This post will highlight the difference between Gold-backed cryptocurrencies and gold ETF’s, and evaluate whether there is a meaningful role for the former.

What is a Gold-Backed Cryptocurrency?

Gold-backed cryptocurrencies are digital currencies that are tied to a certain weight of gold. The gold that the token is hinged to is stored by a trusted third party and can be traded on the market or with other holders.

Is There a Meaningful Role for Gold-Backed Cryptocurrencies?

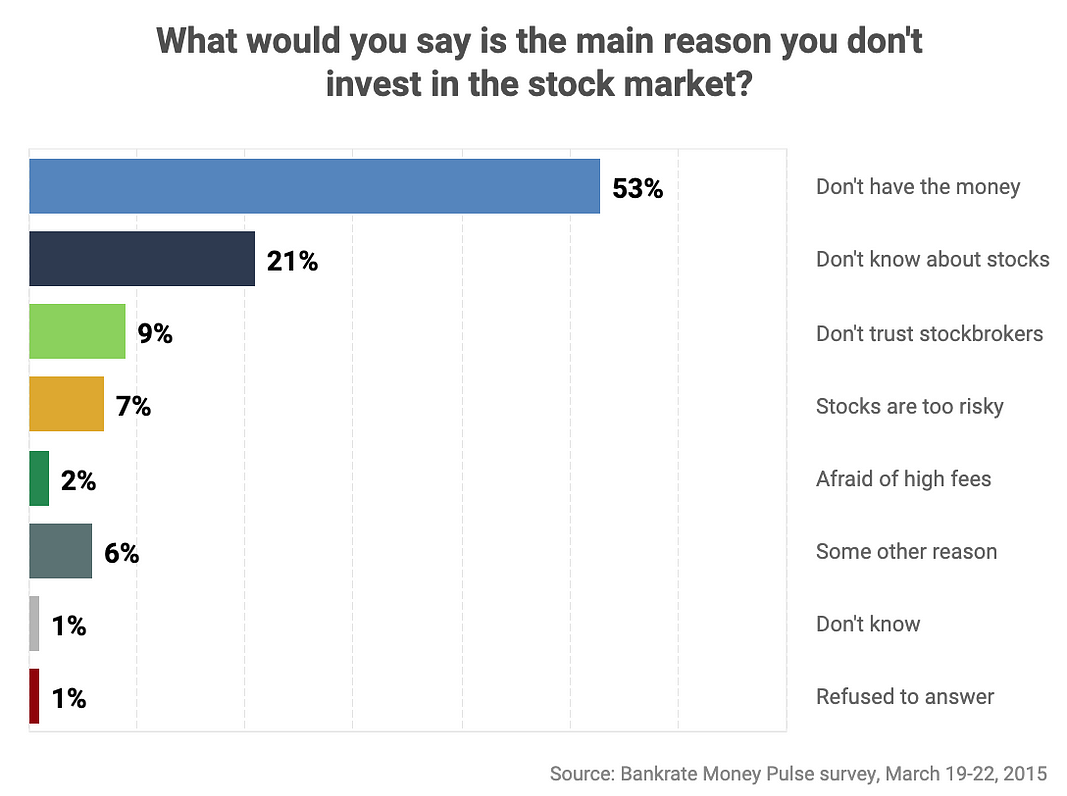

Many people do not buy securities. In the U.S for instance, more than 50% of Americans do not invest in stocks, mutual funds, ETFs or any securities in general. In addition, more than half of those individuals who do not invest, do not invest because they do not have the monetary means to do so.

With a gold-backed cryptocurrency, investors only need a fraction of a dollar to potentially invest.

Another issue with gold ETFs is the difficulty individuals in remote parts of the world have to go through to purchase such. There are many hoops these investors must jump. These investors, for instance, must open a trading account and have the appropriate security measures run, such as KYC. Then they must transfer funds into their trading account and convert their currency into a foreign currency. The process goes on and on and each step takes at least one day to complete, with various fees, costs, and commissions.

Tokenizing gold also provides a way to make gold a medium of exchange again. Currently, transporting heavy quantities of gold and dividing gold bars into smaller denominations is very difficult. By tokenizing gold, people are able to divide up gold into smaller denominations and allow for the use of gold that just sits in vaults worldwide.

Other benefits of tokenizing gold include: (1) no territorial barriers for any investor, (2) no middlemen involved; no third-party brokers or stock-trading accounts are needed, (3) Greater liquidity through fractional ownership; and (4) easily accessible: anyone can access tokens from anywhere, 24/7 through their phones or other devices.

What is a Gold ETF?

A gold exchange-traded fund (ETF) is a commodity ETF that consists of only one principal asset: gold. ETFs are similar to individual stocks and trade on exchanges in the same manner.

The main aspect that complicates gold ETFs more than traditional stocks is the derivative underlying the investment. A derivative is a “contract between two or more parties whose value is based on an agreed-upon underlying financial asset.” An example of an underlying asset would be a security or commodity.

Gold ETFs hold gold derivative contracts that are backed by gold. So when someone invests in a gold ETF, they don’t actually own any of the gold, instead, they are purchasing a share that represents the physical gold. In addition, most ETFs, upon redemption, do not pay out by providing the precious metal; they instead provide an investor with a cash equivalent. The goal of an ETF is to give an investor exposure to the price movements and/or performance of gold.

Tokenized Gold Projects

There are many companies creating gold-backed cryptocurrencies. Some of the better-known ones include:

DigixGlobal (DGX)

Digixglobal is one of the first projects aiming to tokenize gold. In 2018, the team launched its digital token, Digix Gold Token (DGX), with each token representing 1 gram of gold.

The token is redeemable for physical gold as well. The process for redemption though is slightly complicated as you have to be physically present at the vault in Singapore to redeem. Getting the gold mailed or delivered is currently not an option. There is also a 1% redemption fee as well. The steps to redeem can be found here.

PerthMint (PMGT)

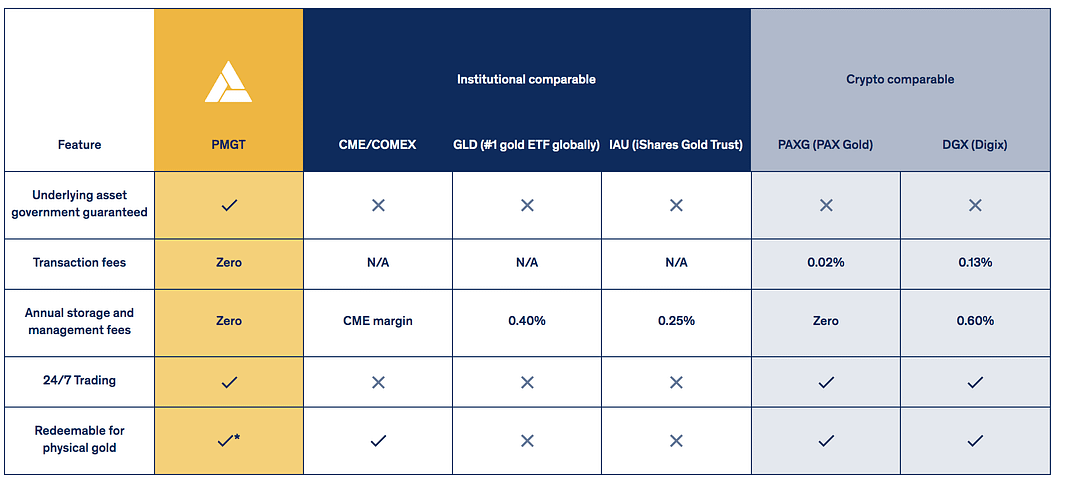

Perth Mint is the world’s first government-guaranteed gold-backed cryptocurrency. They have recently launched the PerthMint Gold Token (PMGT) in October 2019.

PMGT is unique in that, unlike its competitors, there are no management or storage fees, no redemption fees, and no transaction fees.

PMGT is also backed by the Australian Government, making it the first tokenized gold product with a sovereign state backing it.

Two other interesting projects are PAX Gold (PAXG) and OneGram (OGC). PAX gold is a product from Paxos and is the first regulated gold-backed cryptocurrency in New York. They are regulated by the New York Department of Financial Services. You can redeem the token for physical gold at any time. PAX gold also allows token holders to redeem their tokens for gold even if Paxos were to go bankrupt.

OneGram is the first sharia-compliant cryptocurrency in the United Arab Emirates. It also had one of the largest ICO’s ever, selling around $400 million of its gold-backed token. It was initially listed on only one exchange, but the team is now expanding to other exchanges.

Recap

Traditional ETFs are out of reach of many retail investors worldwide. Gold-backed cryptocurrencies, on the other hand, are easily accessible and cheaper to purchase. There is no broker needed to purchase the tokens and individuals may purchase a fraction of a token.

Gold ETFs came to market in 2003 and became one of the most innovative products in the past 15 years. The launch of gold ETFs, initially, was met with a huge amount of skepticism. Most, if not all skeptics have been proven incorrect. It is evident that this new method of investing in gold will be subject to the same skepticism, but will likely prove the skeptics wrong in the near future as well.

To get our premium research into precious metals, mining stocks, and cryptocurrencies, plus our top picks in each sector, click here for instant access.