’s demand will likely continue to rise for a number of reasons.

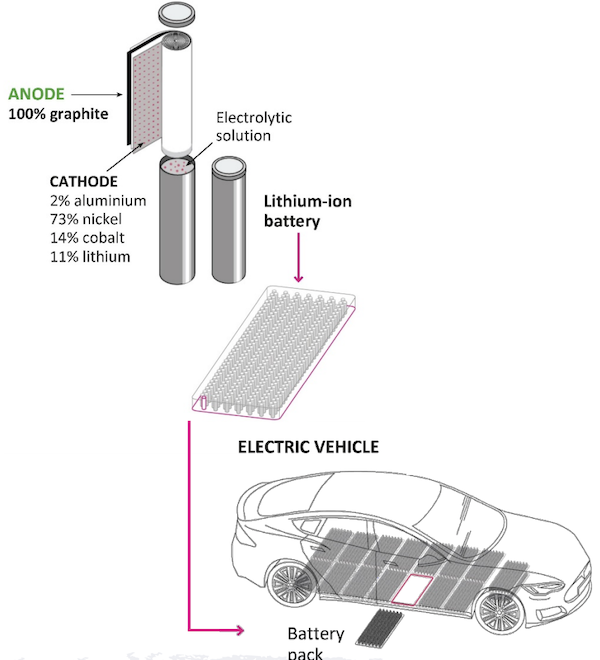

- Increased demand for graphene batteries: Due to its highly conductive material, graphite is used in lithium-ion batteries. There is as much as 40 times the amount of graphite in a lithium-ion battery as lithium itself. With demand for electric vehicles — most plug-in hybrids and all-electric vehicles use lithium-ion batteries — and solar energy on the rise, graphite looks to be a major player in the future.

- Increased demand for electric vehicles: Tesla’s stock was up an incredible 695% in 2020, making it one of the most valuable companies in the world with a $630 billion valuation. In addition, it’s expected that there will be 530 million electric vehicles around the world by 2040 (a 94% increase from today)

- Greener America: Now that the Democrats hold control over the White House and Congress, the next four years will see the US turn to greener energy sources. The Biden Administration is expected to implement a $2 trillion plan, known as Build Back Better, to invest in green infrastructure, including renewable energy sources.

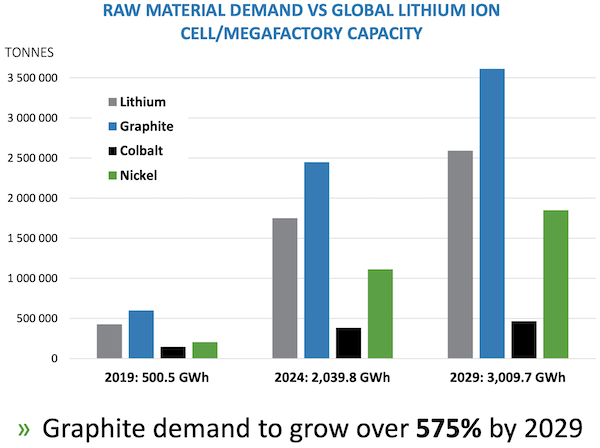

Of all the battery metals, graphite is expected to see the largest demand growth, as much as 575% by 2029!

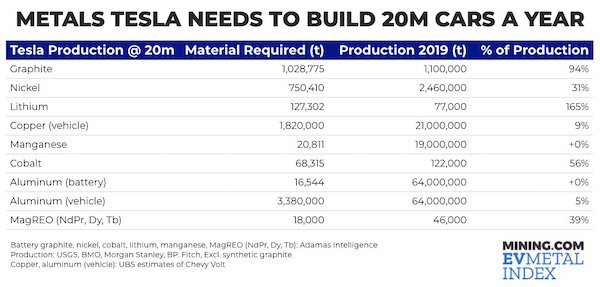

For Tesla to build 20 million cars per year, they will need nearly all (94%) of the graphite produced globally in 2019. This is only second to lithium, for which Tesla would require 165% of 2019 production. Although we are all bullish on lithium and hold 3 lithium stocks in the GSB portfolio, supply is growing faster so we believe fundamental conditions could create an even greater impact on graphite prices over the next few years.

The mining markets will switch gears over the next few years to service these industries and graphite looks to take center stage in an increasingly technological world.

Get Our Top Graphite Stock Picks

We have mentioned a few graphite stocks that will likely do well as demand for battery metals increases in the years ahead. But our top pick is building what is set to become the western world’s largest graphite mine. It will produce high-grade, low-cost graphite and the company just received environmental permits to begin construction. They have a vertically-integrated business model and operate in a Tier 1 jurisdiction.

To get our top graphite pick and all of our top mining stock picks across battery metals, precious metals, energy metals, and more, sign up for our top-rated newsletter Gold Stock Bull: nicoyaresearch.com/premium-services/gold-stock-bull/