In our last article, we covered 7 Junior Silver Mining Companies that Eric Sprott Invested in During 2019. Those stocks have performed very well in 2019 and should have an even better year in 2020.

In this article, we will look at 5 Junior Gold Mining Stocks that Mr. Sprott was busy buying in 2019. While he is employing a splatter strategy of throwing money at dozens of companies to see what sticks, it is safe to assume he has performed comprehensive due diligence on the companies. Only a few of the picks need to be homerun winners for this strategy to be successful, even if the majority were to underperform.

Eric Sprott has become a billionaire through savvy investing and acumen for picking winning mining companies early in their life cycle. He is a “long-time gold bull” that claims to hold 90% of his assets (except for Sprott Inc shares) in gold and silver. He advised investors to buy gold before the 2008 financial crash, which proved prescient. The gold price went on to double in three years or nearly triple from the absolute bottom in 2008 to the high in 2011.

One of Eric Sprott’s biggest investments in recent years was Kirkland Lake Gold. He started buying when the share price was under $5 and it was just an emerging producer. Fast forward 5 years and the company has become a top tier producer with a share price that recently came close to $50 per share. Eric was appointed Chairman of the Board in January of 2015 and held roughly 10% of outstanding shares by 2019.

He stepped down as Chairman in 2019 and booked partial profits on his Kirkland Lake investment. He has been deploying those funds into up-and-coming juniors gold miners that could become the next Kirkland Lake Gold.

Which promising junior gold miners has Eric Sprott been buying in 2019?

Irving Resources

(IRV.CN or IRVRF)

Mr. Sprott now beneficially owns and controls 6,786,228 common shares representing approximately 12.8% of the outstanding common shares on a partially diluted basis.

Irving Resources is a Canadian-based mineral exploration company with interests in projects in Japan and Africa. They encountered high-grade veins at their 100% controlled Omu Gold Project, Hokkaido, Japan.

Management/Directors own 18% and Newmont Goldcorp owns 7.6% of outstanding shares. Their CEO/Director, Ms. Levinson, was previously the President and a director of Gold Canyon Resources Inc. and is currently a director of Novo Resources Corp.

Wallbridge Mining

(WL.TO or WLBMF)

Eric Sprott owns 21.2% of outstanding shares in Wallbridge Mining. He acquired these shares through a private placement in September of 2018 and multiple rounds of investments in 2019. Kirkland Lake Gold also owns roughly 10% of Wallbridge Mining.

Wallbridge is currently developing its 100%-owned high-grade Fenelon Gold property in Quebec with ongoing exploration and a bulk sample.

The company has a robust exploration program underway:

– 75,000 m drilling in 2019

– 100-120,000 m drilling in 2020

– Fully-funded 2020 program & into 2021

Part of the appeal is their high grades, with recent intercepts that include:

High-grade Main Gabbro Zone

– 260.4 g/t Au over 7.02 m

– Completed 33,500 T bulk sample @ 18.5 g/t Au

Ongoing Exploration Success, Area 51 & Tabasco

– 1.46 g/t Au over 227.80 m

– 17.58 g/t Au over 11.04 m

– 20.89 g/t Au over 8.54 m

– 22.73 g/t Au over 48.01 m

They are working toward a NI 43-101 resource update that is expected in Q1/2021. The goal is to define a 1M oz+ underground resource.

Aurion Resources

(AU.V or AIRRF)

Eric Sprott purchased C$5 Million of an $11 million offering in July of 2019 and now owns 5% of Aurion Resources. Kinross also owns around 10% of shares and Newmont owns 3.8%, demonstrating interest from majors that may one day acquire the company. The board and management own a chunky 17.4% of outstanding shares, which helps to align their interests with shareholders.

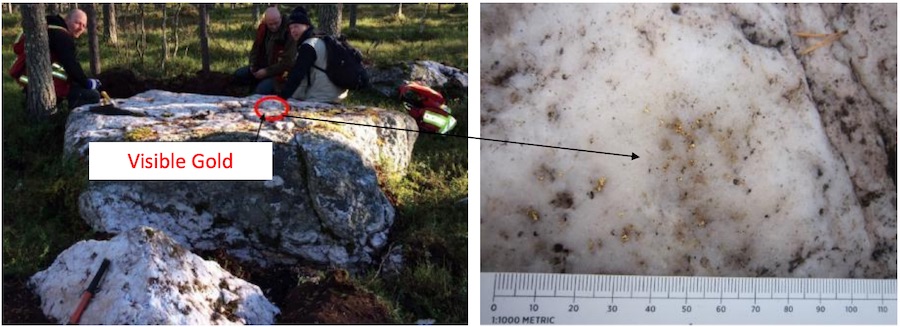

Aurion’s current focus is exploring on its Flagship Risti and Launi projects, as well as advancing joint venture arrangements with Kinross Gold Corp., B2 Gold Corp., and Strategic Resources Inc. in Finland.

Recent high-grade drill results:

➢ 9.42 g/t Au over 28.22 m, including 22.58 g/t over 8.18 m

➢ 23.41 g/t Au over 11.1 m, including 202 g/t over 0.5 m

➢ 6.84 g/t over 19.0 m, including 76.03 g/t over 1.5 m

AMEX Exploration

(AMX.V or AMXEF)

Eric Sprott made his first investment in Amex Exploration during February of 2019, joining as a strategic investor. He increased his position in November to 6,714,400 shares and 3,000,000 warrants representing approximately 10.8% of the outstanding shares on a non-diluted basis and approximately 14.9% on a partially diluted basis. Management also owns 13% of the outstanding shares, which we like to see.

Amex Exploration made a significant gold discovery in Quebec at its 100% owned high-grade Perron Gold Project. A number of significant gold discoveries have been made at Perron, including the Eastern Gold Zone, the Gratien Gold Zone, the Grey Cat Zone, and the Central Polymetallic Zone.

High-grade gold has been identified in each of the zones. A significant portion of the project remains underexplored. 26 drill holes have intersected gold mineralization greater than 10 g/t Au over variable widths. The latest was 41.30 g/t Gold over 4.10 m including 202.81 g/t Au over 0.80 m in New Emerging Upper Gratien Zone.

The current exploration program aims to provide a basis for a maiden NI43-101 resource estimate.

NV Gold

(NVX.V or NVGLF)

During October, Eric Sprott announced he beneficially owns and controls 5,256,430 common shares and 217,500 Warrants representing approximately 11.3% of the outstanding common shares on a non-diluted basis and approximately 11.7% on a partially diluted basis. He started buying shares in 2016 and 2017. The Chairman of NV Gold, John Watson, owns 13.7% of outstanding shares.

NV Gold has control of 15 active mineral projects in Nevada. Follow-up exploration is planned on the Slumber, Frazier, Root Springs, and Sandy Gold Projects in the Spring of 2020. The most notable intercept is a 39.6 meter interval grading 0.34 gpt Au and 1.3 gpt Ag. These aren’t high grade intercepts, but have the potential to be very large projects.

We hold a few of Eric’s top gold and silver mining stock picks in the Gold Stock Bull model portfolio, but have avoided others. Click the subscribe button for instant access to all of our top mining stock picks for 2020.