On Thursday October 28th, the price of Bitcoin (BTC) fell below $13,000 shortly after hitting resistance of around $13,850 at the day’s peak. As we can see from the chart below, the price of Bitcoin is in an uptrend that started on March 12, 2020 and has more than doubled since then.

Currently, the price is up 84% year-to-date, and is 32% below its 2017 high of $19,783. In the past two days, the price of Bitcoin (BTC) rallied 8.5% from $13,783 to $13,850. The move came after a month-long uptrend during which BTC rose from around $10,200 to $13,850. From a technical standpoint, the chart looks very bullish.

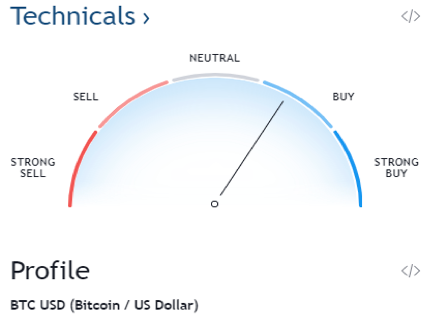

The ‘tradingview.com’ indicator is flashing a ‘BUY’ signal. This indicator is generated from current investor sentiment in an asset class. A recent survey from Grayscale Investments Study shows that more than half of U.S. investor survey respondents would consider investing in bitcoin and 23% already have. Adoption is happening and accelerating.

There is a lot that investors can be optimistic about regarding the price of bitcoin:

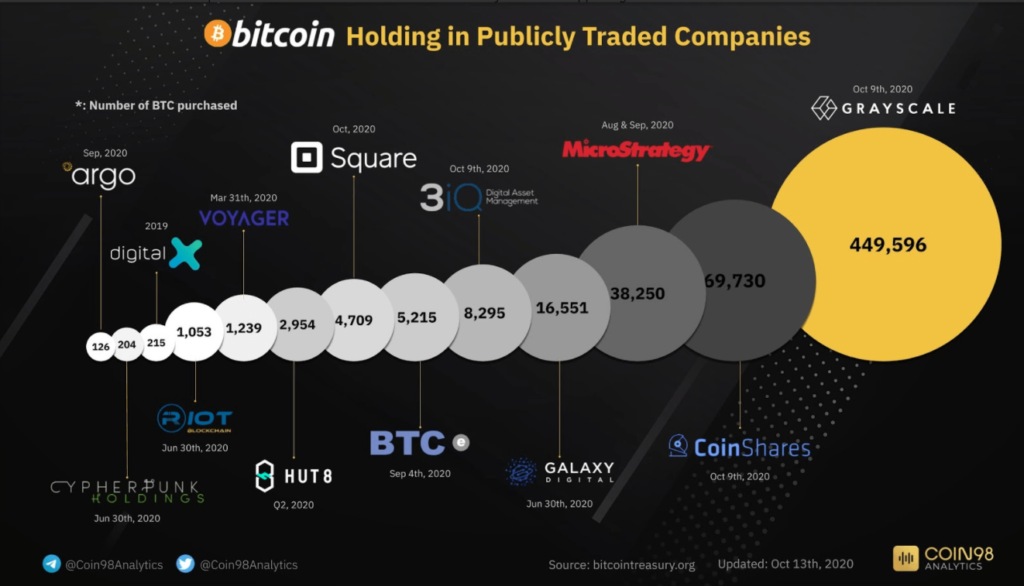

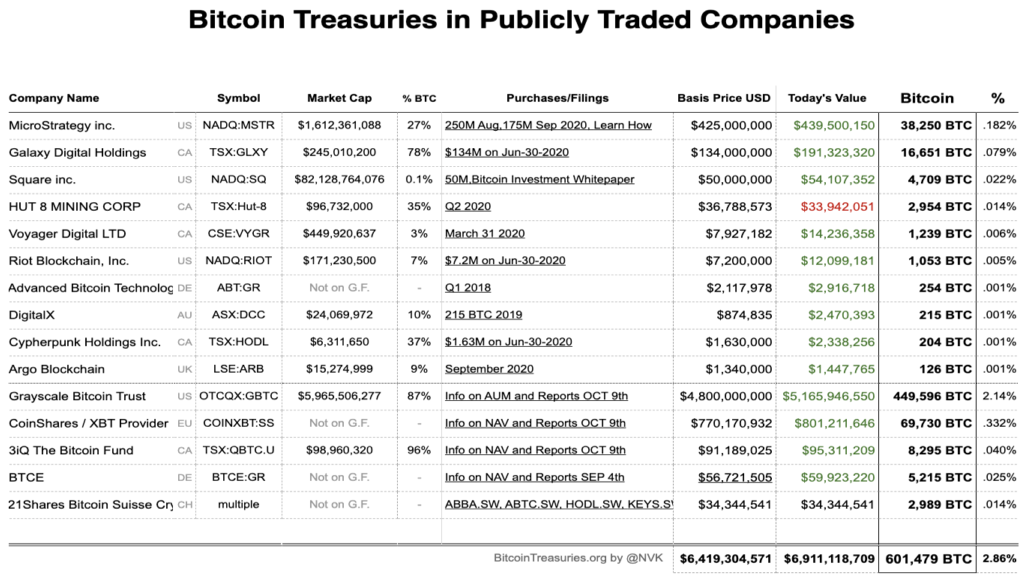

Increase In The Number Of Corporations Investing In Bitcoin As An Asset Class: The biggest bullish factor influencing bitcoin is the rapid acceleration of institutions embracing and investing in it as an asset class. This trend is expected to continue, and the sizes of the transactions could increase.

As we can see from the charts below, the confidence in investing in Bitcoin as an asset class is increasing; Square bought 4,709 BTC ($50M) in October 2020 and MicroStrategy bought 38,250 BTC (Aug/Sept) at $11,111 each. This translates to a profit of $85 Million for MicroStrategy (MSTR). In a recent conference call, the company’s president mentioned that they are looking to add to its $521 million bitcoin portfolio.

Paul Tudor Jones’s BTC Investment And Endorsement Is Very Bullish: Recently legendary Investor Paul Tudor Jones recently mentioned that he likes bitcoin even more now than he did back in May 2020, when he invested 2% of his assets in it. He compared it to investing in the early stages of technology companies such as Apple (AAPL) and Google (GOOG). He mentioned that we are in the first inning of bitcoin and it has got a long way to go. He believes that the unprecedented quantitative easing from the Federal Reserve is setting the stage for inflation to make a grand comeback, and Bitcoin (BTC) is in the best position to benefit.

Paypal Offers An Incredible Cryptocurrency User Base: Recently, PayPal Holdings, Inc. (PYPL) announced the launch of a new service enabling its customers to buy, hold and sell cryptocurrency directly from their PayPal or Venmo account. They also signaled plans to significantly increase cryptocurrency’s utility by making it available as a funding source for purchases at its 26 million merchants worldwide. According to data from Glassnode, Bitcoin currently has over 187 million users. However, this is not as impressive as it compares to PayPal’s 487 million users. This news is incredibly bullish for Bitcoin (BTC).

The Largest US Bank JPMorgan with $2.6T In Deposits Embraces Cryptocurrencies: The bank recently announced the launch of its own cryptocurrency (JPM Coin) enabling the instantaneous transfer of payments between institutional clients. This coin is redeemable 1:1 for US dollar (fiat), held at JP Morgan. This news further expands the reach of cryptocurrency users.

They have been engaging with digital asset firms on how it can offer digital asset custody to its clients. The exploration into custody comes as the firm has rebranded its blockchain division to Onyx. The firm would enlist sub-custodians to offer the service, such as Fidelity Digital Assets and Paxos. This offers credibility to the cryptocurrency and adds to its long-term potential.

The bank which was previously opposed to cryptocurrencies, now states that Bitcoin has the potential to triple its price as BTC challenges gold’s status as the go-to alternative currency. Currently Bitcoin is still a relatively small class asset with a market cap of $248 billion compared to gold’s $10 trillion market value. To catch up with gold’s market dominance, Bitcoin would have to increase 40x its current value. They stated that with millennials set to become a more important market participant in the coming years, their preference for bitcoin to gold sets up the crypto for future success.

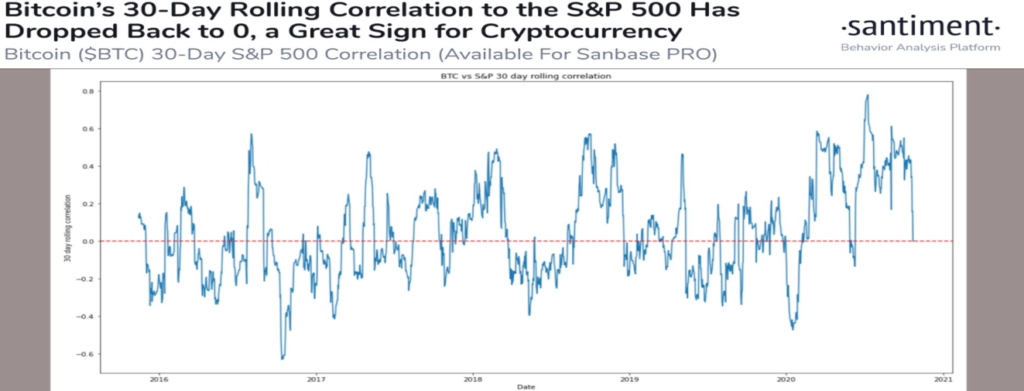

Bitcoin Is Decoupling From The Stock Market: As we can see from the chart below, for most of the year Bitcoin has shown a strong correlation with stocks. However, market data provided by Santiment has highlighted a fairly new development for Bitcoin. The correlation with the S&P 500 has fallen toward zero, suggesting that Bitcoin is decoupling from the stock market. In recent history, Bitcoin’s (BTC) price has always benefited when it has exhibited low correlation stats with the world of traditional finance.

The US Presidential Election: The outcome of next month’s U.S. presidential election may not matter much for bitcoin’s price. Coronavirus relief stimulus in the trillions of dollars is expected, no matter who wins. Current President Donald Trump has stated that he wants a big deal to jump start the US economy (~$2T), while Joe Biden has also announced plans for an even greater stimulus package.

The Grayscale CEO also stated that Bitcoin will win because either a Trump or a Biden election victory would result in more expansion of the US dollar supply. An increase in monetary supply would also imply a lower dollar which would be beneficial for bitcoin prices. After all, when given the choice between a centrally-controlled inflationary currency and a decentralized digital currency with a max supply that has nearly been reached and declining supply growth, which would you choose?

Conclusion: Bloomberg analyst Mike McGlone has stated that ‘as bitcoin’s market capitalization grows, central banks may eventually adopt the cryptocurrency’. He has predicted higher prices due to increased demand, where there is no increase in supply. And central banks essentially have an unlimited amount of fiat money with which to buy bitcoin.

Bitcoin has no top because fiat money has no bottom.

In 2016 the annual rate of new supply was 7%, this number will drop to about 2.5% this year and approach 1% by 2024. This is incredibly bullish for Bitcoin, which is of the most scarce assets ever created. Bitcoin is likely to hit $100,000 over the next few years as demand and adoption increase.

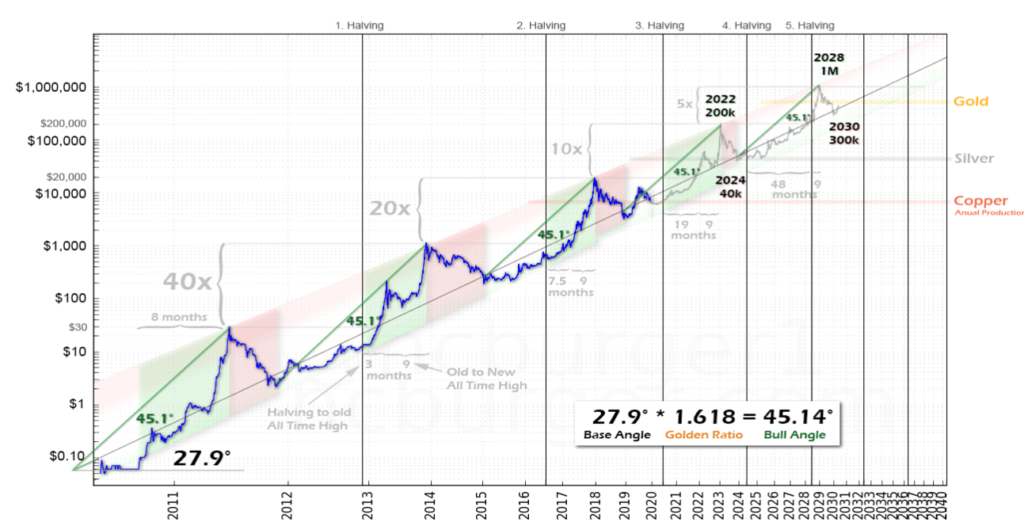

Bitcoin Economics Power Law Corridor model assumes that the Bitcoin cycle length is increasing; i.e. the time taken from halving to retaking old all-time -high (ATH) is increasing. They also assume a 45-degree angle for its cyclical low to its all-time high (ATH). Based on prior occurrences, the new ATH would lie between 5x to 10x from the old ATH of 20k, which is around 100k to 200k.

Based on these perspectives and current developments, it would be fair to assume that the price of bitcoin is headed for higher prices in the weeks and months ahead.

View our crypto portfolio in real time, get our top-rated monthly crypto newsletter and regular trade alerts by subscribing here.

Article written by Rudy Banerjee and Jason Hamlin